The price of gold is still stable around three-week highs, reaching the level of $1819 as of this writing. The gains of the yellow metal came as the yield of the dollar and US bonds fell as a result of the words of Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium on Friday.

The US dollar took losses after Powell took a dovish tone on monetary policy, indicating that the US central bank is in no rush to raise interest rates. Lower interest rates reduce the opportunity cost of holding non-yielding bullion. In a virtual speech last Friday, Powell said the central bank was likely to begin scaling back its bond-buying program this year, but did not specify a timing for the slowdown. Powell noted that there is "a large area to be covered to reach maximum employment," a criterion for starting tapering off.

Important US jobs data next Friday may shed more light on the recovery of the labor market and influence the strategy of the US Federal Reserve.

All in all, fragile economic data from China, rising new virus cases worldwide, and a strong US dollar cast doubt on the bullish outlook for industrial goods.

The recent correction in base metals and energy commodities was primarily due to demand problems in China. Despite this, China's economy has rebounded to pre-epidemic growth levels, as businesses struggle with rising costs and supply bottlenecks losing steam. The surge in new COVID-19 cases has prompted new restrictions, disrupting factories and industrial production, already hit by bad weather this summer.

Severe weather and a new outbreak of COVID-19 sweeping across the country has made the Chinese economy slow more than expected in recent months. Monthly economic figures such as factory activity, retail sales, export and investment data showed growth slowing down more quickly than expected. China's industrial production numbers increased to 6.4 percent in July versus expectations of 7.8 percent. The reading was 8.3 percent in June. Retail sales numbers also contracted to an 8.5% increase in July versus an expected 11.5%. So, economists and research firms have already started lowering their forecasts for China's economic growth.

Expectations for China's economic growth have already begun to decline by economists and research firms. Large investment banks such as Goldman Sachs and Morgan Stanley have cut China's GDP forecast to about 8.2 or 8.3% from a previous estimate of 8.6-8.9%. Few others are set to follow suit due to growing pessimism about China's economic outlook. The Chinese economy grew by 12.7 percent during the first half of 2021 compared to the same period the previous year.

China is the largest consumer of many industrial goods such as base metals and fuels. The widespread slowdown in industrial activities indicates that its economy is rapidly losing momentum, prompting investors to reduce their bullish bets on industrial goods.

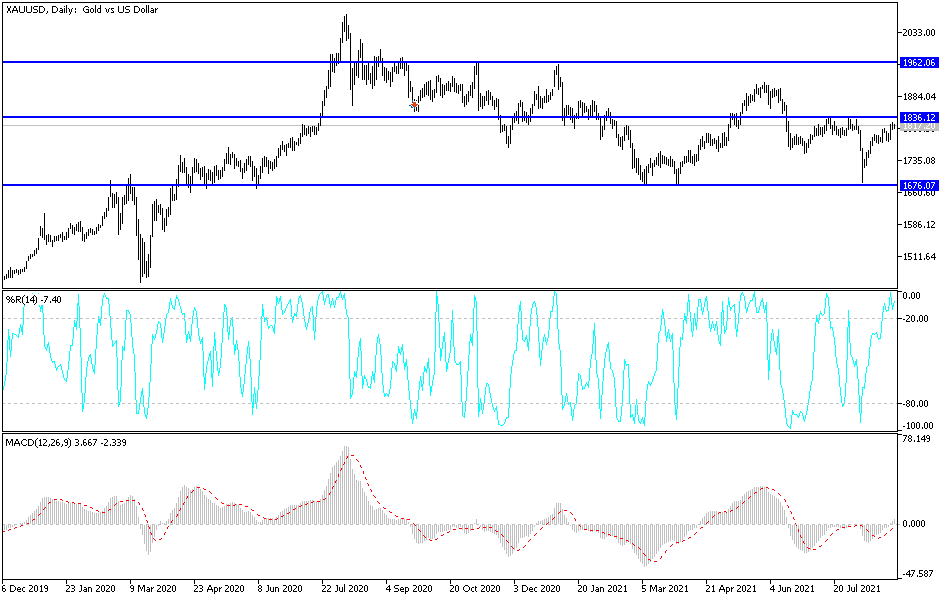

Technical analysis of gold

Stability above the psychological resistance of $1800 opens up a move towards stronger ascending levels. This may happen if the pressure on the US dollar continues and investors' fears increase about the strong outbreak of the Delta variant and the return of global restrictions.

Today, the dollar will be affected by the announcement of the US consumer confidence data.