Buyers shying away from the US dollar and the rapid spread of the Delta variant contributed to a strong bullish momentum for gold. The price reached the resistance level of $1809, its highest in three weeks, before settling around $1793 as of this writing. The US dollar, as well as the price of gold, may continue to move in narrow and limited ranges until the reaction of the markets and investors to statements from the Federal Reserve at the Jackson Hole symposium. Inflation levels and a sharp improvement in the US labor market have increased the expectations in the markets of the Fed tightenng its monetary policy, which would pave the way to raising US interest rates.

By striking a deal with moderates, House Democratic leaders have put President Joe Biden's multibillion-dollar budget blueprint on a major hurdle, ending a perilous standoff and putting the party's domestic infrastructure agenda on the right track.

Tuesday's 220-212 vote was a first step toward crafting Biden's $3.5 trillion rebuilding plan this fall, and the narrow result, in the face of unanimous Republican opposition, signaled the force that few votes must alter the debate and the challenges ahead that still threaten to overturn President's agenda. From the White House, Biden hailed the result as "a step closer to real investment in the American people." He said in a press conference that he called to congratulate the leaders of the House of Representatives on the work.

Japan is set to expand its coronavirus emergency for a second week in a row on Wednesday, adding several more prefectures as the number of infections fueled by the delta variant stress the country's health care system. The government last week extended the state of emergency until September 12 and expanded the areas covered to 13 prefectures out of six of them, including Tokyo. Another 16 areas are currently in a semi-emergency state.

The government proposed in a meeting of experts today, Wednesday, to raise the level of eight governorates from a semi-emergency to a full emergency. Those prefectures include Hokkaido and Miyagi in the north, Aichi and Gifu in central Japan, and Hiroshima and Okayama in the west.

The proposal was expected to be approved and officially announced later Wednesday. The state of emergency in Japan is based on the requirement that restaurants close at 8 pm. The unenforceable requests for social distancing and remote work for the public and employers are also largely ignored due to growing complacency.

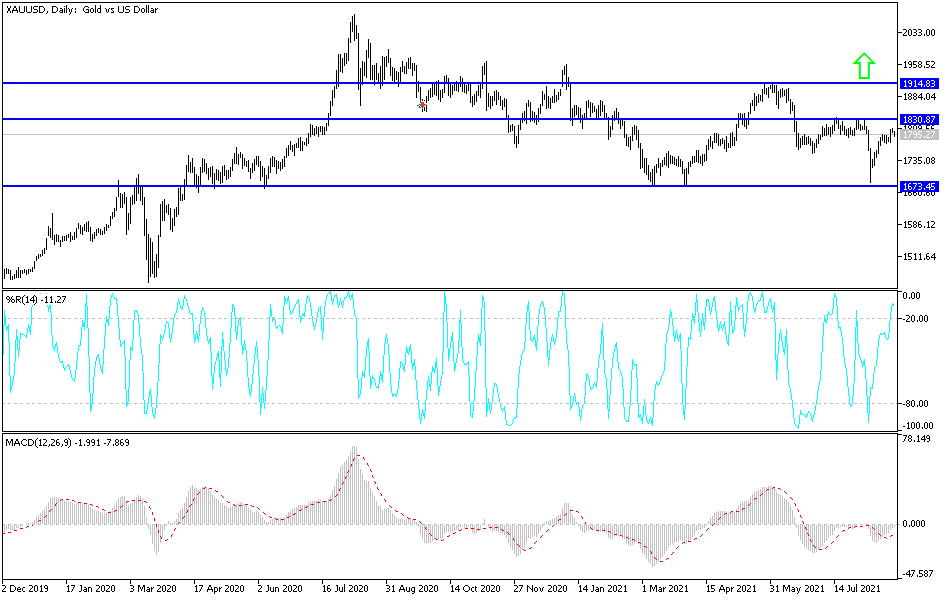

Technical analysis of gold

If gold remains above the psychological resistance of $1800, it will enforce the bullish trend and invite buyers. The price of gold would then move towards the resistance levels of $1819, $1827 and $1845. I still prefer buying gold from every bearish level and after the last performance, the closest support levels for gold will be $1788, $1772 and $1760.

The gold price will be affected today by the strength of the US dollar and risk appetite, as well as the reaction to the German Ifo data and US durable goods orders.