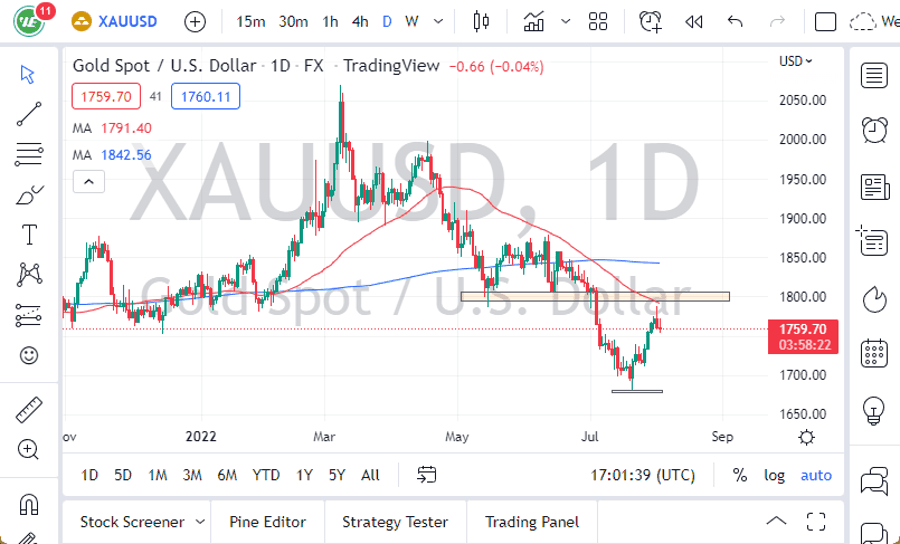

The gold markets have been very choppy during the trading session on Thursday as we continue to see a bit of hesitation just below the previous support level. The $1750 level is essentially the magnet for price at the moment, and now this sets up a very interesting “binary trade”, as the market breaking above the top of the candlestick could open up the possibility of going long, just as a move below the bottom of the candlestick could send this market going much lower.

That being said, I would be much more comfortable going long if we can break above the top of the Monday candlestick, because it would wipe out that massive panic. At that point, it is very likely that the market could go looking towards the 50 day EMA, sitting at the $1800 level. The market recently has just formed a “death cross”, so therefore I think there will be a lot to pay attention to in that general vicinity if we do somehow rally. On the other hand, if we break down then I think the most obvious area to pay the most attention to would be the $1680 level.

When I look at this chart, I think it is obvious that we continue to move in reaction to the 10 year yields in America, so if this is going to continue to see the negative correlation, it makes quite a bit of sense that we should have both charts. The market breaking down below the $1680 underneath would be a catastrophic turn of events for gold, probably right along with some type of massive spike in rates. Those rates tend to make the idea of owning physical metal less attractive because you can get a return for simply holding paper. However, if those rates disappear then you are starting to look at the idea of paying for storage of gold as being okay.

Nonetheless, this is a market that had recently broken down and then had a massive bounce as one would expect, because quite frankly we had just gotten far too ahead of ourselves. By bouncing the way, we have, it does set up the possibility of a breakdown and a continuation of the initial push to the downside. With this being the case, I am much more comfortable shorting than buying if the signal comes.