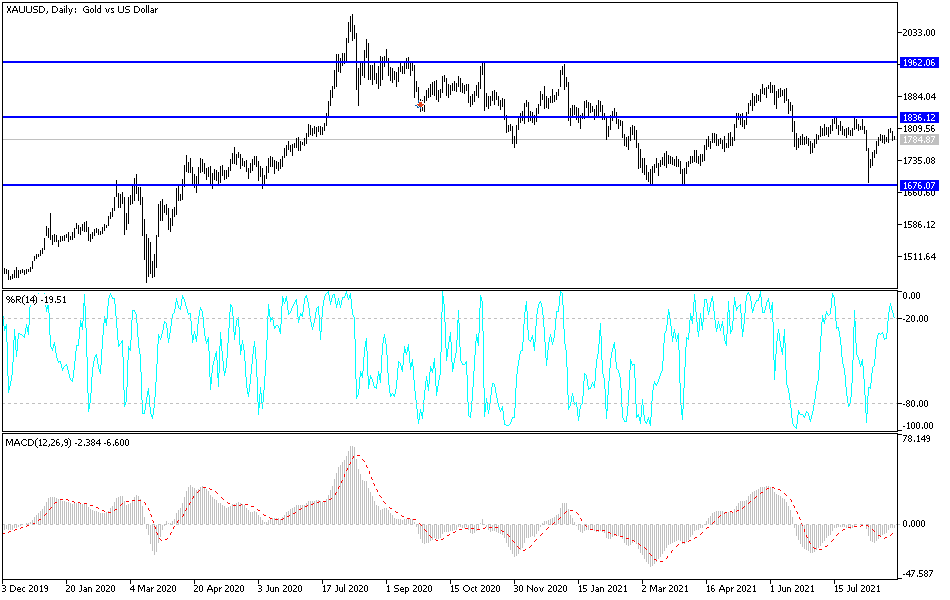

Gold markets fell a bit on Wednesday as the 200-day EMA has offered resistance. The 200-day EMA is a major indicator that a lot of longer-term trend-following type of traders will pay attention to, so it is worth noting that the market formed a bit of an “evening star” at that same region. Having said that, it does look as if we are finding a little bit of a pushback to the selling pressure late in the day.

When you look at the gold market, you have to think about the US dollar. The Jackson Hole meeting over the next couple of days will have a major influence on where we go next, because a lot of people are waiting to see what is going on with tapering from the Federal Reserve. We had recently heard several members of the voting committee suggest that tapering could come much sooner than anticipated but have since heard a little bit of a walk back as well. In other words, the market is all over the place as far as a timeline for bond purchasing slowdown, and as usual the Federal Reserve has been extraordinarily opaque as to what they are doing, or perhaps they are becoming much clearer about the fact that they do not know what they are doing.

Gold does tend to move in a negative correlation to the greenback and yields as well. If yields rally in the United States, then it makes sense that we would see gold drop a bit, as the larger players out there are much more comfortable holding paper than they are paying for storage when it comes to physical gold. For what it is worth, the market sees a lot of resistance above that extends to the $1830 level, so if we can break above there then it is likely that we would go looking towards the $1910 level. To the downside, if we break down below the lows of the Monday session, then it is possible that we will go looking towards the $1750 level. Breaking down below that level opens up the possibility of a move towards the $1680 level. Over the next couple of days, headlines coming out of the mouth of Jerome Powell will move the market.