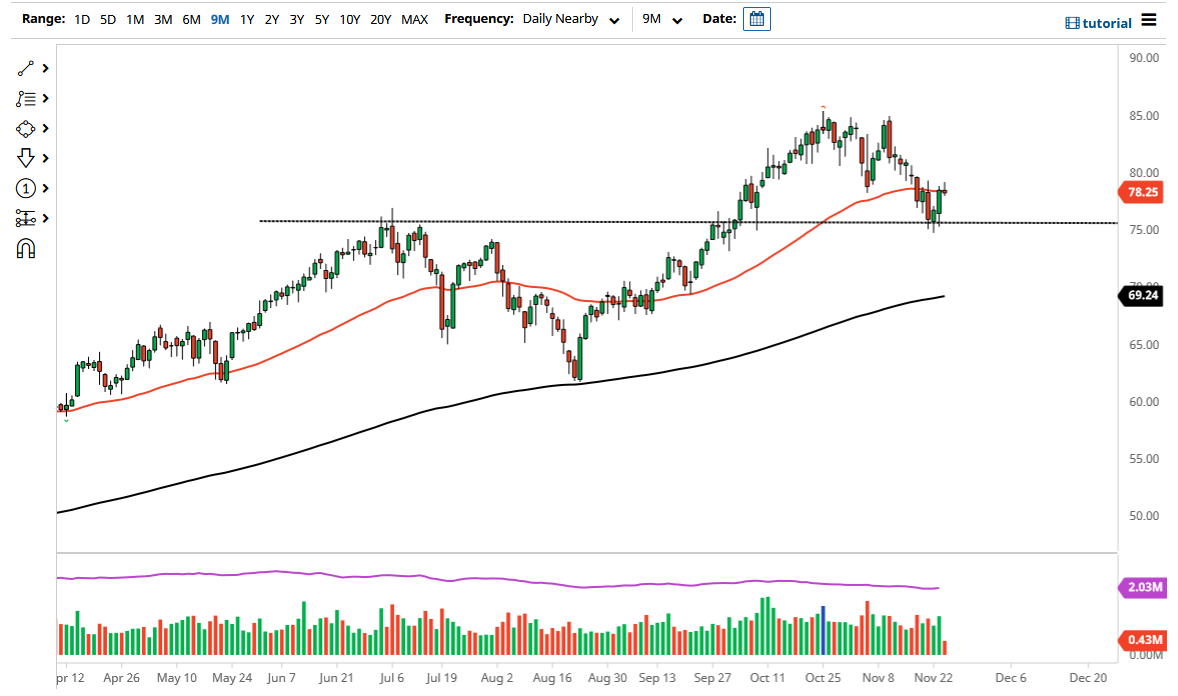

The West Texas Intermediate Crude Oil market initially tried to rally on Wednesday but stalled just below the $80 level, and perhaps even more importantly, the 50-day EMA, as the indicator tends to attract a lot of attention. Because of this, it is very likely that we will see a bit of a pullback, but you should also keep in mind that the Thursday session is Thanksgiving in the United States, so there might be a little bit of electronic trading, but at the end of the day liquidity will be a major issue.

When you look at this chart, it is worth noting that the market rallied quite significantly after Joe Biden announced that the United States was going to release 50 million barrels from the Strategic Petroleum Reserve. In other words, we may have seen the bottom of the most recent pullback, with the $75 level offering significant support, so it will be interesting to see that if a pullback gets bought into.

On the other hand, if we break above the top of the shooting star for the trading session on Wednesday, that could bring in fresh buying. Clearing the $80 level would help as well, both of which would be a reason to get long. I think short-term pullbacks are more likely than not though, so look at those as potential buying opportunities. Having said that, if we were to turn around and break down below the lows that were formed on Monday, that would be a very negative sign. I do believe that the crude oil situation is going to come down to any response that OPEC has to the release of crude oil from the SPR, as it is very likely they may use that as an excuse not to increase production. If that is the case, we could have a bit of a economic situation, so it is worth paying attention to is the comments coming out of the Vienna meeting. Furthermore, you also need to pay attention to the US dollar, although both the US dollar and crude oil can climb at the same time under the right conditions. As things stand right now though, I do not really have any interest in trying to short this market, because I think there is far too much demand out there right now.