Bearish View

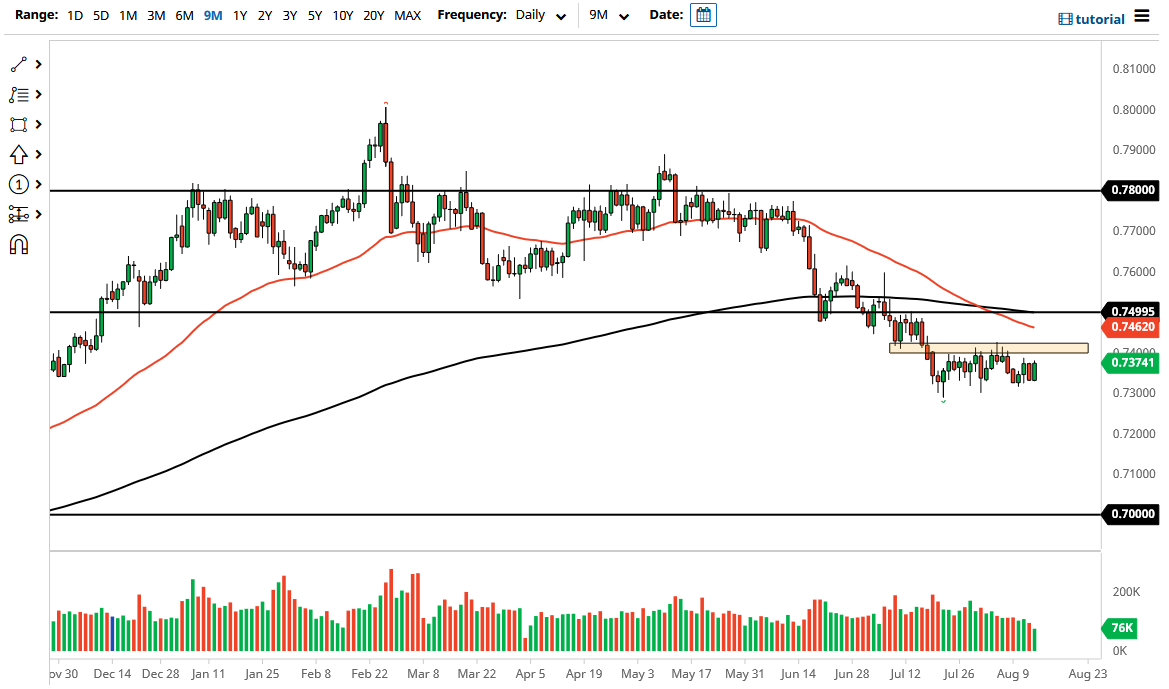

Sell the AUD/USD and set a take-profit at 0.7288.

Add a stop-loss at 0.7400.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 0.7382 and a take-profit at 0.7450.

Add a stop-loss at 0.7300.

The AUD/USD price retreated in early trading as the COVID situation and business outlook worsened. The pair dropped to 0.7352, which was the lowest level since Friday last week.

Australian Economic utlook

The Chinese and Australian economies have a strong relationship. Besides, China buys most of Australia’s goods and services.

Data published earlier today showed that the Chinese economy is retreating. The country’s retail sales declined to 8.5% in July from 12.1% in June. This decline was lower than the median estimate of 11.5%.

In the same period, industrial production declined from 8.3% in June to 6.4% in July while fixed asset investments fell from 12.6% to 10.3%.

This performance was mostly because of the new COVID wave in the country. In fact, authorities have recently shut down a major port to curb the spread of the pandemic. This could have an impact on Australia since it points to less imports.

The AUD/USD pair also reacted to the rising number of COVID cases in Australia. In New South Wales, the government reported 478 new cases and 8 deaths. Victoria added more than 20 cases. Therefore, because of the COVID-zero strategy, it means that the Australian economic recovery will be slower than anticipated. Besides, Melbourne is said to be about to restart its lockdowns.

Looking ahead, the pair will be driven by events from the United States. On Tuesday, the government will publish the latest retail sales numbers while the Federal Reserve chairman will deliver a speech. This will be his first speech since the US released the latest inflation numbers.

Fed speakers last week hinted that the central bank will start deliberations on tapering later this year. The AUD/USD will also react to the latest RBA and Fed minutes that will come out on Tuesday and Wednesday.

AUD/USD Technical Analysis

The three-hour chart shows that the AUD/USD pair has been in a consolidation mode in the past few weeks. Along the way, it has formed a rectangle pattern whose support and resistance are at 0.7320 and 0.7410.

The pair is along the 25-day and 50-day moving averages. It also appears like it has formed a head and shoulders pattern while the MACD indicator is along the neutral level. Therefore, the pair will likely maintain the bearish trend as bears target the next key support at 0.7300.