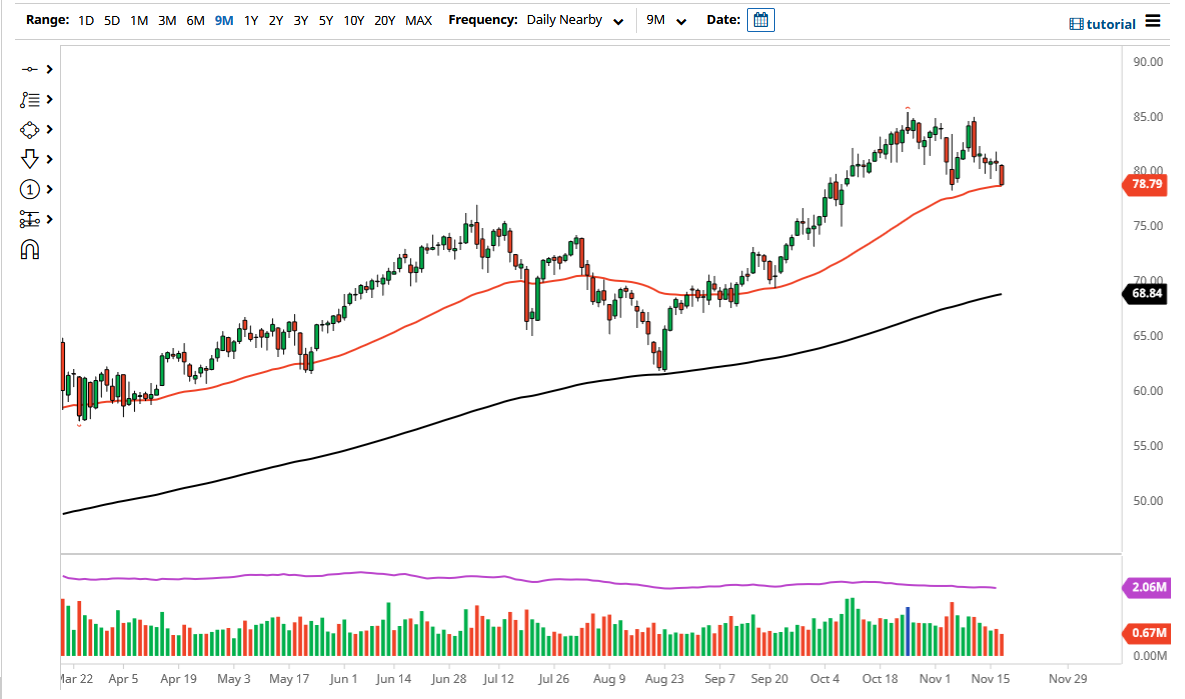

The West Texas Intermediate Crude Oil market fell on Wednesday to reach down towards the crucial 50-day EMA. The 50-day EMA is an area that will continue to cause a certain amount of attention, but it should be noted that we have sliced through the $80 level rather easily. We are closing towards the bottom of the range for the day, so now the question is whether or not we will have follow-through. That typically is the case that when you close towards the bottom of the range; quite often you will see a bit of follow-through in the next session.

There are a lot of concerns out there that the Biden administration may release the Strategic Petroleum Reserve, which could bring down pricing for a short-term move, but longer-term it tends to have a very limited effect on the markets. Because of this, I think that we will eventually have a nice buying opportunity, but it is a scenario where we need to pay close attention to the idea of value as it occurs, because there is no reason that I can see for a longer-term trend change. The market looking at the consolidation area could probably see it as a bullish flag being formed.

This is a market that I think continues to offer plenty of value, so it is likely that we could eventually find quite a bit of buying pressure. Keep in mind that the inventory numbers coming out of the United States will continue to dictate where we go, and we have those over the next 24 hours. Underneath, I think the $75 level is going to end up being a bit of a floorin the market, unless of course there is some type of huge negative attitude out there, something that I have not seen much of recently. In fact, one could make an argument for the recent action forming a little bit of a big “potential double bottom” in what would be a continuation longer term. We will have to wait and see, but that is one potential set up if we can break above the highs of the day, extensively recapturing the $80 level. I do not like shorting oil right now, but that does not necessarily mean you need to jump in with both feet.