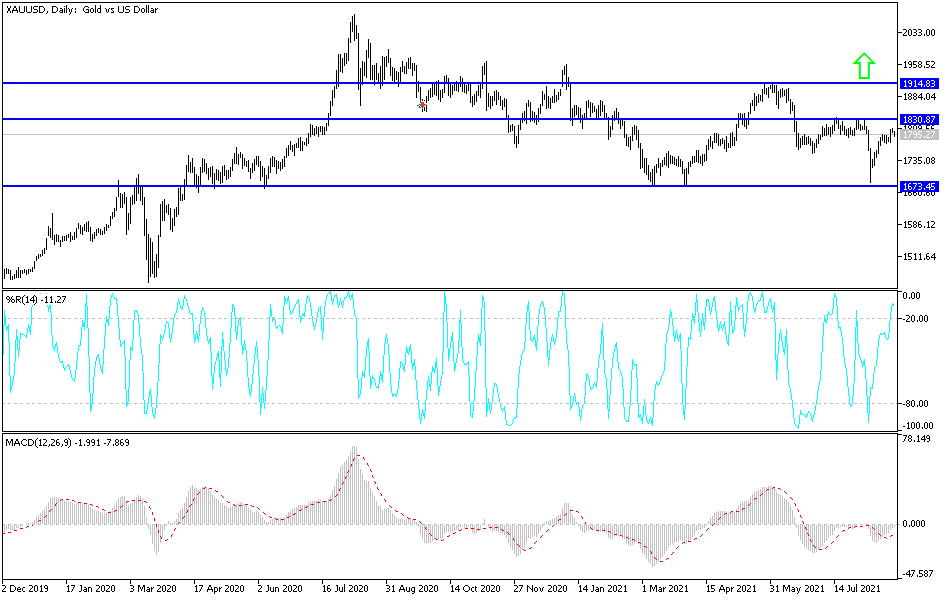

The gold markets did very little during the trading session on Tuesday as we approached the 200-day EMA. After the extraordinarily bullish candlestick on Monday, one would think that gold markets would continue to go higher, but the fact that it could not move much higher makes me wonder whether or not we are ready to break out. At this point, one would have to say that it does in fact look somewhat bullish but obviously we are waiting to see what Jerome Powell has to say coming out of Jackson Hole.

I do believe at this point it is likely that we are going to run into a bit of resistance in the short term, but if the US dollar starts to strengthen it could even push this market lower. If we take out the lows from the Monday candlestick then I believe that the market breaks down rather significantly, perhaps reaching down towards the $1750 level. That is an area that if we break down below it, the market is likely to go looking towards the $1680 level. That is an area we have tested multiple times, and one that more than likely would attract a lot of attention.

On the other hand, if the US dollar starts to fall, it is likely that we could go looking towards $1830 level. That is an area where we have seen quite a bit of resistance, so it would make sense that it might be difficult to break above there. At that point, one would have to assume that the US dollar is going to continue falling, and at that juncture it would be very good for gold. That being said, the 50-day EMA and the 200-day EMA are both flat, so that suggests that the market is still very indecisive, and I think it is going to take getting past Jackson Hole in order to move forward. Furthermore, you have to keep in mind that August is typically a very quiet time a year anyway, so the real move might be a couple of weeks away as September brings in more volume. Once that volume comes, it will probably be much clearer as to where we are going to go over the next several weeks. Until then, it is probably just going to be choppy and noisy more than anything else.