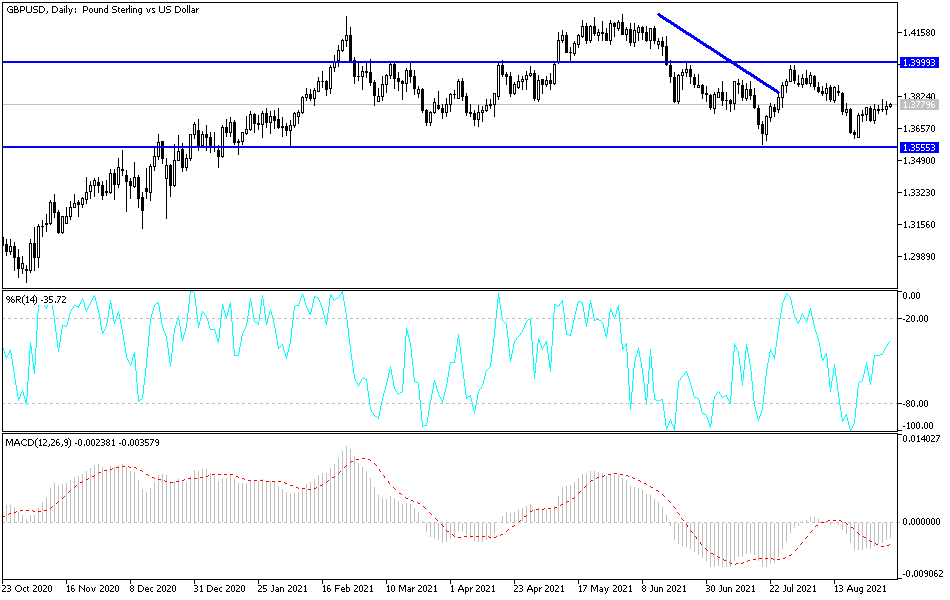

The British pound was somewhat bullish on Wednesday as the US dollar fell a bit. The 50-day EMA is just above, showing resistance as well. The previous candle was a shooting star and showed a lot of trouble. The 1.37 level below is significant support, so breaking below there would be a sell signal form what I see. This would be a continuation of the overall malaise that this market has been in.

The pound has been suffering for some time, as the UK economy has been pummeled by the coronavirus pandemic and the shutdowns that came with it. The market could break down below that support level, only to test the ‘double bottom’ under there at 1.36 as well. Anything below there would be a nasty sign for the pound going forward. Alternately, we could break above the 50-day EMA, which is a positive sign, and that could open up the move to the 1.40 level, an area that has been massive resistance previously. The market breaking above there would then be a signal that we are going to the 1.42 level after that.

The US dollar could get a boost due to the ‘risk off’ trade, especially if something happens to shake overall confidence, as the markets tend to run towards the bond market in that scenario. The shape of the candle is positive, but not overwhelmingly so. The market certainly has taken notice of the shooting star from Tuesday, and this is something that a lot of people will trade against. I think this shows that the market will continue to bounce back and forth. This is a scenario that could work itself out between now and the non-form payroll announcement on Friday.

The markets look as if they are trying to figure out the next move, and an impulsive candle could come into play, and give the market a bit of a signal as to where to go next. The sideways action will more than likely continue, at least until we get more volatility after the holiday season ends in the next week or so. At that point, the markets are more than likely to give a bigger signal. The best course of action in my estimation could be sitting still and waiting to see what happens next.