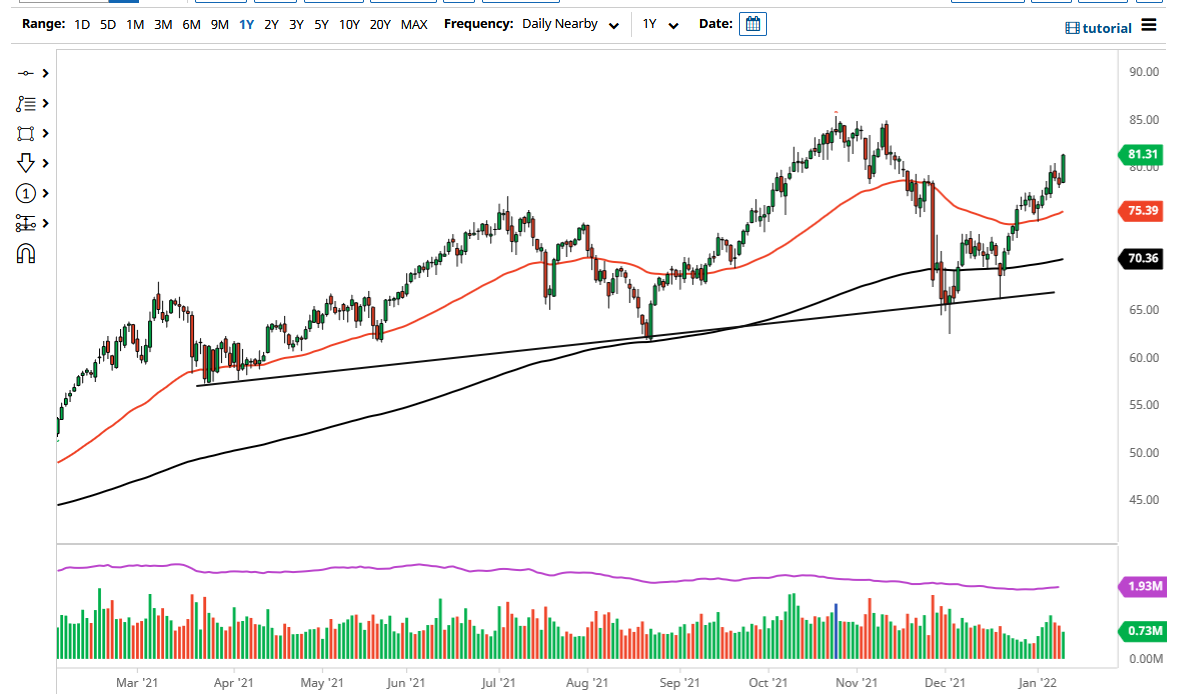

The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Tuesday to break above the $81 level. In fact, it looks like the market is smashing towards the upside and I think that short-term pullbacks will continue to attract a lot of attention due to the fact that the market has look past the omicron variant has been a major issue. All things being equal, the market is likely to continue to find dips as value based upon the fact that we are not locking everything down.

The $80 level course will offer a significant amount of psychological support, as it is a large, round, psychologically significant figure. The market will find plenty of support underneath at the $70.50 level as well, which is the bottom of this impulsive candlestick for the day. All things been equal, this is a market that I think will continue to find plenty of reasons to go higher, if for no other reason than the fact that we are going to continue to see buyers based upon the price action.

To the upside, I believe that the $85 level could be a target based upon the double top from several months ago that caused the breakdown. Furthermore, the market is likely to see this pullback as simple noise based upon the idea of the market overreacted to the idea of a new variant of Covid. In fact, there is another variant been found in France at the moment that the market is completely ignoring. It seems as if each one of these variants will become less dangerous, as most experts expect it. Because of this, the market will continue to see the situation as one that continues to see value on pullbacks and with the 50 day EMA rising above the $75 level, it looks as if the market is going to continue to see that as a “floor the market.”

Whether or not we can break out above the $85 level is a completely different question in general, but if we were, at that point in time oil could really start to take off. As far as selling is concerned, we would need to break down below the 50 day EMA at the very least to even think about doing so, and really based upon the price action that we had seen during the day on Tuesday, that seems to be an infinitesimal possibility.