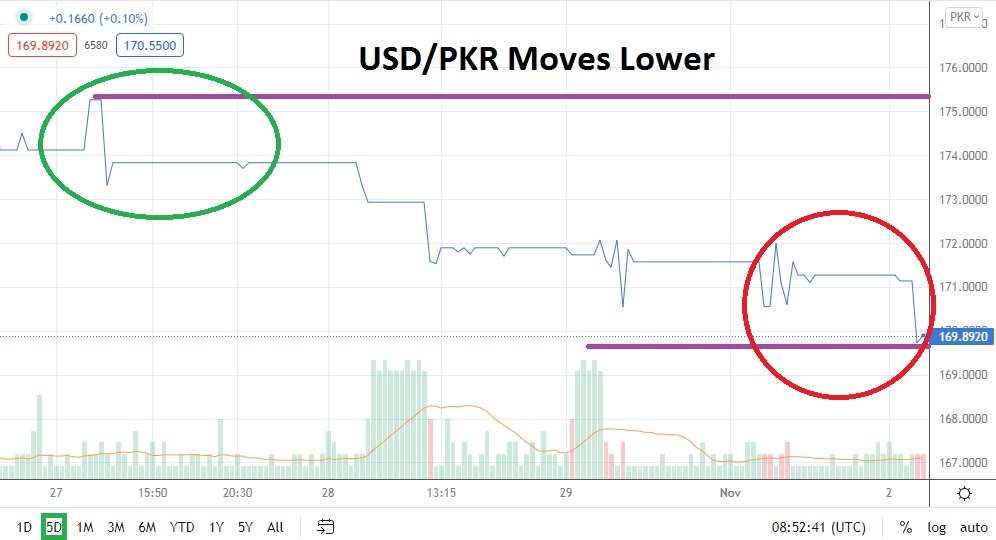

The past week of trading has seen an extraordinary reversal lower take place within the USD/PRK. After hitting an all-time high of nearly 175.3100 on the 26th and 27th of October, the pair has turned in a strong bearish move and, as of this writing, is traversing near the 169.9000 level. The lower values of the USD/PKR are testing support levels which were seen in late September and the first couple of weeks in October.

Since May of 2021, the USD/PKR had been within the grasp of a strong bullish surge. A value of 151.7100 was seen on the 10th of May. The last time this lower value had been touched was in June of 2019. The USD/PKR has a habit of producing strong trends. The fact that the Forex pair has been within a demonstrative upwards trajectory and touched all-time values only a handful of trading days ago, should work as a caution sign for traders who want to blindly sell the USD/PKR now.

However, there tends to be a time when trends in fact do come to an end, and speculators may want to ask if something has happened within the market place which has helped to initiate this sudden reversal lower. Technical traders may want to close their ears to the news, but there have been reports emerging that Saudi Arabia and Pakistan has begun to make progress regarding their economic relationship. One week ago it was announced Saudi Arabia will begin to provide Pakistan with more economic support.

The news that Saudi Arabia and Pakistan may be able to improve their relationship has certainly helped the USD/PKR turn bearish. Technical traders may be looking at current support levels and suspect some type of reversal is about to occur, but if they are going to wager against the short-term trend they should be very careful. The USD/PKR has produced a rather solid amount of price velocity the past few trading days too.

The USD/PKR is now trading near one-month lows and if current support near 169.7500 begins to look vulnerable it could mean lower values will be tested near term. The long-term trend of the USD/PKR has been bullish, but perhaps speculators should begin to embrace the potential the Forex pair will be able to actually exhibit the ability to move lower and sustain this type of move for longer durations.

Pakistani Rupee Short-Term Outlook

Current Resistance: 170.2200

Current Support: 169.4500

High Target: 171.5000

Low Target: 168.8500