Up against a strong US dollar, the price of gold returned to the support level of $1725 at the beginning of today's trading and settled around $1732 as of this writing. The strength of the US dollar increased after recent data showed that US jobs data were stronger than expected, which in turn raised hopes that the US Federal Reserve may begin to scale back its asset purchase program sooner than previously thought.

Data released by the US Department of Labor at the end of last week showed that US employment in the private sector rose by 943,000 jobs in July after rising by an upwardly revised 938K jobs in June. Economists had expected employment to jump by 870,000 jobs, compared to an addition of 850,000 jobs originally reported for the previous month.

The stronger-than-expected US job growth was partly due to sharp increases in employment in leisure, hospitality and local government education, which jumped by 380,000 jobs and 221,000 jobs. Reflecting the strong job growth, the US unemployment rate fell to 5.4% in July from 5.9% in June, dropping to its lowest level since March 2020. Economists had expected the unemployment rate to fall to 5.7%.

Yesterday it was announced that US employers posted a record 10.1 million job vacancies in June, another sign that the US labor market and economy are recovering strongly from last year's coronavirus shutdowns.

The Labor Department reported that job openings rose from 9.5 million in May. Employers employed 6.7 million workers in June, up from 6 million in May. The gap between job openings and employment means that companies are striving to find workers. Ongoing health concerns, difficulty obtaining child care at a time when many schools are closed and the extension of federal aid to the unemployed may have prevented some unemployed Americans from seeking work. 1.3 million people were laid off or dismissed in June.

The monthly Job Opportunity and Employment Turnover Survey, or JOLTS, showed that nearly 3.9 million workers left their jobs in June, in a sign of confidence in their prospects for a better job. The number of people leaving work in June was just shy of the record 4 million, set in April. In general, the US economy has rebounded with unexpected strength, as the introduction of vaccines allows companies to reopen or extend working hours and encourages Americans to go out again and visit restaurants, bars and stores. However, the fast-spreading Delta variant cast a shadow over the forecast. The average daily US case count is more than 100,000, up from less than 12,000 in late June, but down by about 250,000 in early January.

Last Friday, the Labor Department reported that the US economy created 943,000 jobs last month and the unemployment rate fell to 5.4% from 5.9% in June.

Now the US monetary policy outlook may be affected by the latest US inflation data. Markets are also looking forward to speeches by several Fed officials throughout the week.

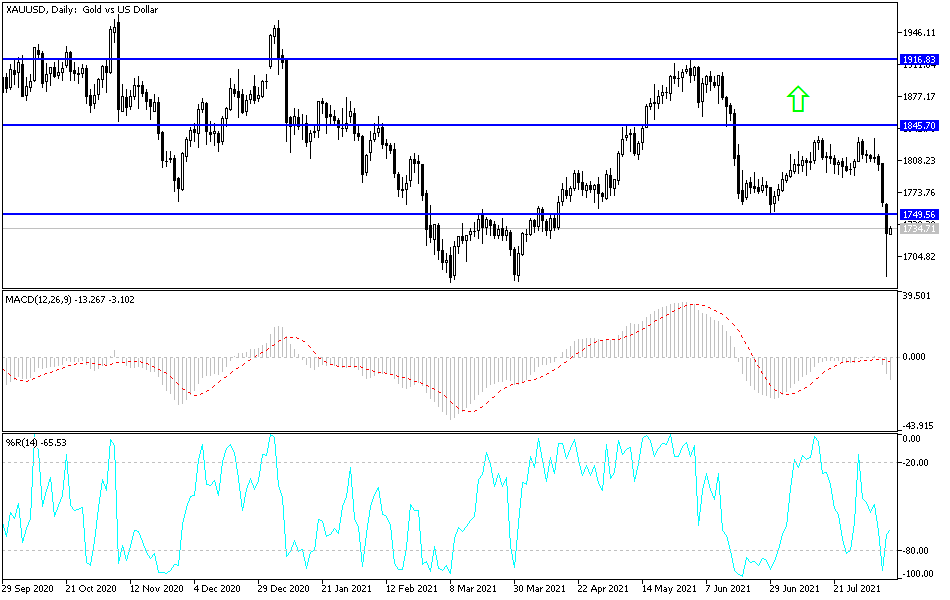

Technical analysis of gold

The recent decline in the price of gold pushed the technical indicators to strong oversold levels, leaving a better opportunity for gold investors to return to buying gold. The markets absorbed the latest numbers of US jobs, which caused the dollar's gains and gold's loss. I still prefer buying gold from every dip, particularly from support levels at $1695, $1670 and $1645 dollars.

On the upside, the bulls still need to test the $1800 psychological resistance again to control the performance.

The price of gold today will be affected by the strength of the US dollar and the extent of investor risk appetite.