Investors weighed expectations about the future of monetary policy tightening by the Bank of England and the US Federal Reserve, which favor the US dollar. There is also the momentum from the re-appointment of Jerome Powell as head of the Federal Reserve and the positive results of US economic data. Led by the stronger growth of the US economy, weekly jobless claims fell to the lowest in 50 years. This situation was a catalyst for the bears to push the price of the GBP/USD currency pair towards 1.3315, its lowest support level of the year, before settling around the 1.3335 level as of this writing.

Factory orders in Britain rose to an all-time high, while price expectations also rose and point to persistent inflationary pressures that are unlikely to abate soon. CBI's November Survey of Industrial Trends showed manufacturing order books rose to the strongest level since 1977 while export orders recovered to their pre-Brexit highs.

Output growth in the three months to November rose at an above-average pace, with 12 out of 17 sectors seeing increases in production. Commenting on this, Samuel Tombs, chief UK economist at Pantheon Macroeconomics, says: "Demand for commodities continues to increase rapidly, leaving manufacturers struggling to keep up." Even taking into account seasonality, the total order balance rose by 11 points in November to reach its highest level since records began in 1977 according to Tombs.

The main growth was largely driven by the food and beverage, tobacco, electronic engineering and chemical sub-sectors. Moreover, manufacturers expect production growth to accelerate in the next three months. “Industrial production may still have room to pick up more in the fourth quarter, as previously furloughed employees are called in and manufacturers invest in to boost productivity,” says Tombs. “Even if orders weaken next year, perhaps as restocking fades, The production will be supported by the large backlog that has accumulated this year.”

According to the CBI report, stock adequacy of finished goods has worsened to its weakest level ever (since April 1977). Meanwhile, expectations for production price growth in the next quarter were at their strongest since May 1977.

The British pound came under more pressure from the dollar's rally as the latter advanced against the other major currencies led by a batch of data released in the US as well as the latest insights from the Federal Reserve Board. “If things continue to do what they have been doing, I will fully support an accelerated pace of tapering,” Mary Daly, president of the Federal Reserve Bank of San Francisco, told Yahoo Finance in an interview published on Wednesday. "But I have two data points in front of me and also deliberations with my colleagues to really think about this."

Mary Daley, president of the San Francisco Fed, became the latest US rate setter to signal that the Fed may eventually be persuaded to cancel the Fed's $120 billion per month quantitative easing program at a faster pace than one that would have indirect repercussions on US interest rates.

President Daley's comments are likely to be more significant given the market's perception of a "dove" and thus someone who would normally be less likely to support measures that could be described as monetary tightening. The comments and the potential change in the situation come after official data revealed on November 10 that US inflation rose at an accelerated pace of more than six percent during October, which represents the strongest price growth in the United States since 1990.

That trend was confirmed Wednesday by the Fed's preferred measure of inflation pressure, the core PCE price index, which rose from 3.7% to 4.1% for the 12 months through the end of October even after excluding alcohol, food and energy prices from the data. Economic indicators so far point to the strongest GDP growth for the fourth quarter, while the labor market looks tighter than expected and inflation is running hotter than suggested in September.

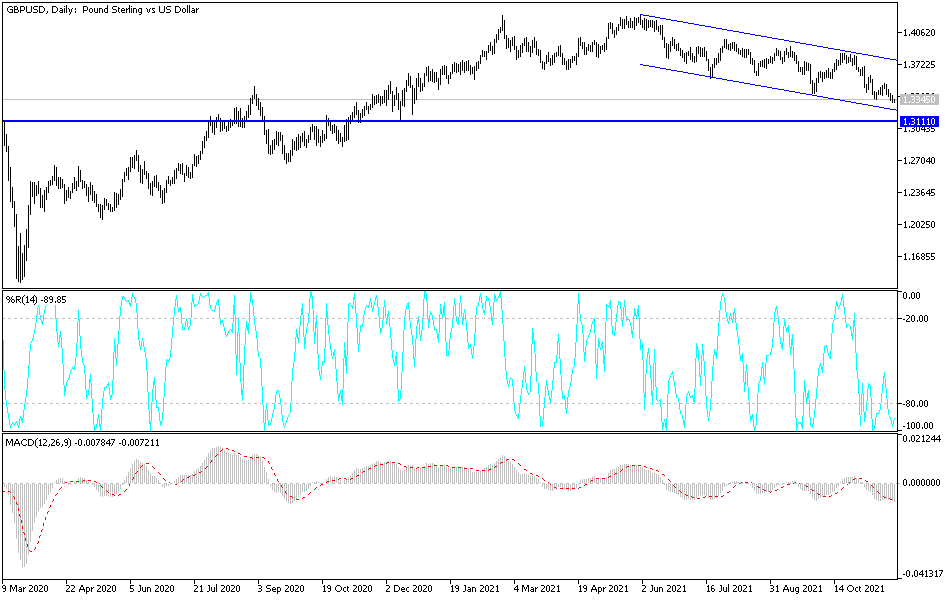

Technical Analysis

On the daily chart, the general trend of the GBP/USD is still under bearish pressure, and breaking below the 1.3300 support will move the technical indicators towards oversold levels. I expect movements for the pair today in narrow ranges in light of the American holiday, which affects liquidity in the markets, paving the way for a new bearish weekly closing for the GBP/USD pair. The closest bear targets are currently 1.3245, 1.3160 and 1.3080.

On the other hand, to break the current trend, the bulls must break through the 1.3600 resistance again. Amid the absence of US and British economic releases, all focus will be on the Bank of England Governor's comments later today.