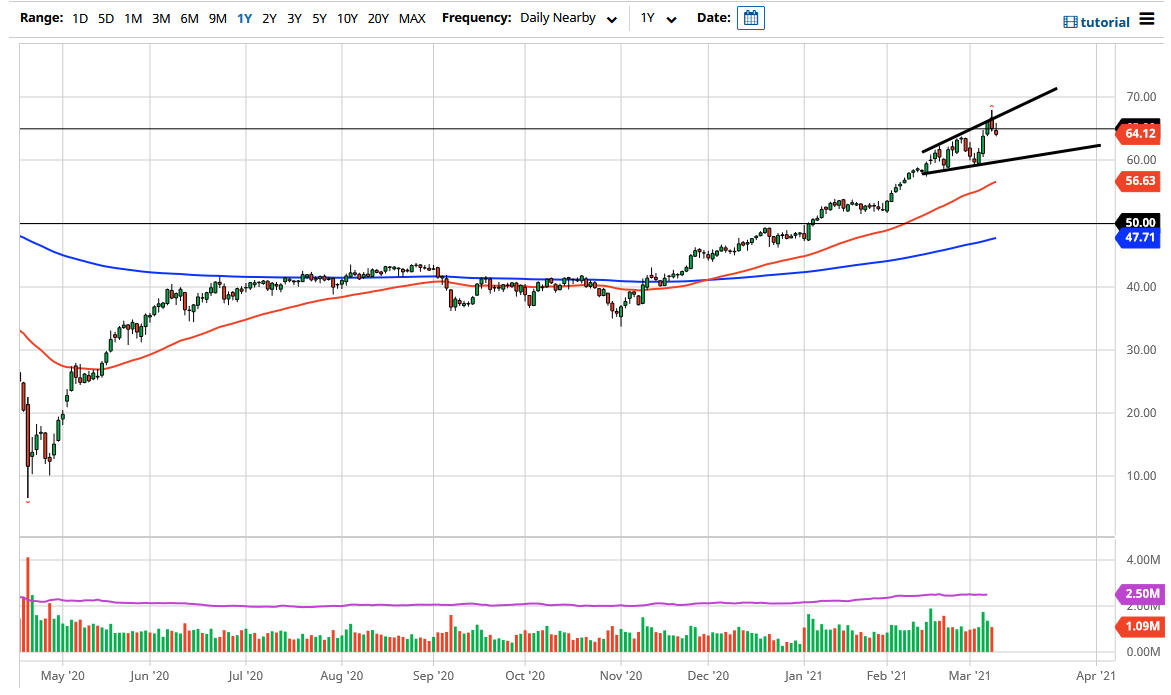

The West Texas Intermediate Crude Oil market initially tried to rally above the $65 level on Tuesday but gave back the gains to break down towards the $64 level. At this point, the market is going to continue to see bearish pressure from what I can see, and we could go down towards the bottom of the megaphone pattern that I have drawn on the chart. The $60 level is roughly where the bottom of the pattern is, so I think it makes sense that we would see support come in at that large figure.

Looking at this market, you can see that we had been relentlessly bullish, and at one point or another we need to give back some of those gains in order to show signs of momentum building so that we can continue to go higher. I think that the $70 level above is a target that a lot of the buyers want to see, but then there is the issue that the market has gotten far too ahead of itself. In the meantime, I believe that we will probably just bounce around in this megaphone pattern, but that does tell me there is the possibility of serious negative pressure.

The reason I say that this could be a sign of negative pressure coming is the fact that for the first time in months we are not simply grinding higher. We are starting to see the sellers pushback, and when you look at the $65 level on the longer-term charts, you can see that that level and the $70 level have offered a lot of supply, so I do think that we are getting closer to the end of the uptrend. If we were to break down below the $60 level, then it is likely that this market will drop rather significantly. At that point I would be looking for a move down to the $52.50 level. In the short term, I think we will simply get a lot of back-and-forth, but it is worth noting that the candlestick on Monday was bearish and the one on Tuesday is a bit of a shooting star. This does not exactly look strong, at least in the short term.