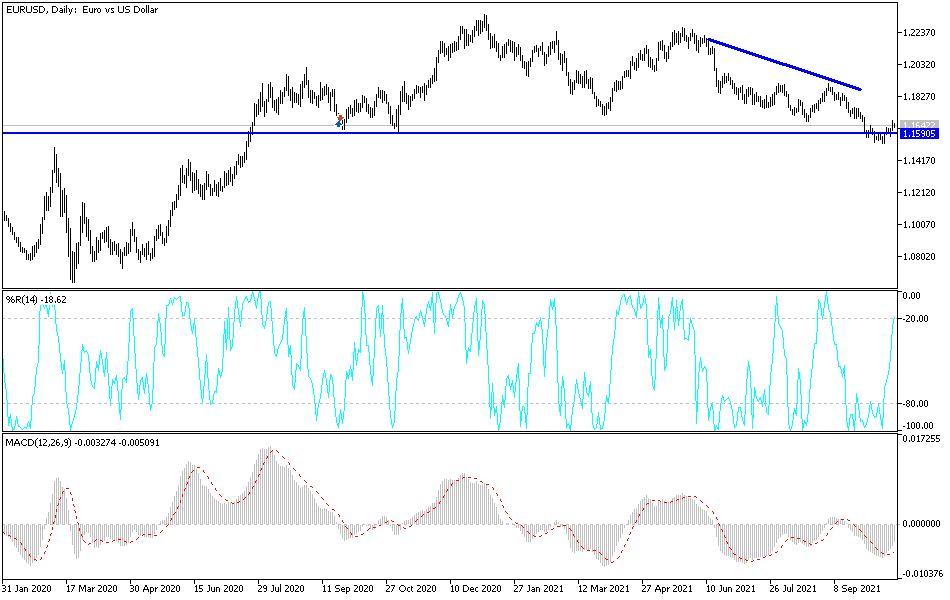

The euro rallied significantly on Tuesday to reach towards the 1.1650 level before rolling over and showing signs of exhaustion. The candlestick is a bit like a shooting star, so it suggests that perhaps we are going to get a pullback. The 1.16 level is an area that attracts a lot of attention, so I think it is probably only a matter of time before the sellers coming back in to try to do their best to drive this market back below that level.

On the other hand, if we can break above the top of the candlestick, then it is likely that we would go looking towards the 50-day EMA which is currently at the psychologically important 1.17 level. That is an area where we had broken down from previously, so it does make sense that we would see pressure there. Breaking above there does not necessarily give the “all clear” in order to get long, but it does suggest that we would then challenge the 1.1750 level.

Keep in mind that the European Union has a huge mess of issues to deal with right now, but it is worth noting that bonds in the European Union are starting to creep towards a positive return, something that we have not seen recently. In fact, during the early morning hours on Tuesday, Dutch bonds started to yield a positive return again. That being said, there is also a lot of concern about the COVID cases in the European Union, because they are rising so quickly. That being said, it is very likely that we will continue to see a lackluster performance from the euro, despite the fact that the US dollar is on its back foot at the moment.

If we do break above the 1.1750 level, then I think you will probably have enough momentum to go much higher. Nonetheless, I still believe that the best way you can play this market is to either to short it on US dollar strength or use it as an indicator as to where we are going next with the greenback against multiple other currencies. Quite frankly, I just do not have much interest in trying to get long anytime soon, as the market has been so decidedly negative when it comes to the common currency.