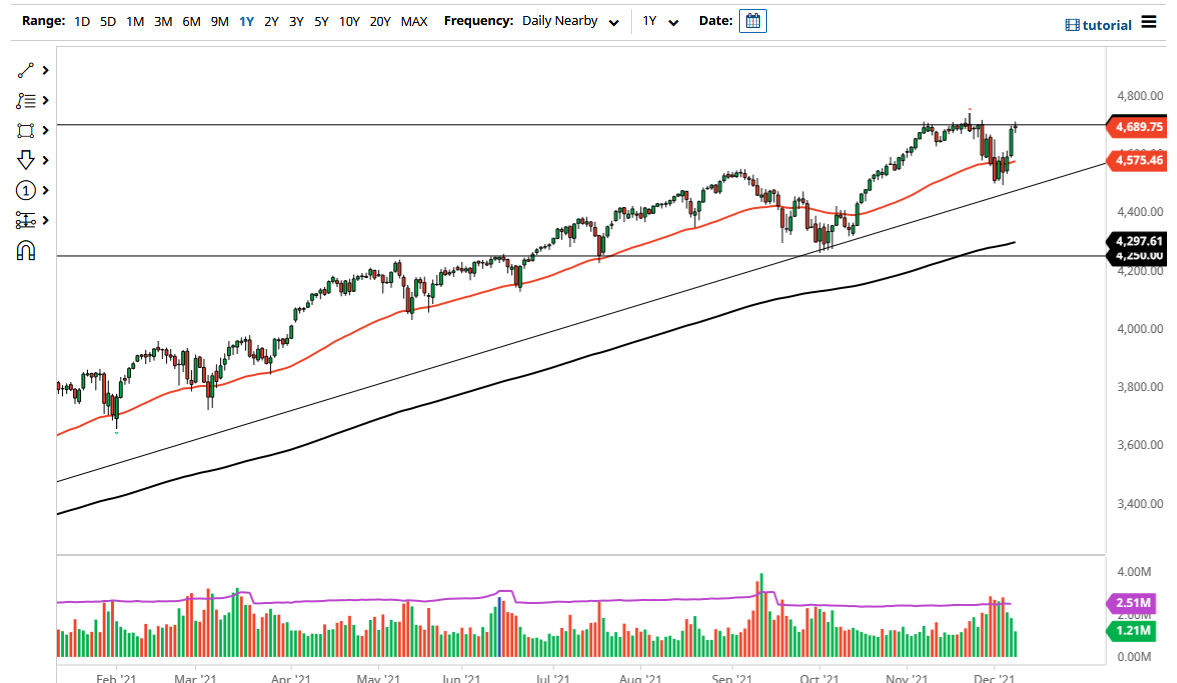

The S&P 500 rallied ever so slightly on Wednesday as we continue to see a little bit of noisy behavior right around the 4700 level. This is an area that is rather important, and you should pay close attention to it as it has been like a brick wall. If we can break above here, then the market is likely to go towards the all-time highs at 4740, on its way to 4800. This is not to say that I think the market is simply going to explode to the upside, but it certainly looks as if it is a “beach ball held under water” at this point, and that we could get a bit of a rip.

Pullbacks are likely as well, perhaps opening up the possibility of buying on the dips going forward. The 50 day EMA sits at the 4575 handle and is rising, so that comes into the picture as well. Given enough time, I fully anticipate that we will continue the overall rally based upon the so-called “Santa Claus rally” that happens every time we get close to the end of the year as traders will have to come up with some type of gains to show their clients.

Underneath, the 4500 level I think is now the “floor in the market” going forward, as the traders around the world continue to look for that value. The 50 day EMA is above there, but the 200 day EMA is currently at the 4300 level and racing higher. This has been a relentless uptrend, and even though the market had sold off quite drastically last week, the reality is that we are roughly 0.3% from the all-time highs, meaning that the market is still very strong, despite the fact that there may have been a lot of noise and fear out there. I think we will still go to the 5000 level, but that could take some time to make happen. I have no interest in shorting this market and never do when it comes to US indices, but if we were to somehow slice through the 200-day EMA, you could convince me to start buying puts, as at least then I can mitigate the risk of trying to benefit from something that is structurally made to go higher falling.