Bullish View

- Buy the EUR/USD and set a take profit 1.2300.

- Set a stop-loss at 1.2182.

- Timeline: 1-2 days.

Bearish View

- Set a sell-stop at 1.2182 and a take-profit at 1.2100.

- Set a stop-loss at 1.2250.

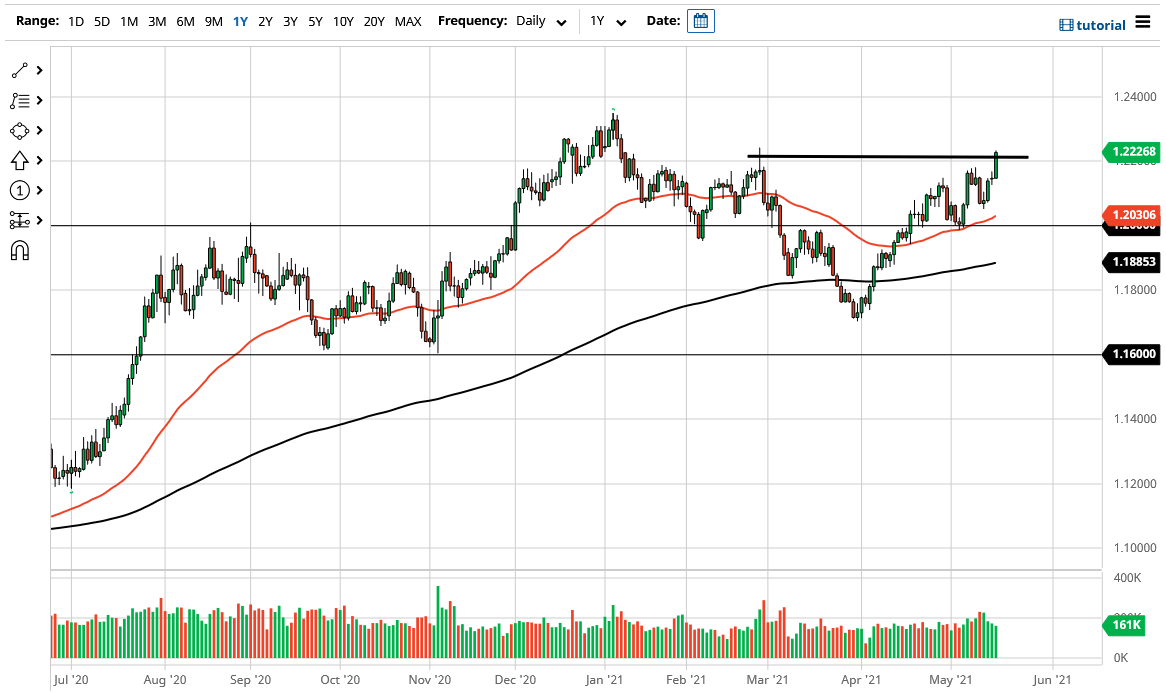

The EUR/USD pair is hovering near its highest level since March ahead of the upcoming European inflation data. The overall weaker dollar has also contributed to the current price action. It is trading at 1.2223, which is the highest it has been since February 24.

Weaker US Dollar

The US dollar rallied against most peers last week as investors continued to worry about the rising inflation and the potential tightening of the Federal Reserve. These fears intensified after the US published upbeat consumer and producer inflation numbers.

This week, the dollar has weakened as some Fed officials hinted that they will maintain their status quo. In an interview with CNBC, Raphael Bostic of Atlanta Fed said that the ongoing inflation was transitory. He said that prices will start to moderate in the coming months as the impacts of the recent stimulus start to fade. Robert Kaplan, another FOMC member, repeated the same sentiment.

On Tuesday, the EUR/USD pair reacted to the relatively weak housing data from the United States. The data showed that housing starts rose by 0.3% in April after rising by 1.7% in the previous month. In total, the number of housing starts issued declined to 1.56 million from the previous 1.733 million. In the same period, the number of building permits declined from 1.755 million to 1.76 million.

Later today, the pair will react mildly to the Eurozone Consumer Price Index (CPI). The data is expected to show that the headline CPI rose by 0.6% in April after rising by 0.9% in the previous month. This will translate to a year-on-year increase of 1.6%. Similarly, the core CPI is expected to rise by 0.6% month-on-month and by 0.8% year-on-year. In the past, EU inflation numbers tend to have no major impact on the pair.

EUR/USD Technical Analysis

The four-hour chart shows that the EUR/USD pair has been relatively strong in the past few weeks. Indeed, it has risen by more than 4.20% from its lowest level in April. This week, the pair managed to move above the important resistance at 1.2182, which was the previous high. It is now being supported by the 25-day and 15-day moving averages while the two lines of the MACD have kept rising. Therefore, the pair may keep rising as bulls attempt to move above the year-to-date high of 1.2243.