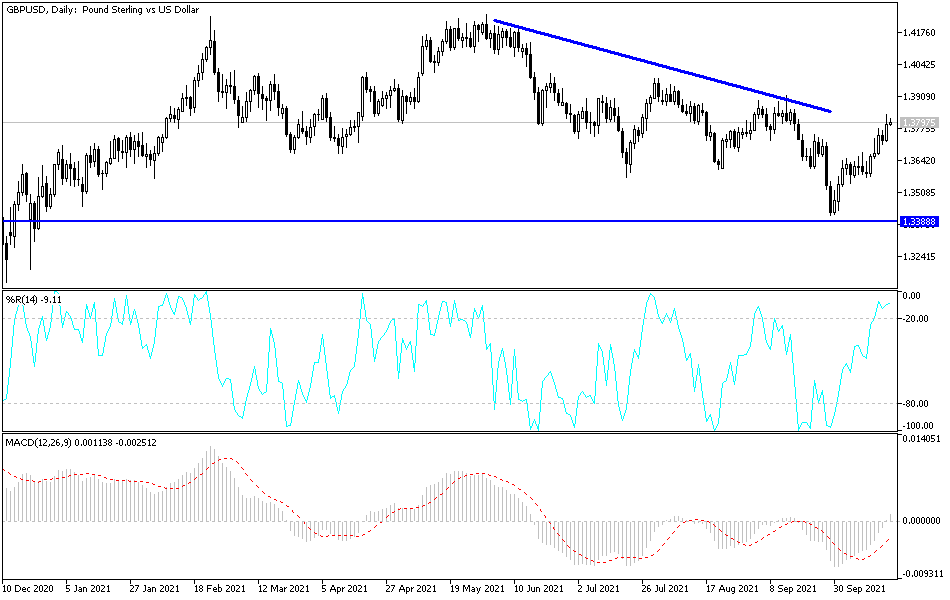

The British pound rallied on Tuesday again to show even more strength. We broke above the 1.38 level during the session, as well as the trendline that I have marked on the chart. This looks as if it is trying to turn around and reach to the upside, perhaps trying to get to the 1.39 handle over the longer term. The US dollar was sold off against almost everything, and the British pound was going to be no different. That being said, towards the end of the day we did see a little bit of a pullback.

Looking at this chart, it is very likely that we will continue to see upward momentum, so I do like the idea of buying short-term pullbacks, with the 1.37 level offering a significant amount of support not only due to the previous resistance, but the fact that the 50- and 200-day EMA both sit there. As long as that is the case, it is very likely that there are a lot of technical reasons to get involved one way or the other. I do think at this point in time, dips will be looked at as a potential buying opportunity, with the market very unlikely to be selling off drastically anytime soon.

When you look at this chart, you can see that we had previously formed a major descending triangle but have turned around to break back above it. At this point, it is a major rebuke of selling pressure, and it does make sense that we would get follow-through. The British pound is getting a bit of a boost due to the fact that the Bank of England is very likely to raise interest rates between now and the end of the year, so that has a positive effect on the currency in general, due to the fact that interest rates are rising in the UK. That being said, the US dollar has been somewhat strong, so it is also possible that we will see the market be very noisy, and as a result I think it is probably easier to buy the British pound against other currencies, but this chart certainly looks as if it does want to rally. We are in a situation in which the majority of major central banks around the world will continue to look like they have to raise interest rates in order to fight inflation, so expect a lot of noisy behavior regardless.