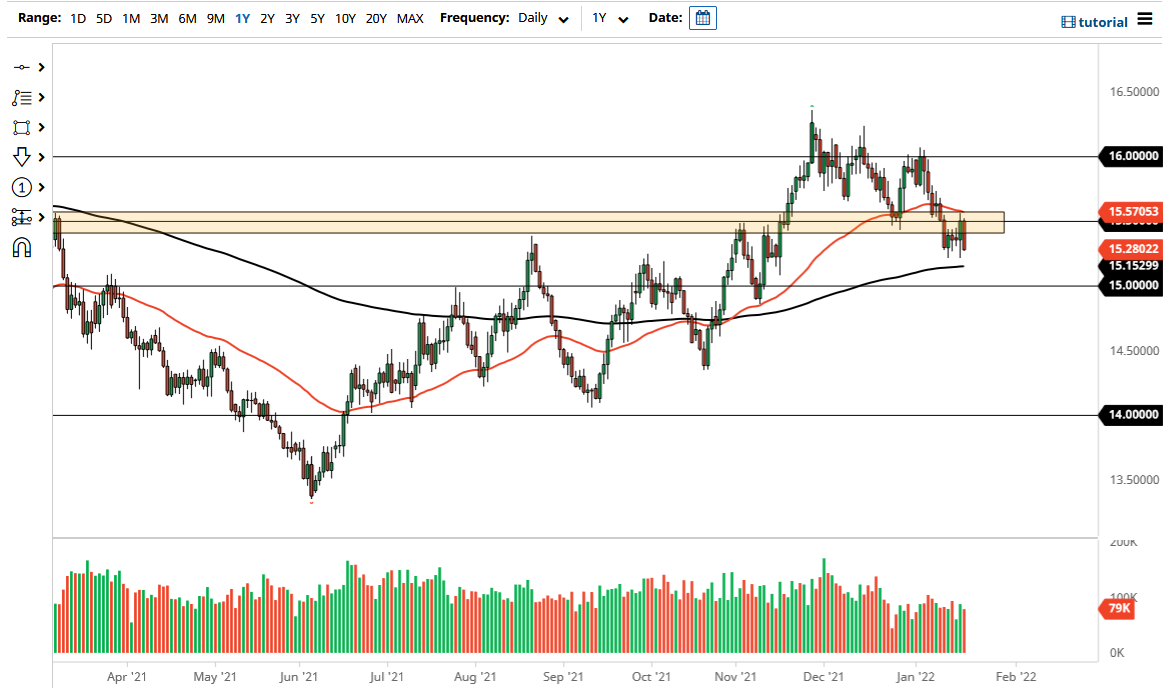

The US dollar fell a bit against the South African rand on Wednesday, reaching down towards the 15.29 rand level, but perhaps more importantly, the 200-day EMA sitting just below there. The 200 day EMA currently sits at 15.15 rand and is trying to rise ever so slightly. The market is currently being squeezed between the 50 day EMA and the 200 day EMA. Typically, this will squeeze the market and force it to make a bigger move, but at this point the question becomes whether or not the US dollar continues falling, or are we going to focus on the fact that South Africa has not crumbled due to the omicron variant? At this point, it seems like we are focusing more on the idea of emerging markets picking up momentum due to omicron falling, and there is the possibility that traders are focusing on the fact that the Federal Reserve is about to make a serious mistake.

What I mean by this is that typically tightening into a slowing cycle economically ends up being a huge policy mistake. Whether or not we have peaked from an inflationary situation in the United States is still an open question, because we are starting to see the numbers roll over ever so slightly. This is a market that typically will see a lot of reactionary moves due to the idea of inflation and perhaps whether or not the Federal Reserve is going to completely tighten the market. Typically, it is not good for emerging markets, but we have already seen the South African rand and stock market both get punished due to the omicron variant. In fact, the South African stock market has been one of the better performers for a couple of weeks now, which is now being reflected in the currency.

Simply put, I believe that if we break down below the 200 day EMA, we will challenge the 15 rand level rather quickly. If we break that level, then I think the US dollar has much further to fall, with the first serious target being 14.50 rand. On the other hand, if we turn around and take out the 15.60 rand level, and the 50 day EMA, then we could make a move towards the 16 rand level.