Last Wednesday’s Bitcoin signals were not triggered, as the eventual bearish price action took place above all the resistance levels which I had identified that day.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered prior to 5pm Tokyo time Tuesday.

Long Trade Ideas

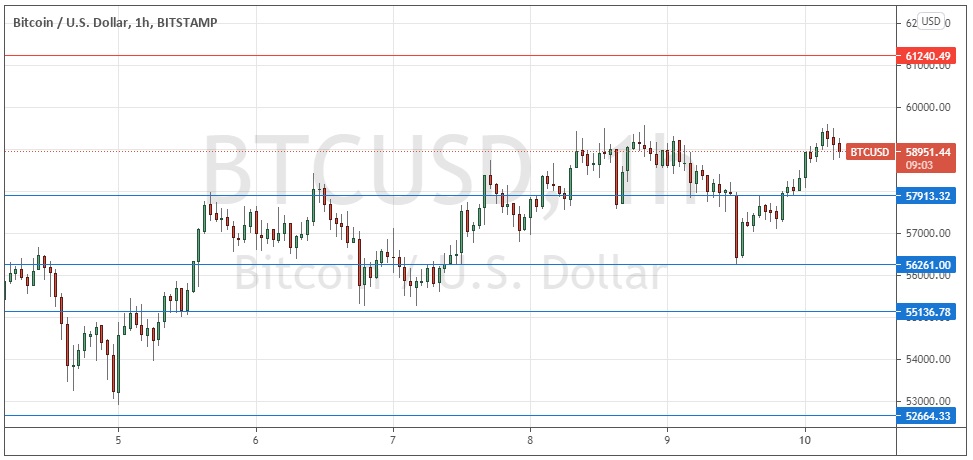

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $57,913, $56,261, or $55,137.

- Put the stop loss $100 below the local swing low.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry after a bullish price action reversal on the H1 time frame following the next touch of or $61,240.

- Put the stop loss $100 above the local swing high.

- Adjust the stop loss to break even once the trade is $100 in profit by price.

- Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Wednesday that although the technical picture had become more bearish.

The support level at $52,664 looked especially strong, and after reaching near there, the price was threatening the resistance level at $55,190, which looked like it would be the day’s pivotal point. I thought that if the price could get established above this level, it would be a bullish sign and suggest the trend of the past few days was over.

This was a good call, as after breaking above $55,190, the price has continued to rise, and has spent all the time since then above that level.

All the resistance levels have been flipped to become probable support or have been invalidated, except the all-time high price at $61,240, which is the only remaining obstacle to a new all-time high.

Although the road seems wide open to bulls, we are only seeing a weak bullishness right now.

Due to the subdued bullish condition, it should make sense to wait for bearish retracements to key support levels and buy at any firm bounce. I will be very happy to take a long trade from any bullish reversals at $57,913, $56,261, or $55,137.

For the first time ever, we are seeing cryptocurrencies really being led by Ethereum (the second-largest cryptocurrency by market capitalization) and not Bitcoin, which may be significant. Ethereum continues to make new record highs and is up by more than 10% over the past day.

There is nothing of high importance due today concerning the USD.