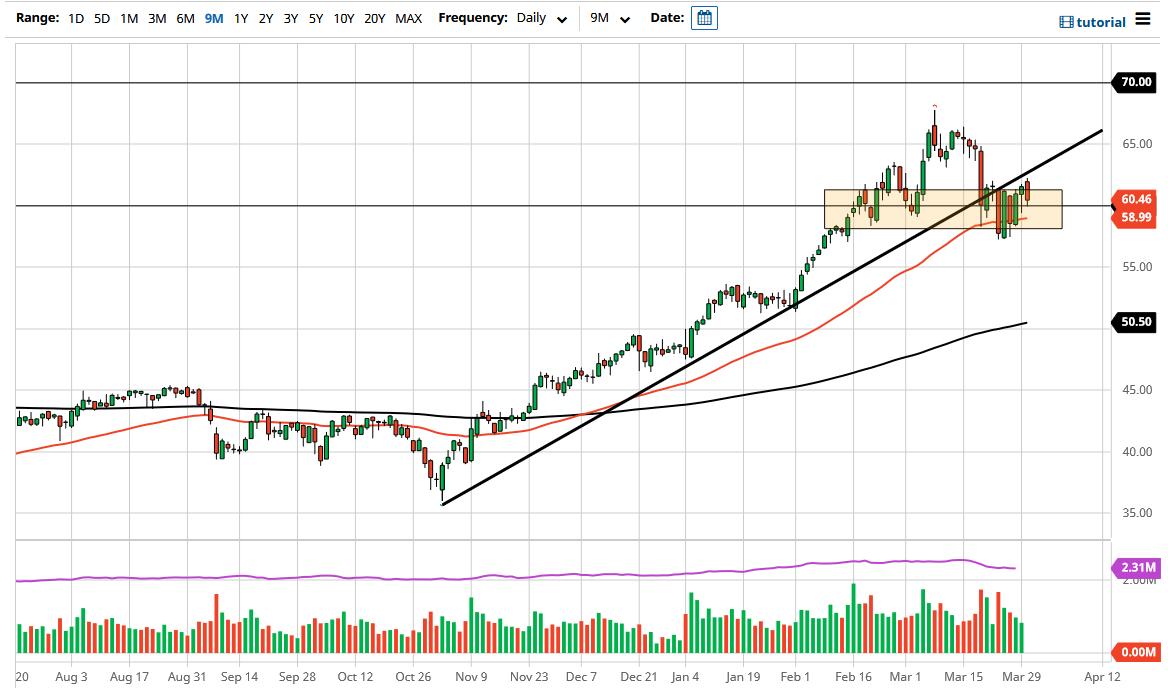

The West Texas Intermediate Crude Oil market has gapped higher to kick off the Tuesday session, but seems to be respecting the previous uptrend line as resistance. As a result, we have ended up testing the $60 level underneath to show signs of “stickiness” yet again, and as a result it looks like we are not quite ready to go anywhere at this point.

This makes quite a bit of sense, as OPEC+ has a meeting later this week, and there are a lot of questions as to whether or not Russia can convince some of the others to extend production cuts into the month of April. At this point, the market is probably going to kill time over the next several days, waiting to see what happens. The 50 day EMA also sits just below to offer support, so that is another reason why think we are simply going to hang around in this area.

What is interesting from a technical analysis standpoint is the fact that we have broken below that uptrend line, pulled back from again, and now we are looking to go back into this range. The market is still trying to recover from the massive selloff a couple of weeks ago, and I certainly think that could have been a major “shot across the bow” for traders. To me it looks as if we are trying to form a little bit of a head and shoulders pattern, but it is not necessarily a confirmed pattern until we break down about three dollars.

If we do, the market is likely to go looking towards the $52.50 underneath, and as a result it is likely that the 200 day EMA could meet up in that same area as we can see it trying to climb to that area. This being said, you should also pay attention to the US dollar, because if it continues to strengthen that might be reason enough to push his market in that direction as well.

The bullish signal would be as if we break above the $62.50 level, because at that point in time I think we would go looking towards the $65 level, possibly even the most recent high. There are a lot of people calling for higher oil prices, but the technical structure go take quite look compelling at this point in time.