The US dollar has rallied rather significantly during the trading session on Thursday to reach towards the ₹74 level. We have not been able to break out to the upside though, so it will be interesting to see whether or not we can finally clear the ₹74 level. This is a market that continues to be very noisy, and therefore I think you need to keep an eye on that level, at least for a short-term guide. All things being equal, this is a market that I think is going to be reflective of the overall emerging market situation, which is all over the place at this point with the Federal Reserve coming back into the possible tightening phase coming.

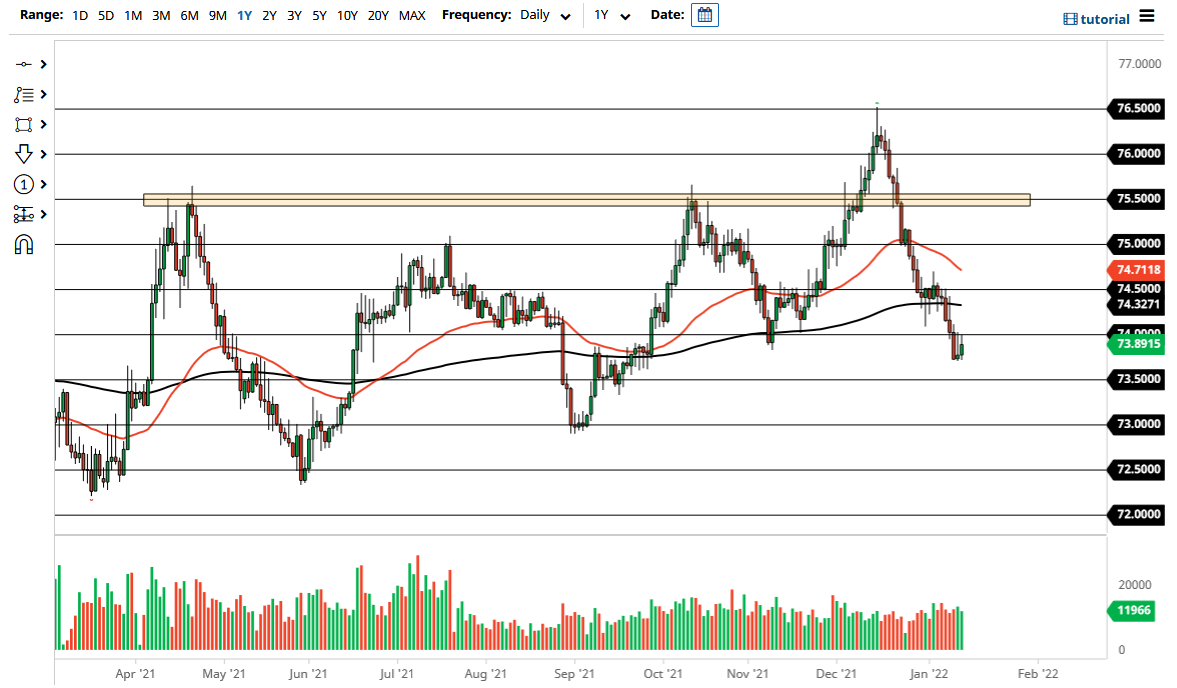

If we do break above the ₹74 level, then it is likely that we could go looking towards the 200 day EMA which currently sits at the ₹74.32 level. On the other hand, if we break down below the ₹73.70 level to the downside, then the market is likely to go looking towards the ₹73.50 level which of course is important, as we have seen a significant amount of support at that area previously. That could be an area that we see a bit of reactionary buying, but if we break down below it then it is obvious that the US dollar would plunge.

It will be interesting to see how this plays out, because quite frankly India tends to somewhat steer its currency in one direction or the other through the central bank. There is a lot of volatility out there so the smaller currency pairs such as the US dollar/Indian rupee market will probably get slapped around by a lot of external factors. If there are concerns about inflation, that tends to really punish emerging markets, such as India. After all, commodities become very expensive in that type of situation, and of course EM markets suffer as a result. It will be interesting to see how this plays out because we are most certainly oversold at this point, so at the very least I think you will see the market make an attempt to bounce. Whether or not we can break above that 200 day EMA would of course be a completely different question at this point in time. In general, I think we are set for a sideways move before an explosive one.