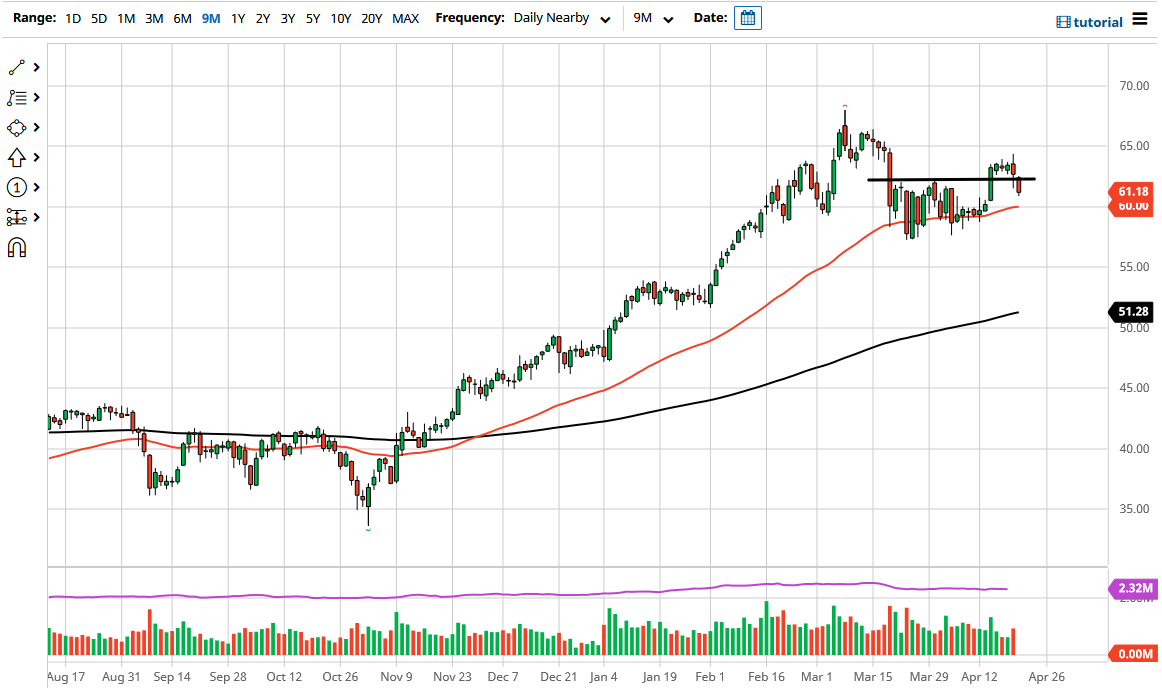

The West Texas Intermediate Crude Oil market broke down a bit during the trading session on Wednesday, slicing through a significant area of support at the $62.25 level. Furthermore, we even broke down below the bottom of the candlestick for the trading session on Tuesday, which would be a break of the bottom of a hammer. That could open up a move down to the $60 level, where the 50-day EMA sits, and this makes sense considering that inventory numbers in the United States suddenly rose. That has people worried about crude oil demand, as the United States is considered to be one of the “better places” when it comes to the reopening play.

The other concern for crude oil right now is the fact that coronavirus numbers around the world are rising in certain places such as India and Japan, which are major importers of crude oil. If we are starting to see the global pandemic get worse, that would obviously put a major dent in the idea of demand, which has been one of the biggest drivers of this market, due to the fact that the reopening of the global economy would demand more energy. Another thing that has been helping as of late is the fact that almost a lot of the glut of supply has been worked through that was built up during the pandemic.

That being said, it will be interesting to see how the 50-day EMA causes the market to move, because it is not only an indicator that a lot of people pay attention to, but also sits at the $60 level, an area that I think continues to be a large, round, psychologically significant figure that a lot of people will be monitoring. If we were to break down below there, then we may have a little bit more of a break down, but it is worth noting that we had recently broken out of a consolidation area and made a “higher high”, so at this point it still favors the upside, but obviously we have some significant amount of volatility ahead that could cause some issues. If we do break down below that region, then we could be looking at a move towards the $52.50 level.