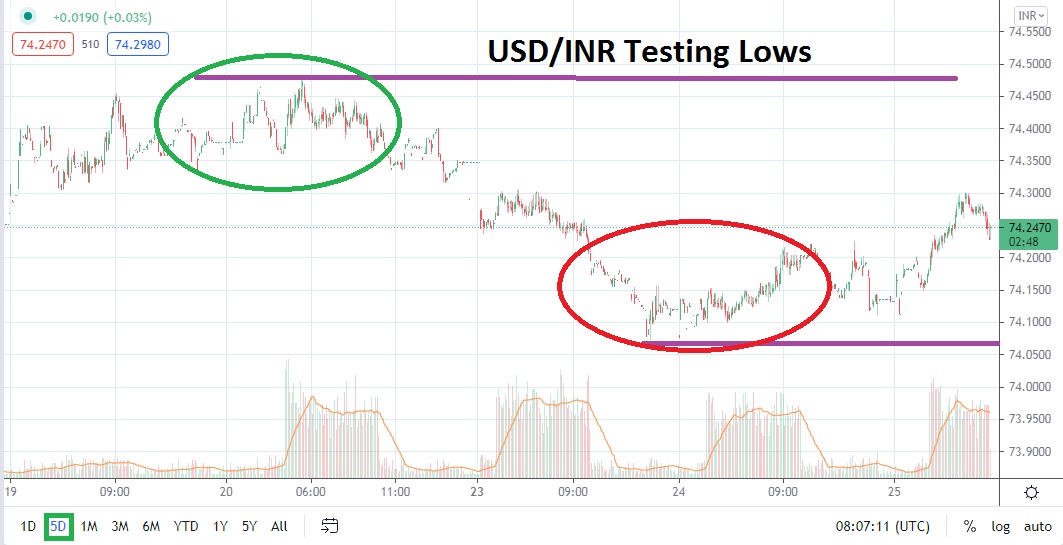

The USD/INR has produced attractive technical trading this morning. After testing short-term highs early today which challenged values seen on Monday, the USD/INR has reversed lower in a significant manner and is now within sight of rather alluring support which could prove vulnerable. As of this writing, the USD/INR is hovering with sight of the 74.2000 level.

If the current support levels prove weak, there is plenty of technical reason to believe the USD/INR may retest the 74.1500 mark which was traded yesterday; in fact, the 74.1000 level was challenged too. The USD/INR has produced a rather choppy trading range between the 74.1000 and 74.5000 junctures the past four weeks and until one of these ratios burst, traders may simply want to keep speculating based on this value band.

However, technical traders who are also keeping their eyes on the global Forex market may have noticed the USD has been weaker the past couple of days. If a solid reversal of fortune is underway regarding the USD suddenly, the Indian rupee may find that it attracts more speculators. The USD/INR has been rather choppy the past handful of weeks, but perhaps bearish momentum may continue to generate speed. If downward momentum continues challenge short-term support levels, the USD/INR may be ready to break free from its current price range.

While the USD/INR trades above the 74.2000 juncture, speculators may use the current price vicinity and decide that a logical option is to sell if the 74.2600 to 74.2800 levels are touched while looking for a lower move which will challenge support again. Make no mistake: the USD/INR has produced volatility within its weeks-long price range and traders need to use conservative amounts of leverage, select stop loss spots wisely and be ready to let their positions trade perhaps overnight.

The USD/INR has shown technical signs of bearish behavior and this may prove enticing for technical traders who believe more selling action will develop. Speculating on short positions within the USD/INR may be the logical wager and could prove worthwhile near term as the USD shows signs of potentially losing additional value/

Indian Rupee Short-Term Outlook

Current Resistance: 74.2940

Current Support: 74.2040

High Target: 74.3500

Low Target: 74.1320