Bearish View

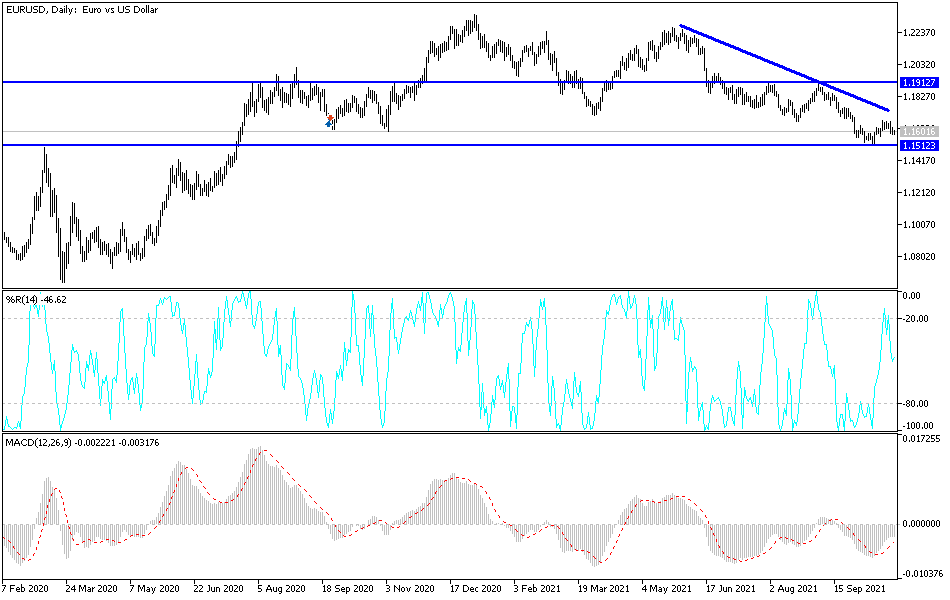

Sell the EUR/USD pair and set a take-profit at 1.1500.

Add a stop-loss at 1.1650.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.1630 and a take-profit at 1.1700.

Add a stop-loss at 1.1550.

The EUR/USD declined for the second consecutive day as investors reflected on the strong American consumer confidence and the upcoming European Central Bank (ECB) meeting. It is trading at 1.1590, which is lower than this week’s high at 1.1665.

US Consumer Confidence and ECB

The EUR/USD pair declined after strong data from the US. Numbers by Conference Board showed that the country’s consumer confidence rose in October. They rose from 109.8 in September to 113.8 in October. This increase was better than the median estimate of 108.3. Confidence rose even as many people remained concerned about the state of inflation.

Additional data showed that new home sales rose sharply in September. These sales rose by 14% in September after falling by 1.4% in the previous month. Precisely, new home sales rose from 702k in August to 800k in September. Economists polled by Reuters were expecting the data to show that sales rose to 760k.

At the same time, home prices remained high in August. The House Price Index rose by 18.5%. Therefore, there are hopes that the Federal Reserve will start tapering in the coming meeting. According to the WSJ, the bank will start winding down the $120 billion per month QE program when it meets in November.

The next key mover for the EUR/USD will be the latest durable goods order numbers from the US that will come out today. These numbers will be followed by the latest European Central Bank (ECB) meeting that will start today.

Economists expect that the ECB will leave its interest rates unchanged in this meeting. However, the bank will likely sound a bit hawkish considering that the European economy has made a strong recovery and that inflation is already above the bank’s estimate.

EUR/USD Forecast

The four-hour chart shows that the EUR/USD pair formed a strong resistance at 1.1666 recently. It has struggled moving above this level several times this month. At the same time, the pair managed to move below the key support at 1.1616. It even did a break and retest pattern at this level. Also, the pair has moved below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has been in a bearish trend.

Therefore, the pair’s path of least resistance will be to the downside, with the next key level to watch being at 1.1500.