The Aussie dollar has followed the same back-and-forth pattern that we have seen over the last couple of weeks, as it seems like Australia is hell-bent on destroying its own economy. Canberra has now locked itself down right along with Sydney and Melbourne, and therefore it is hard to imagine a scenario where the Australian economy takes off. Furthermore, we have to worry about the Chinese economy which looks as if it is trying to slow down a little bit as well, and that has a bit of a “knock on effect” in Australia, as the Australian economy has a massive export business of raw commodities to the mainland.

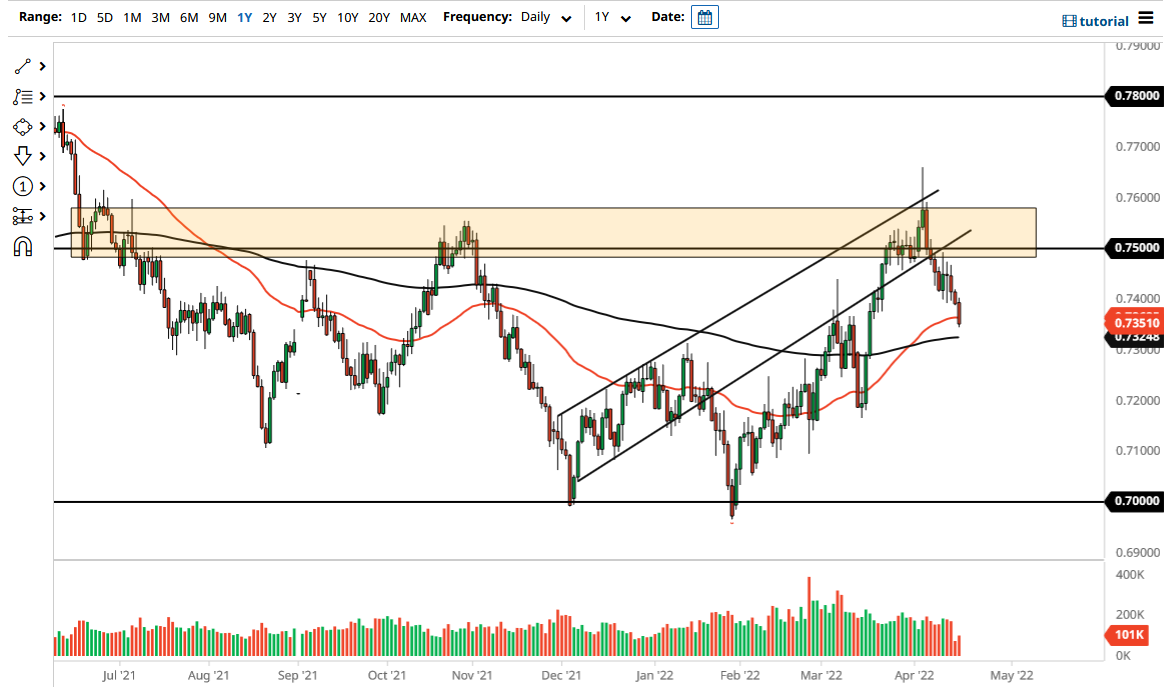

When you look at the chart, you can also see that the 50 day EMA has crossed below the 200 day EMA in order to form a “death cross”, which sits just above the 0.75 handle. The 0.75 level is of course a large, round, psychologically significant figure, which of course has a lot of people paying close attention to it. Nonetheless, if we were to break above there then you can make an argument for a bullish turn around but right now it does not look to be very likely.

Underneath, the 0.73 level has offered quite a bit of support over the last couple of weeks, and if we were to break down below there it would obviously be a very negative sign. At that point, I would anticipate that we would continue to move towards the 0.70 level, which is my longer-term target as long as interest rates in the United States continue to climb. Furthermore, a mix of negativity out of Australia and the Chinese economy will only continue to put further downward pressure on this pair. The US dollar itself has been strengthening against most currencies, so the Australian dollar falling is not a real stretch of the imagination.

If we do somehow break above the 0.75 handle, then it is possible that we could go looking towards the 0.76 level, but at this point in time it would take some type of significant change in the overall attitude of the markets on the whole in order to make this happen. With that in mind, I think this is a market that continues to drift lower over the longer term and we will continue to see pressure.