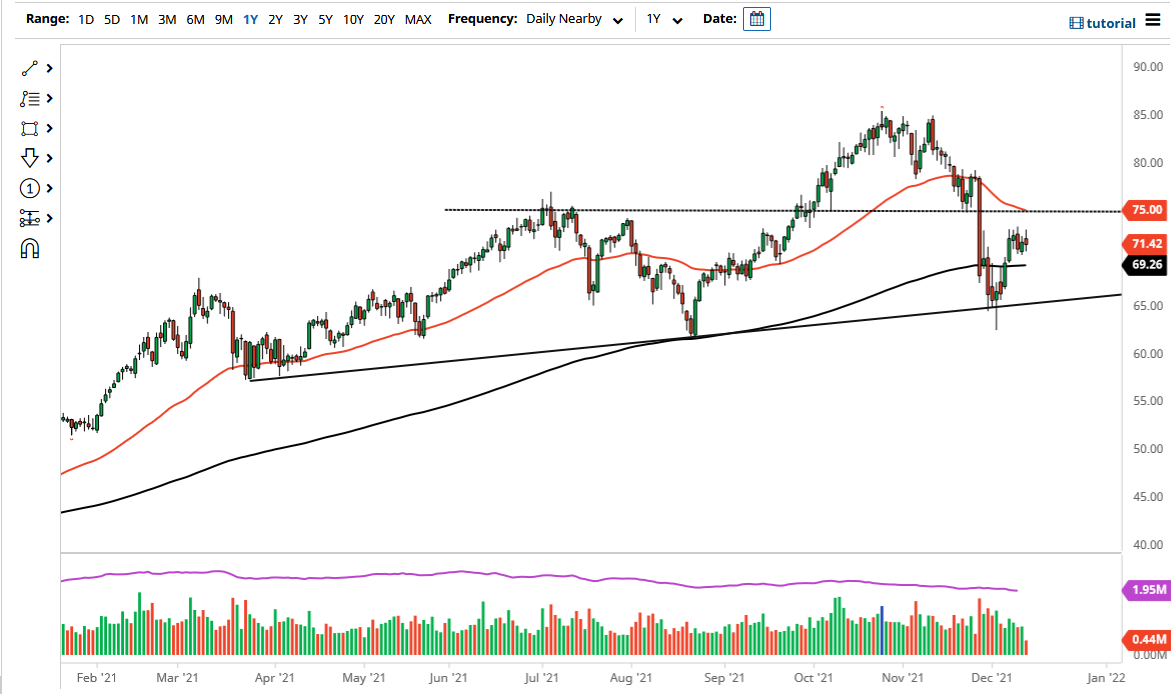

The West Texas Intermediate Crude Oil market was grinding sideways during the majority of trading on Monday, as traders seem relatively content to ride out the rest of the year, waiting for more liquidity to come into the marketplace. Because of this, the market is likely to be somewhat complacent, but it is worth noting that the 200 day EMA currently sits just below. Because of this, I would be interested in shorting below that indicator, because it would show a complete failure.

The candlestick itself is relatively neutral, but it does have a slightly negative real body. Perhaps that is a bit of a hint as to whether or not there is momentum picking up to the downside, but at this point in time I think there is a lot of noise underneath that could effectively offer a certain amount of support. I do not necessarily like the idea of blindly shorting, but I certainly would not be a buyer at this point. What is particularly telling is that there seems to be a lot of uncertainty around the narrative of whether or not economies are going to lock down or reopen, so I think you will continue to see more of a “wait and see approach.” With that in mind, I think if you are a shorter-term trader, this might be a good market for you, but if you are looking for a bigger trade you need some type of catalyst.

To the upside, the $75 level will almost certainly be psychological resistance, not only due to the fact that it is a large, round, psychologically significant number, but we also have the 50 day EMA in the same neighborhood. That being said, I think rallies at this point are probably going to get sold into, giving us an opportunity to get short at the first signs of exhaustion. With that in mind, I am looking for signs of selling pressure to take advantage of. On the other hand, if we break down below the 200 day EMA, it is very likely we go looking towards the uptrend line underneath as well. I do not really have a scenario in which I'm willing to buy this market until we can clear the $75 level on a daily close.