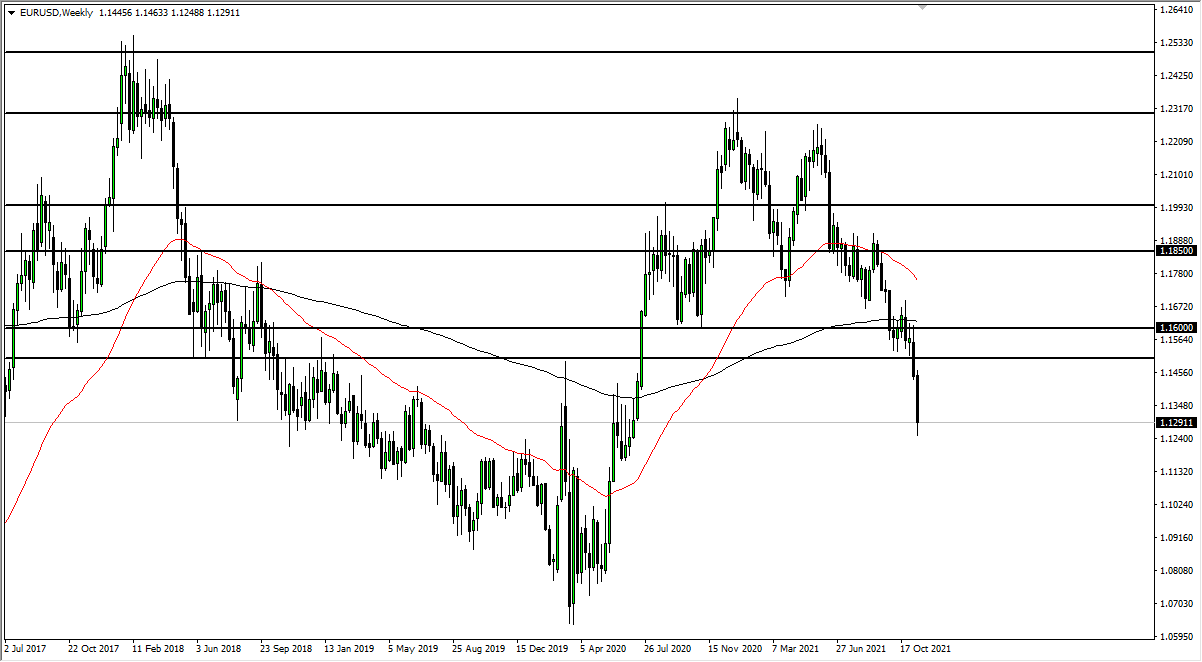

EUR/USD

The euro got absolutely pummeled again during last week as Austria decided to lock itself down. There have also been murmurs coming out of Germany that the same thing could happen there, so that obviously works against the value of the EU economy. Furthermore, the European Central Bank seems to be stuck in a dovish tone, so as long as there is a major differential between the ECB and the Federal Reserve, it makes sense that the US dollar continues to gain ground against the common currency. Rallies at this point are likely, only because we have fallen so far, but I look at those as selling opportunities on signs of exhaustion.

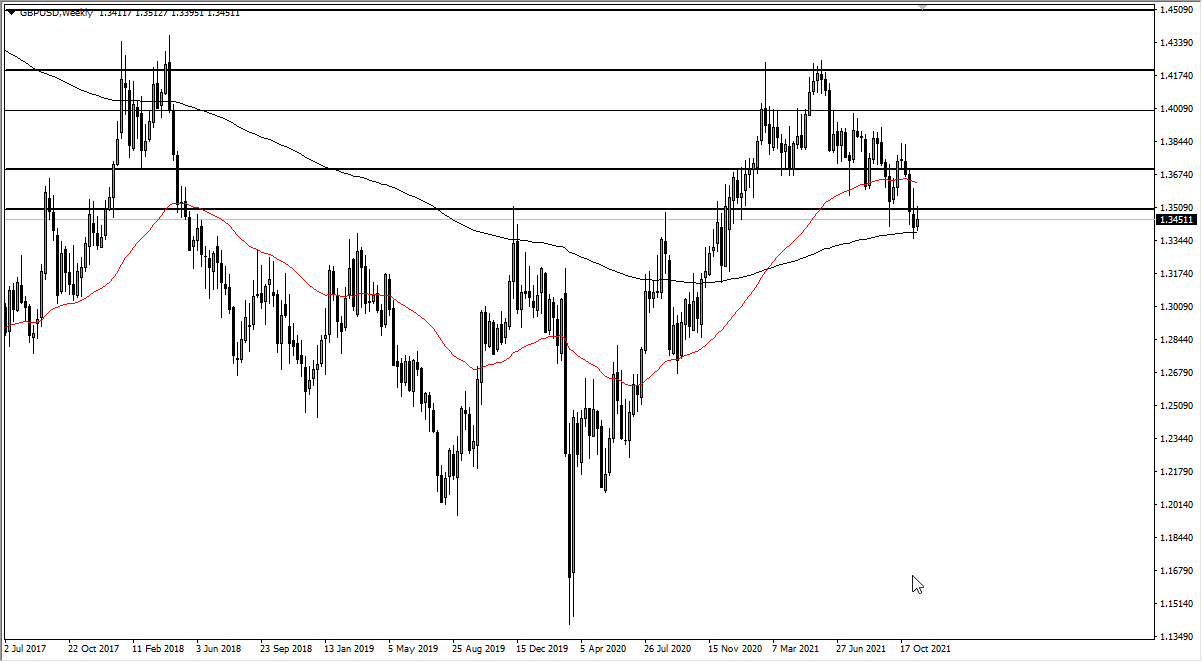

GBP/USD

The British pound rallied a bit during the course of last week, but as you can see the 1.35 level has offered resistance. This tells me that the pound is running out of steam and may be getting ready to break down. On a breakdown below the lows of the week, I suspect that we will probably continue our move towards the 1.30 handle, which now seems more likely than not. If we do rally at this point, we need to overtake the 1.36 level for me to be comfortable going long of this currency. At this point, it is all about the US dollar.

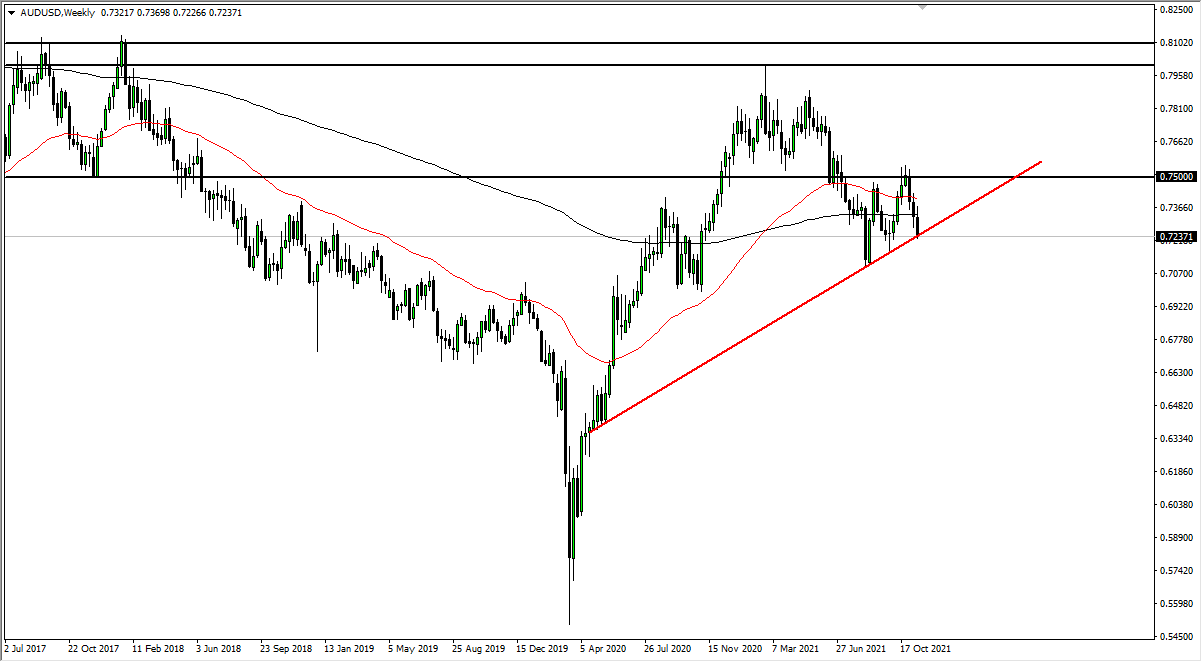

AUD/USD

The Australian dollar initially rallied during the week but gave back the gains rather quickly. On the weekly chart, you can see there is a major uptrend line that I have drawn, and we are sitting right on top of it. If we break down below the 0.72 level on a daily close, I believe that this market will probably start to break down and continue going much lower. A lot of this is going to come down to Chinese domestic numbers, and of course the commodity markets. It is worth noting that we are starting to see a little bit of a shift into a “risk off” type of world, and if that is the case the Australian dollar will most certainly suffer.

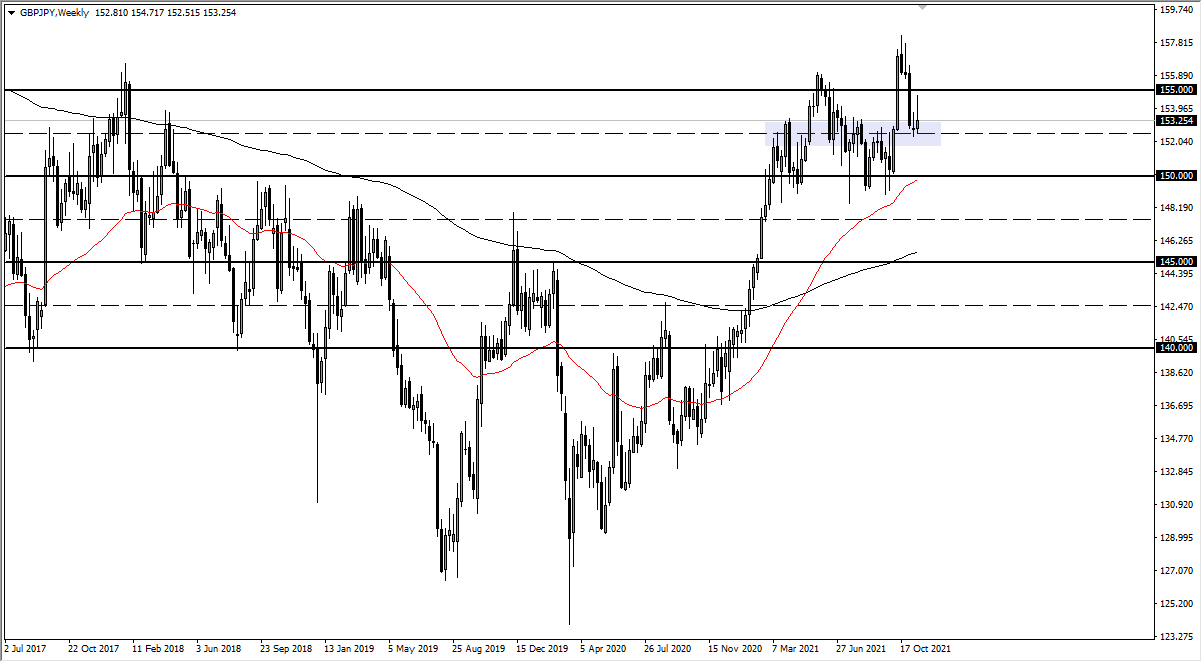

GBP/JPY

The British pound spent most of the week trying to rally against the Japanese yen but struggled at the ¥155 region. This is an area that has seen quite a bit of action as of late, and the resulting inverted hammer does suggest that perhaps we could break down. On a move below the ¥152.50 level, I anticipate this market will go looking towards the ¥150 level. On the other hand, it is just as likely that we will simply bounce around between ¥152.50 on the bottom of the range for the week, and ¥154.50 at the top.