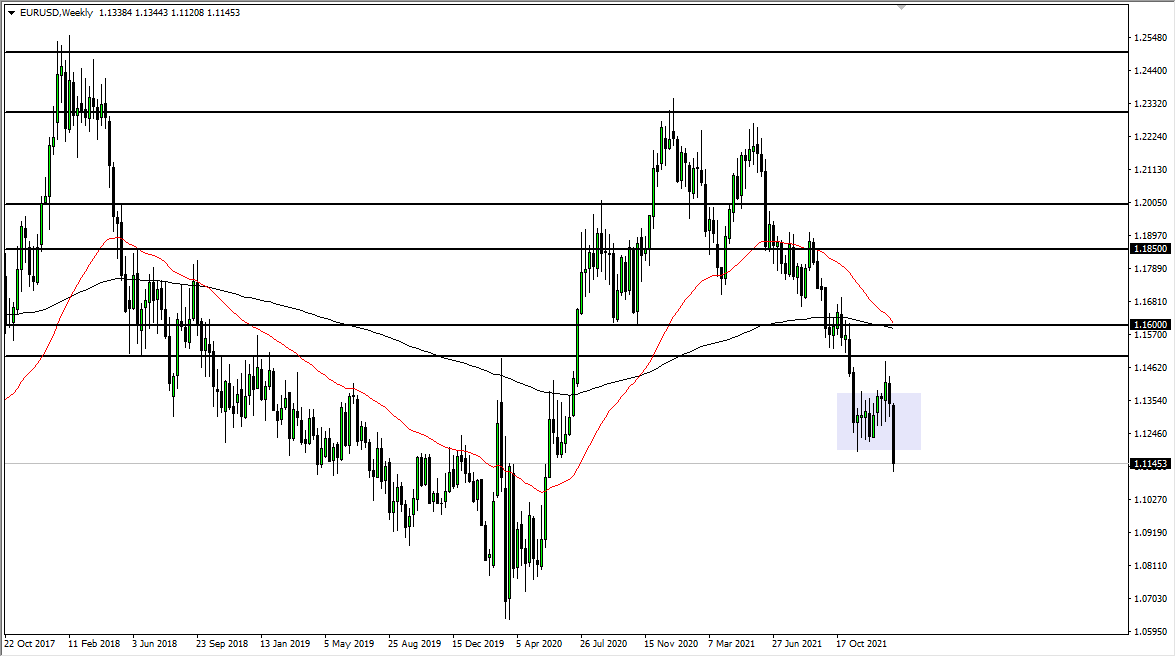

EUR/USD

The euro struggled in general during the course of last week, as we have broken down through the 1.12 level. That being said, the market is likely to continue looking towards the downside, but we may get a short-term bounce. Any short-term bounce at this point should end up being a nice selling opportunity on signs of exhaustion. Ultimately, I have no interest in trying to get long of this market, at least not until the Federal Reserve changes its attitude. I suspect that given enough time, we are heading towards the 1.10 level underneath.

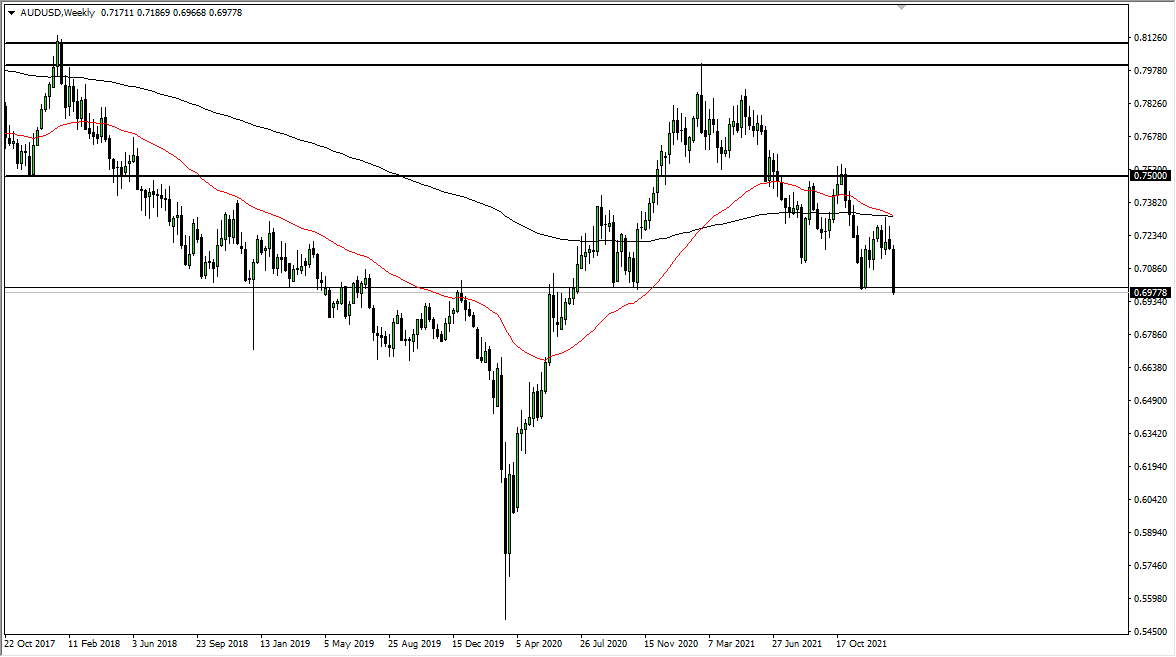

AUD/USD

The Australian dollar has broken down significantly during the week, slicing through the crucial 0.70 level. That of course is a large, round, psychologically significant figure, and an area that of course will attract a lot of attention. That being said, as long as there is risk aversion out there, that of course works against the value of the Aussie. I think short-term rallies are going to start selling again unless the Federal Reserve changes its tune, something that does not seem very likely at this juncture. The markets have seen a lot of fear, and I think more is coming. The 0.68 level could very well be tested if we continue to see negativity.

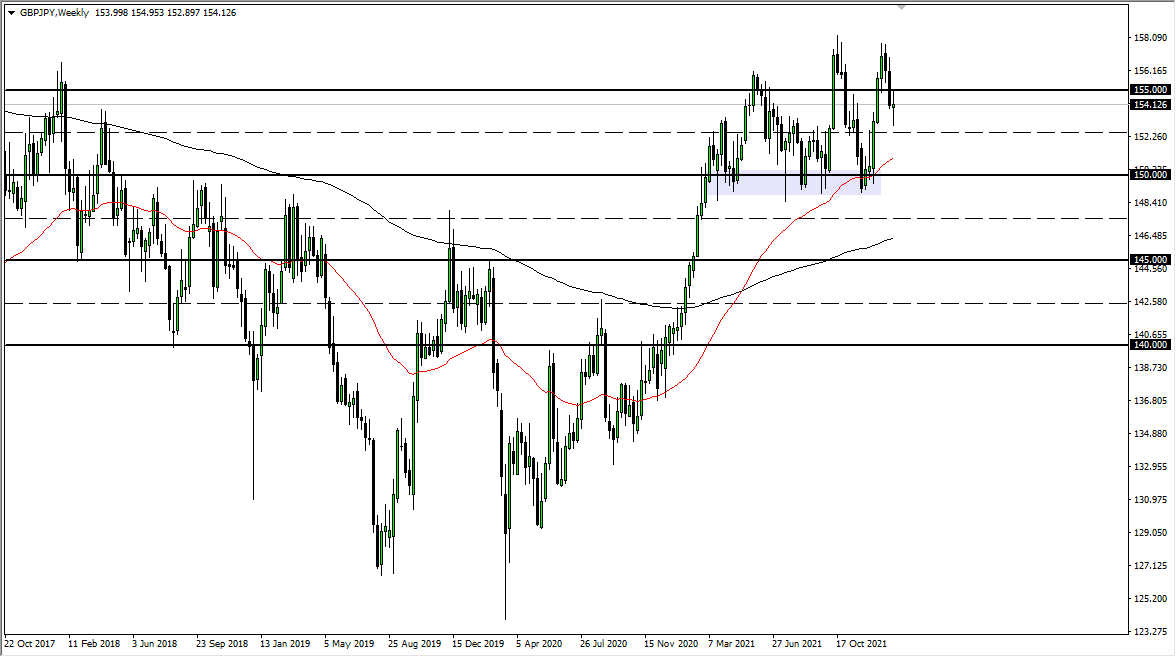

GBP/JPY

The British pound has been all over the place this past week, which makes sense as the Japanese yen is a safety currency and, as a result, there will more than likely be noise. As there is a lot of fear out there, we will continue to see this market drop. The ¥152.50 level underneath should be supportive, and if we break down below there then I think we will go much lower. The ¥155 level above is significant resistance, and if we can break above there then it could change the overall attitude.

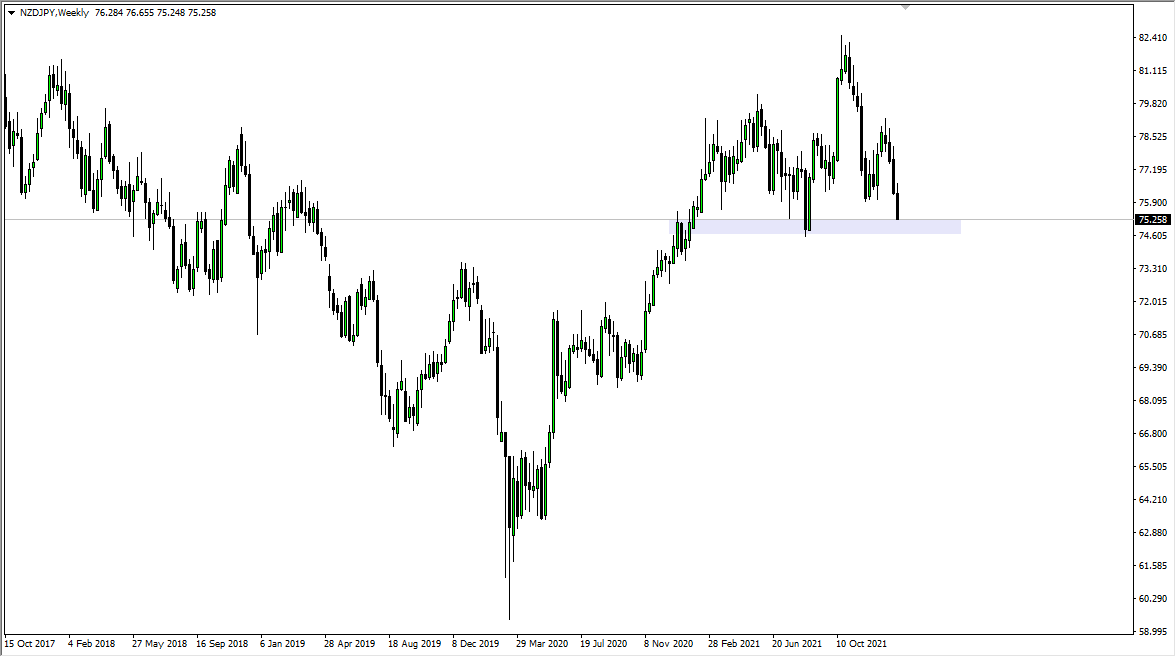

NZD/JPY

The New Zealand dollar has crashed against the Japanese yen over the last several weeks, and it certainly looks as if we are going to continue struggling. At this point, the market is likely to continue seeing downward pressure, and if we can break down below the 75 level, then the market is likely to continue seeing a lot of negative pressure. With the amount of ugliness and fear there is out there, it makes sense that we would see this pair drop towards the safety currency of the Japanese yen.