For the second day in a row, gold has given up its strong gains recently, which pushed it towards the resistance level of $1809. A correction then pushed it towards the support level of $1783, where it has settled as of this writing. Gold futures settled lower as the dollar remained somewhat flat as traders look ahead to the upcoming Jackson Hole Symposium. At the annual monetary policy seminar for central bankers in Jackson Hole, Federal Reserve Chairman Jerome Powell is likely to indicate when the bank might begin to scale back its bond-buying program.

In the same performance, the price of an ounce of silver fell to the level of $23.775, while copper futures contracts settled at $4.2675 per pound.

Data from the Commerce Department showed US durable goods orders fell 0.1% in July after a 0.8% increase in June. Economists had expected orders to fall 0.3%. Excluding a sharp drop in transportation equipment orders, durable goods orders rose 0.7% in July after rising 0.6% in June. Previous transfer orders are expected to increase by 0.5%.

On the other hand, the US-Chinese dispute may affect the performance of the gold price in the coming period, as it is one of the most important safe havens in times of uncertainty. China's regulatory crackdown has alarmed foreign investors. The Securities and Exchange Commission has revised disclosures required for Chinese initial public offerings in part due to recent actions by Beijing.

Consider the performance of the NASDAQ Golden Dragon, which has been put at risk by US-traded companies while doing the majority of their business in China. It hit a record high in mid-February, a few months after Beijing halted the Ant IPO. It halved in the following six months and hit its lowest level since June 2020 on August 19. The index has fallen for eight consecutive weeks this week and 11 of the past 12 weeks. The Golden Dragon Index recently rose by 8%. It was the third consecutive gain. The fear of being lost may be greater than the fear of Beijing's moves.

In the latest development, the Chairman Gensler of the US Securities and Exchange Commission renewed his warning that unless Chinese companies listed in the United States allow inspections of their financial audits, their shares can be delisted from the New York Stock Exchange and Nasdaq starting in 2024.

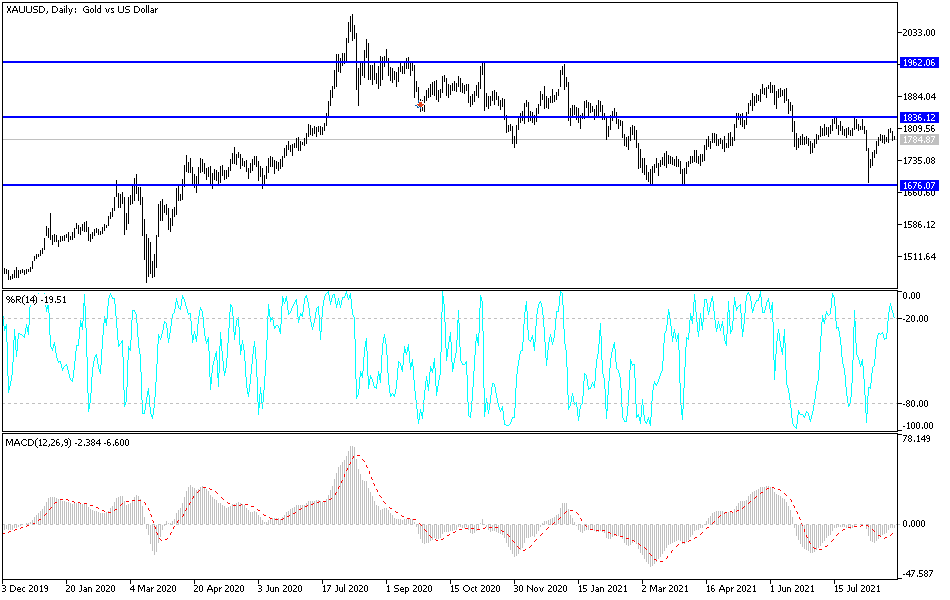

Technical analysis of gold

There is no change in my technical view of the price of gold, as stability above the psychological resistance of $1800 supports the strength of the bulls’ control over performance and supports more buying. The closest targets are the resistance levels of $1819, $1827 and $1845. With the current correction, the support levels of $1775, $1760 and $1745 will remain the most important targets for the bears. I still prefer buying gold from every bearish level.

The price of gold will be affected today by the strength of the US dollar in reaction to the announcement of the growth rate of the US economy and the number of weekly jobless claims, bearing in mind that the Jackson Hole symposium will start today and the focus will be on Jerome Powell’s statements tomorrow.