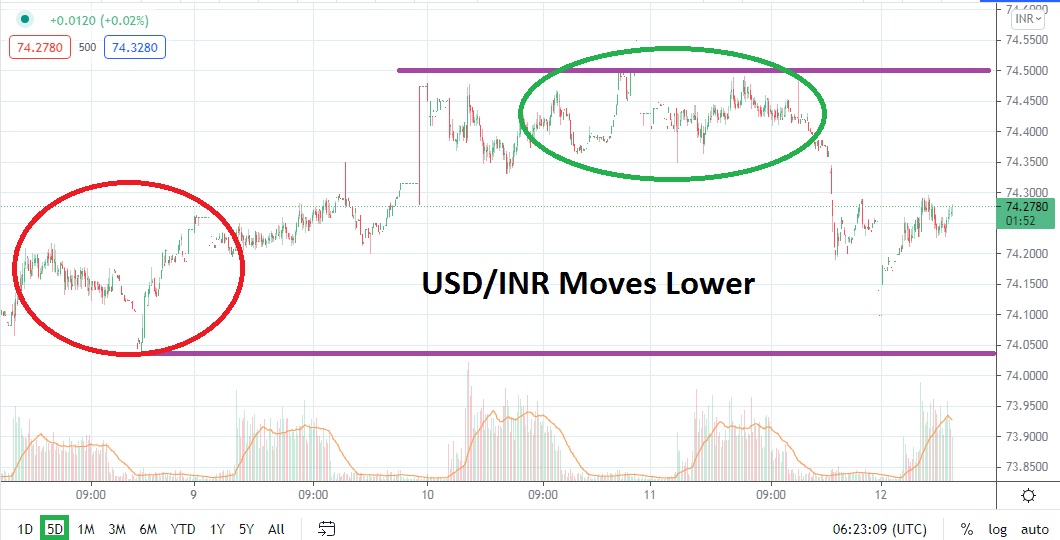

After coming within sight of the 74.5000 resistance level the past couple of days, the USD/INR began to see stronger selling occur late yesterday and a low of 74.1800 was seen. The move higher the past two days appears to have run out of power temporarily, and as the USD/INR opened today, the Forex pair traversed lower again before experiencing a natural reversal upwards. This morning’s low of nearly 74.1450 tested levels seen late last week before going into the weekend.

Speculators may be looking at technical charts from the past month and suspect that the USD/INR has shown rather impressive incremental bearish movement. After traversing over the 75.0000 juncture briefly on the 19th of July, the USD/INR has demonstrated that this higher price level was not durable.

Since the 17th of June, the USD/INR has been within the clutches of its upper price range. Technically, the Forex pair is now beginning to come into sight of important support within this value band. Yes, short-term support levels of 74.2300 to 74.1000 do look important and may be tough to penetrate for the time being. Yet, support near the 74.0600 level could prove absolutely crucial. While traders are urged not to become overly greedy, if the 74.1000 ratio fails to hold in the near term, this could be a signal that vital support below may be about to be tested.

Fundamentally, the USD/INR certainly jumped higher in mid-June based on the whispers from the U.S Federal Reserve. While institutional investors certainly reacted to the pronouncement from the U.S central bank, in the past week the U.S government has begun to initiate another massive wave of proposed spending. Reports of a few more trillion USD being earmarked for stimulus in the past day may increase the perception that the Forex markets need to respond.

Speculators who continue to favor selling the USD/INR on slight reversals higher may be making the logical choice. Resistance near the 74.3300 to 74.3500 levels could prove to be worthwhile spots to ignite selling positions if they are touched. Yes, the USD/INR has the potential to see volatility develop in rapid flourishes, but the one-month trend for the Forex pair has exhibited signs that it may still produce selling opportunities near term.

Indian Rupee Short-Term Outlook:

Current Resistance: 74.3300

Current Support: 74.2300

High Target: 74.4600

Low Target: 74.1000