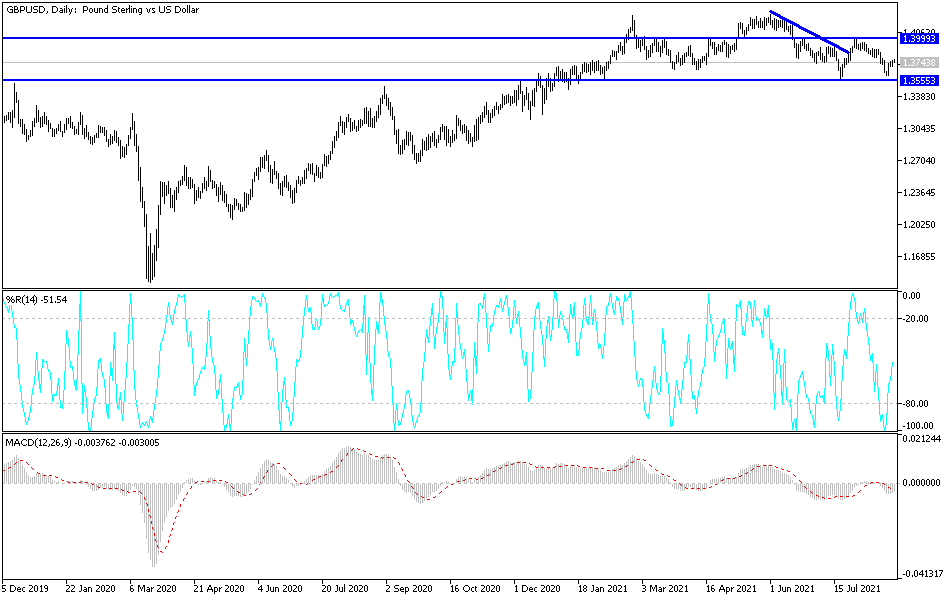

The British pound initially pulled back on Wednesday to test the 200-day EMA and the 1.37 handle. The 1.37 handle is a significant area on the longer-term charts, and people will pay close attention to it. Furthermore, the area has been interesting for some time, so it does make sense that there is a lot of noise here. If we were to turn around and break down below the 1.37 handle, that could send the market lower to reach towards 1.36 handle.

Now that we are looking at the Jackson Hole meeting coming up over the next couple of days, traders will be paying close attention to Jerome Powell and anything that he says regarding tapering. After all, the tapering narrative will have a lot to do with what happens next with the US dollar, as yields will either rise or fall. The talk of tapering has made the dollar go higher at one point, but as the markets have started to price in the fact that tapering may be pushed back, this will move the US dollar in one direction or the other, and that will be your cue for the next several weeks. The Jackson Hole Symposium typically provides some type of headline with expectations when it comes to central banks, so the next couple of days could be interesting.

If we do break out to the upside, the 50-day EMA above would be resistance, but if we can break above there then it is likely that the market will go looking towards the 1.40 handle. The British pound will more than likely be moving based upon the greenback more than anything else, as there is not much moving the British pound as far as fundamentals are concerned right now. The market has previously formed a bit of a “double bottom” near the 1.36 handle, so that is something that you have to pay close attention to as well. Breaking down below that would obviously be a very negative turn of events. The alternate scenario of course is that we are in the midst of trying to form a “W pattern.” Either way, we are probably getting ready to have a somewhat big move appear.