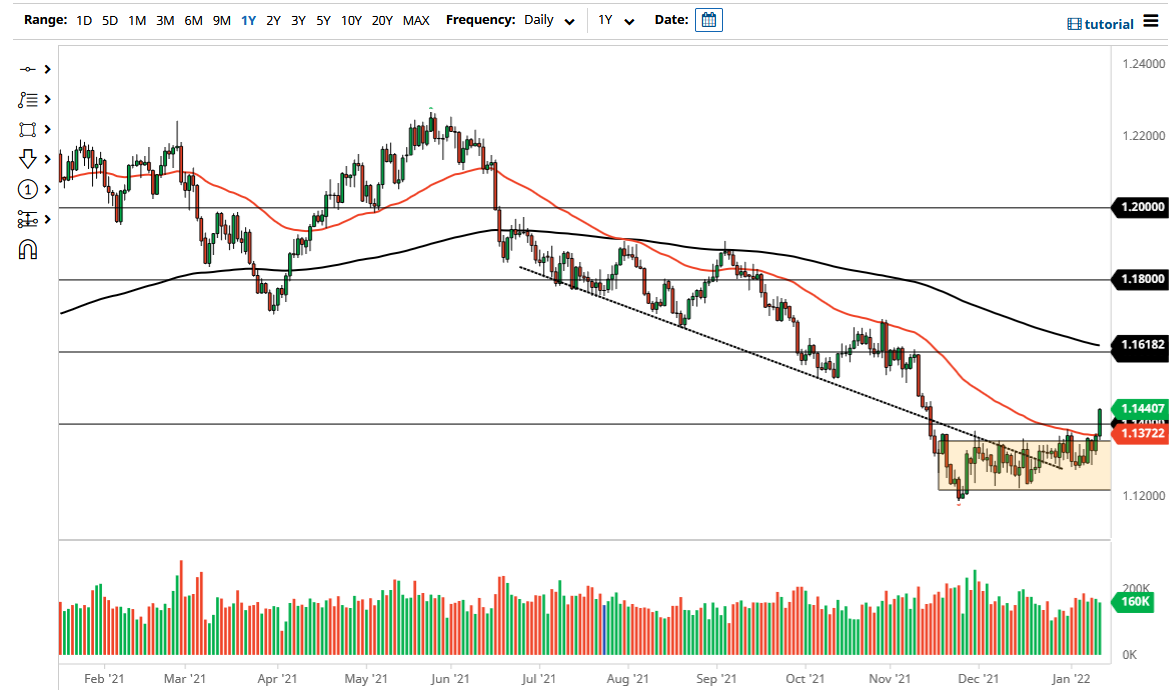

The euro has finally broken out against the US dollar, cleanly wiping out the 50-day EMA and even breaking above the 1.14 handle. By doing so, this is a very strong sign, and it suggests that we are ready to go higher against the greenback at this point, as there has been a lot of technical damage done to the US dollar. Ultimately, the market had been whispering that it wanted to go higher for a while, so it is not a huge surprise that we have broken out.

Inflation printing at 7% year-over-year in the United States seems to have people breathing a sigh of relief, perhaps because there were “whisper numbers” of much higher inflation. Because of this, the relief rally has sent the US dollar lower, as markets have taken on more of a “risk on” type of tone. Ultimately, I do think that is something that a lot of people will pay close attention to, as risk appetite has a major influence on the Forex markets.

Now that we have broken out of this somewhat ascending triangle, it does suggest that we are going to go to the selloff point at the 1.16 level. I do not necessarily think that it will be easy to get there, but clearly the market is interested in doing so based upon what I have seen over the last couple of days. The fact that we are closing towards the top of the range for the trading session on Wednesday is a good sign as well, so I do think that it is probably only a matter of time before we break even higher. The breakdown point at the 1.16 level was rather negative, so I do think that it will be difficult to break above. Nonetheless, the market looks like it is hell-bent on at least trying to do just that.

I have no interest in selling this pair, unless of course we break down below the 1.1350 level, at which point we could re-enter the previous consolidation area. I do not think that is going to be the case though, so it is very likely that I will be placing the trade. However, you always need to keep both potential trades in the back of your mind, and your eyes open as well as your mind.