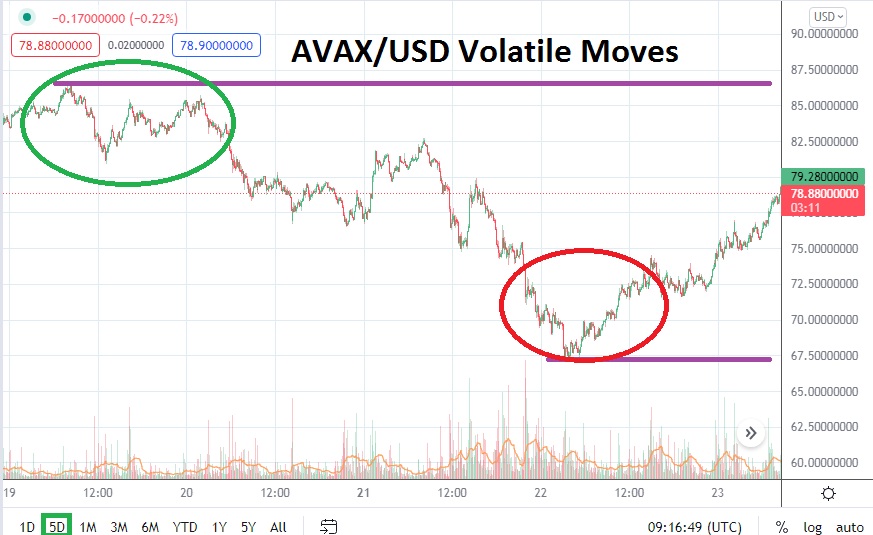

AVAX/USD traded below the 67.0000 level for a brief moment of time yesterday, but a reversal higher has put Avalanche within sight of the 80.0000 juncture as of this writing. AVAX/USD traded below the 54.0000 price on the 22nd and 24th of January, and then went onto a choppy incremental climb until it reached the 98.9000 ratio on the 16th of February.

The high values seen in AVAX/USD last week did touch prices seen in Avalanche on the 6th of January. Technically, this may be intriguing because the highs of February actually surpassed prices seen in the middle of January, before a strong move downwards gained power and lows of nearly 52.5000 were displayed on the 22nd of last month. AVAX/USD clearly remains a favorite among many speculators and influencers in the cryptocurrency world and its ranking as the 10th biggest digital asset backs up this notion.

Clearly since reaching its apex highs in November AVAX/USD has been within a steady bearish trend. The current value AVAX/USD is traversing below the 80.0000 range remains troubling, and if Avalanche is not able to surpass this level it would be a poor short term signal. In fact if AVAX/USD is not able to climb above the 85.0000 price realm, some speculators may remain skeptical regarding its trend. The broad cryptocurrency market has definitely put in gains the past day, but traders may remain suspicious.

However, the one day results from AVAX/USD do highlight the ability of the cryptocurrency to create brisk and volatile returns for its traders. Risk management is essential when trading AVAX/USD because of its capability to produce lightning fast results, with fluctuations which can easily be more than 10% in one day of trading. If current support levels falter again in AVAX/USD and the 79.0000 ratio proves vulnerable, this could spur on additional short term nervous selling.

AVAX/USD is within the middle of its five day price range having created some upward action the past day. However, traders who feel like the current short term reversal has been achieved too quickly may be making a logical decision if they decide to actually sell Avalanche and look for reversals lower. Until AVAX/USD can topple the 80.0000 mark, selling the cryptocurrency with quick hitting targets below may prove to be worthwhile.

Avalanche Short-Term Outlook

Current Resistance: 80.2600

Current Support: 78.3100

High Target: 83.7600

Low Target: 70.7400