Bullish View

Set a buy-stop at 1.1750 and a take-profit at 1.1850.

Add a stop-loss at 1.1650.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 1.1690 and a take-profit at 1.1600.

Add a stop-loss at 1.1750.

The EUR/USD price retreated after the relatively weak German sentiment data and the overnight vote on infrastructure in the US. Focus now shifts to the latest German and US inflation numbers. The pair declined to a multi-month low of 1.1700.

US Dollar Strength Continues

The EUR/USD declined mostly because of the relatively strong US dollar after last Friday’s strong jobs numbers. The US also published strong vacancy numbers on Monday. The data revealed that the US is not only adding hundreds of thousands of jobs every month, but that more than 10 million jobs are yet to be filled. As a result, the dollar has gained against key developed and emerging market currencies.

The next key mover for the pair will be the upcoming US inflation numbers. Economists polled by Reuters expect that the overall Consumer Price Index (CPI) rose by 0.5% on a month-on-month basis after rising by 0.9% in the previous month. On a year-on-year basis, they expect that the CPI dropped from 5.4% to 5.3%.

Meanwhile, analysts expect that the core CPI figure declined ffrom 4.5% in June to 4.3% in July. If they are correct, the numbers will still be above the Fed’s target of 2.0%. Still, they will prove the Fed right that consumer prices will start easing as the economy continues to reopen.

The pair will also likely react mildly to the latest German inflation data. The numbers are expected to show that German prices rose from 2.3% in June to 3.8% in July. That will be the highest increase since 1994 and will be in line with the preliminary figures published a while ago. On Tuesday, data from Germany showed that business sentiment declined in August because of supply shortages and the new COVID wave.

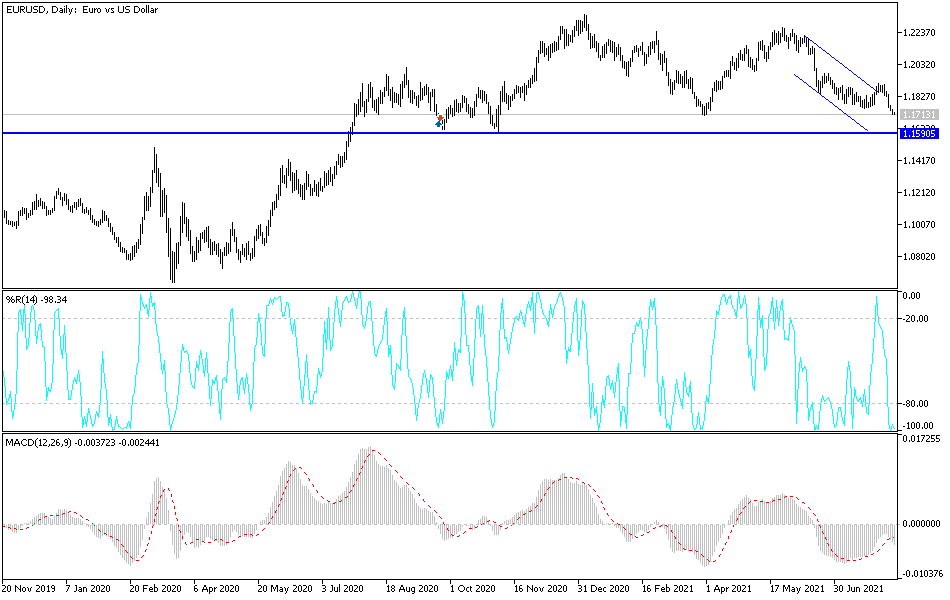

EUR/USD Technical Analysis

The EUR/USD pair has been in a strong downward trend in the past few weeks. It has dropped from the year-to-date high of 1.2350 to the 1.1700. On the four-hour chart, the pair moved below the key support at 1.1750 on Monday. This was a notable support since it was the lowest level in July.

The downward trend is being supported by the Bollinger Bands. It is between the lower and the middle lines of these bands while the Relative Strength Index (RSI) has moved to the oversold level. Therefore, there is a possibility that a relief rally will happen in the near term.