The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

The Forex market is currently showing some strong trends, so it’s a good time to be looking at trading Forex.

Big Picture 30th January 2022

As the first month of 2022 approaches its end, stock markets and other “risk” assets are continuing to sour compared to December’s broad bullishness on stocks and risk. Last week saw most global stock markets fall to new lows, although the S&P 500 index closed higher by the end of the week despite closing for the past six consecutive days below its 200-day moving average, while in the Forex market, the US dollar rose strongly. The major cryptocurrencies ended the week slightly higher.

Last week was dominated by the semi-monthly FOMC release which produced something of a hawkish surprise, as Fed Chair Jerome Powell used more hawkish language about high US inflation and about the prospects of rate hikes in 2022 being “front loaded” and possibly totaling closer to a final rate of 2% by the end of 2022. This created more bearish trading in stocks and other risky assets but had the primary affect of strongly boosting the US Dollar.

Last week also saw higher than expected Australian and New Zealand inflation rates, which may have contributed to the strong falls in the respective relative values of their currencies. There was also a release of US Advance GDP data which came in much more strongly than had been expected, at an annualized quarterly increase of 6.9% compared to the 5.3% which had been expected.

In the Forex market, the US dollar has strengthened significantly, with the US Dollar Index (USDX) breaking to its highest levels seen in 18 months. The Australian dollar was the biggest loser of the week in the Forex market.

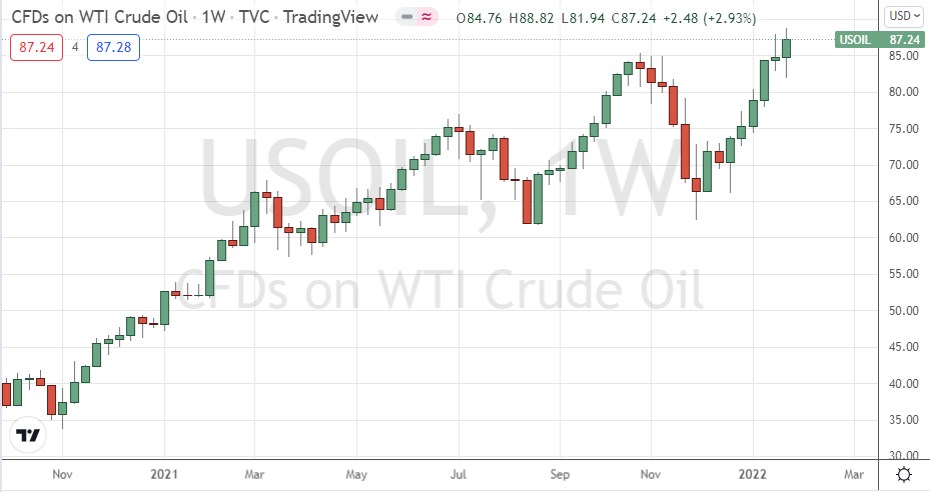

In the commodities market, crude oil, and some agricultural commodities, especially grains, are either very close to or making new long-term high prices.

Last week was the first week in about two months that we did not see an increase in new global confirmed coronavirus cases. It may be that the omicron variant pandemic has begun to ebb, although that would probably be an early call.

I wrote in my previous piece last week that the best trades for the week were likely to be long of WTI Crude Oil following a daily (New York) close above $86.52 and short of BTC/USD following a daily (New York) close below $36,656 with a take profit target at $32,817. This was a good call on Bitcoin as I was correct to wait for the specified breakdown before entering, which never came and therefore prevented what would have been a losing trade. With crude oil, we did get a trade entry on WTI Crude Oil at $87.15 which closed higher for the week by 0.10% producing a profit.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were:

- The Federal Reserve put a hawkish surprise into the market last week, raising the prospect of higher and faster rate hikes which strongly boosted the US dollar and knocked stocks and other risky assets.

- The benchmark US stock market index, the S&P 500, closed a bit higher, rallying on Friday after a bad week, but ended Friday below its 200-day moving average for the sixth day in a row, which is a bearish sign. The market has retraced by more than 10% from its peak so has entered correction territory.

- US treasury yields for 10 years, and 2 years, remain close to recent highs.

- Australian and New Zealand CPI (inflation) data came in a little higher than had been expected, especially the Australian rate.

- US Advance GDP data came in much more strongly than had been expected, at an annualized rate of 6.9%.

The coming week is likely to see a similar level of volatility compared to last week, with markets seeming to have moved into risk-off mode, which could see further strong falls in stocks and currencies which can be seen as safe havens. In the Forex market, the US dollar is very strong, while the Australian and New Zealand dollars are very weak. The coming week will be quite busy and will bring releases of:

- US Non-Farm Payrolls data.

- ECB Monetary Policy Statement and Refinancing Rate

- Bank of England’s Bank Rate and Monetary Policy Report

- Reserve Bank of Australia’s Cash Rate and Rate Statement

- Canadian GDP data.

- Canadian and New Zealand Employment data.

Last week saw the global number of confirmed new coronavirus cases fall slightly. Approximately 61.0% of the global population has now received at least one vaccination.

The strongest growths in new confirmed coronavirus cases overall right now are happening in Armenia, Austria, Azerbaijan, Bahrain, Barbados, Belarus, Belgium, Bhutan, Brazil, Bulgaria, Costa Rica, Croatia, Czech Republic, Denmark, Egypt, Estonia, France, Germany, Guatemala, Hungary, Iran, Iraq, Israel, Japan, Jordan, South Korea, Kosovo, Kuwait, Latvia, Liechtenstein, Lithuania, Luxembourg, Netherlands, New Zealand, North Macedonia, Norway, Oman, Pakistan, Paraguay, Poland, Portugal, Russia, Serbia, Singapore, Slovakia, Slovenia, Sweden, Switzerland, Turkey, and the Ukraine.

Technical Analysis

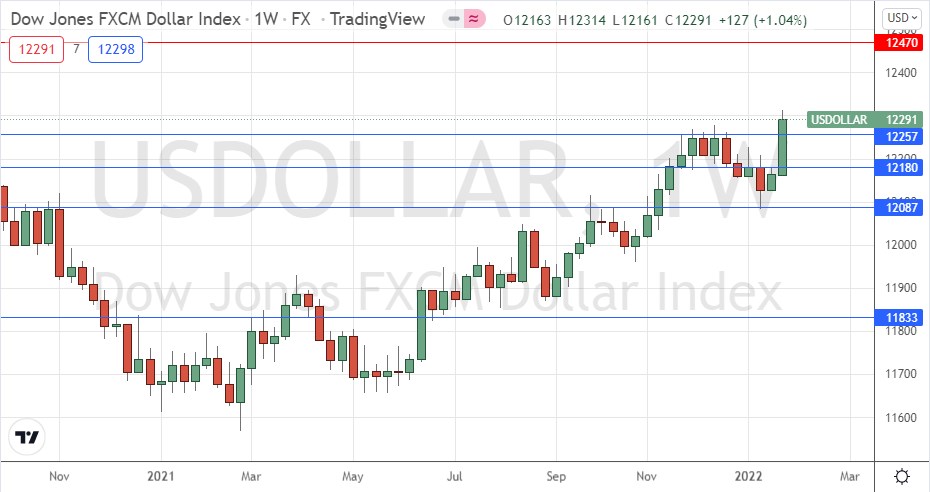

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a large bullish candlestick last week, after previously rejecting the support level at 12257, which closed relatively close to the high of its range. The price ended the week at its highest weekly close seen in 18 months. These are all strongly bullish signs for the greenback. The dollar was boosted by last week’s Federal Reserve release which suggested 2022 will see higher and faster rate hikes than had been widely expected.

Overall, it seems clear we have a very bullish picture in the USD over the long and medium terms, so it will probably be wise to trade in the direction of long USD over the coming week.

WTI Crude Oil

For the third week running, WTI Crude Oil made its highest weekly close in 7 years last week and printed a bullish outside bar which looks healthy and suggests a further rise to come. There are bullish signs, and I continue to see WTI Crude Oil as an interesting buy.

EUR/USD

The euro had been weak for a long time, causing this currency pair to continue in its relatively bearish consolidation pattern over recent months. Last week’s release from the Federal Reserve created a strong surge in the dollar, and due to the continuing weakness of the euro, we saw the price of this currency pair fall unusually sharply to end the week at an 18-month low on above-average volatility.

A bearish retracement will quite possibly happen, but there is a good chance that we are going to see the bearish momentum continue over the next few days, due to the above-average volatility and fundamental factor behind the price’s fall.

For these reasons, I see this currency pair as an attractive short trade.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be long of WTI Crude Oil and short of the EUR/USD currency pair.