The resilience of the GBP/USD may collapse if COVID cases in the UK start to rise again. The pair was the best performer against the recent strength of the US dollar after the US jobs numbers increased expectations of an interest rate hike. For two trading sessions in a row, the currency pair is trying not to cross the 1.3840 support so as not to increase selloffs. The pound has been one of the more resilient of the G10 major currencies amid the dollar's recent bounce, and is likely to remain so for now. The Bank of England has officially acknowledged that a "modest monetary tightening" in early August may be necessary to bring UK inflation back to the Bank's 2% target over the coming years.

But the GBP/USD is still at risk of further decline over the coming days and there are several lower support levels before the 200-day moving average around 1.3757. Commenting on the performance of the currency pair, Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank, said that the GBP/USD continues to consolidate below the 61.8% Fibonacci retracement level at 1.3990. "We are looking for the market to remain on the 1.4018 pivot and we will allow failure (we have warning signs on the intraday charts). As such, lower dips around 1.3800 are likely to be supported.”

Jones and the Commerzbank team are shorting GBP/USD from around 1.3875 and have set a target of 1.3786, which is the June 21 low for GBP/USD, and the 1.3735 level, around which any renewed dips will likely start to run out. The British pound had previously appeared on its way to retest the psychological top of $1.40 but only reached 1.3950 before falling last Wednesday when a new record high for the Institute for Supply Management's PMI Index came shortly before a "hard-line" speech from the Fed Vice Chairman US Richard Clarida, who indicated that US interest rates may rise by late 2022 if the economy is in line with expectations in the meantime.

Last week's ISM PMI readings along with Friday's massive non-farm payrolls report indicated that a renewed acceleration may have begun in the US economy last month, altogether highlighting the risk that FOMC members may decided in September to end the Federal Reserve's $120 billion per month quantitative easing program.

However, this is not the only risk to US policy. A renewed acceleration in the economy could enhance the likelihood that a US interest rate hike will be announced at the end of next year or shortly thereafter, which will be more supportive of the dollar and an additional burden on the GBP/USD currency pair in the coming weeks.

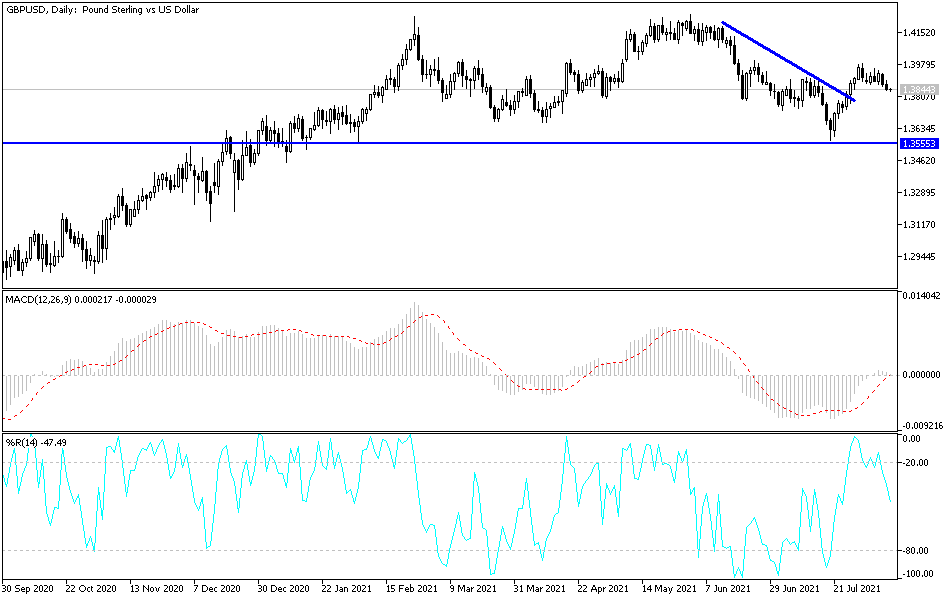

Technical analysis of the pair

A state of cautious stability dominates the performance of the GBP/USD currency pair, and this is clearly evident on the daily chart below. The pair may abandon stability if it falls to the support levels at 1.3748, 1.3660 and 1.3570. On the other hand, the strong and continuous transformation of the general trend to the upside depends on a breach of the 1.4000 psychological resistance. Otherwise, the currency pair will remain subject to threats to the downside. The currency pair may remain stable until the announcement of US inflation figures and the growth rate of the British economy in the coming days of this week's trading.

The currency pair is not expecting any important data from the British or American economies today. Investor sentiment will have the strongest and direct impact on performance.