Today is an important one for GBP pairs, with British GDP figures expected to be released later on. Before the announcement of these releases, the GBP/USD currency pair collapsed to the 1.3802 support level, its lowest in two weeks. The pair then bounced higher towards the 1.3888 resistance level after US inflation figures came in as expected, and settled around the 1.3865 level as of this writing. The rebound gains came with the dollar's decline after the release of US inflation data that indicated that inflationary pressure may be temporary, thus easing pressure on the Federal Reserve to start the process of tightening monetary policy.

However, after absorbing the numbers, a number of economists say that although prices may be at their peak, it looks like they will remain stubbornly high. Thus, the latest numbers do not provide any reason for the dollar to turn lower and any weakness after the data may be temporary. The core US CPI rose 0.3% month-over-month in July, less than market expectations of 0.4% and a fast slowdown from 0.9% in June.

The CPI rose 0.5% month-on-month, matching market expectations.

In the near term, economists at RBC Capital Markets expect the growth in prices for goods and services that have been largely unavailable over the past year to continue to accelerate, while early indications from wholesale auto markets suggest that gains in used car prices are expected to unwind. “At the same time, there is still a risk that inflationary pressure will become more widespread,” says Claire Fan, an economist at RBC Economics.

For its part, the Fed said that it sees the current round of hot inflation readings as temporary, and that it is expected to fade over the coming months, so it is premature to rush towards a tapering decline and raise interest rates. Instead, the Fed wants to maintain loose monetary policy terms in order to support economic growth and boost employment levels.

But with the US economy adding jobs quickly (+900k in July alone) and inflation rising, some Fed members are now calling for tapering off as soon as possible. This dynamic has contributed to the increased demand for the dollar and now the US currency is the best-performing currency in the last month among the largest currencies in the world.

The August monetary policy decision from the Bank of England (BoE) gave businesses and households advance notice that normalization of interest rates could be most likely over the next year or so, although there is still a wide variety of views among analysts and economists about when borrowing costs and savings returns are likely to rise.

This month's policy decision proved to be a milestone in the UK economy's journey through the pandemic after an announcement by the Bank of England revealed that an unknown number of eight participants at the August Monetary Policy Committee (MPC) meeting believed the bank's minimum economic limits entailed an interest rate. The rise has already been fully met in recent months. The minutes of the MPC meeting stated: “Some members of the Committee were of the opinion that despite the significant progress that has been made in achieving the terms of the MPC’s current policy guidance, the conditions have not yet been fully met.”

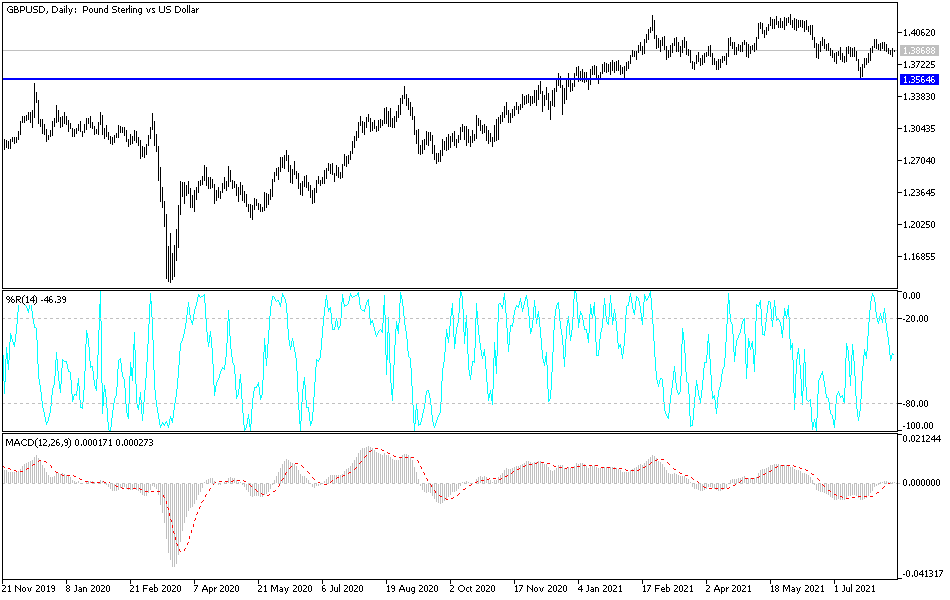

Technical analysis of the pair

On the daily chart, the GBP/USD started forming a bearish channel. Bearish confirmation may increase if the bears move to the support levels 1.3800 and 1.3690. On the upside, the psychological resistance at 1.4000 is still the most important target for the bulls to regain control of the trend. The approaching date of monetary policy tightening between the Bank of England and the US Federal Reserve created a balanced performance of the currency pair in the recent period.

From Britain, the GDP numbers and the rate of industrial and manufacturing production will be announced today. From the United States of America, the Producer Price Index, one of the tools for measuring US inflation, will be announced, along with the number of weekly jobless claims.