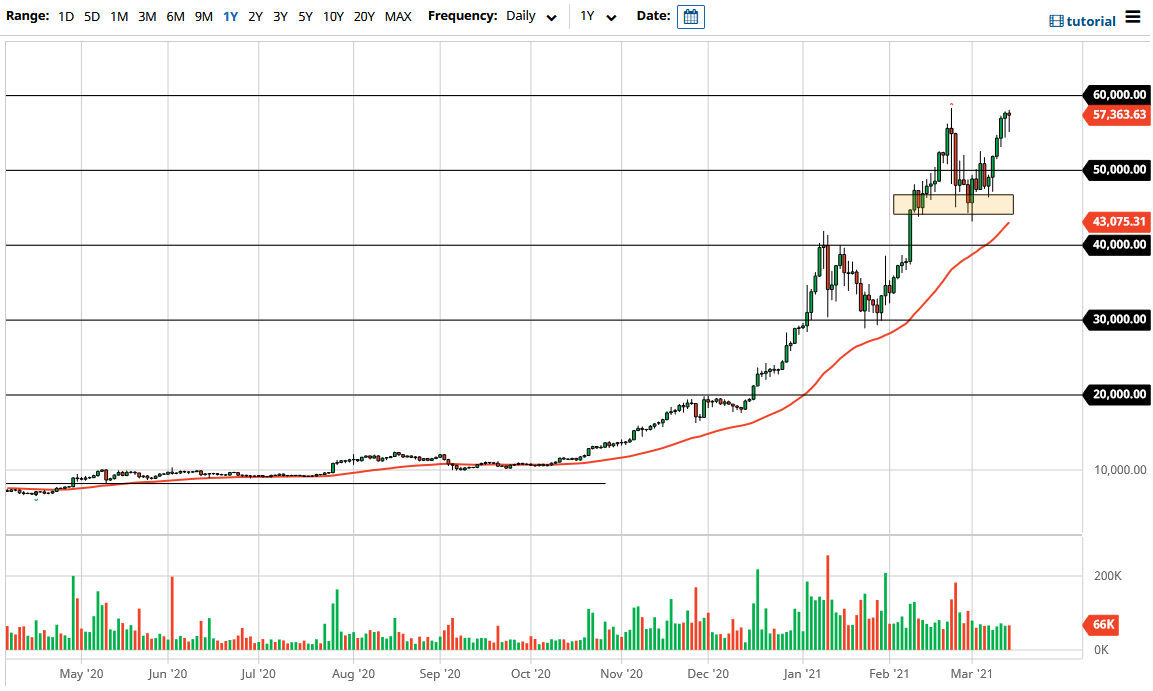

The Bitcoin market initially pulled back during the course of the trading session on Friday, but just as we had seen during the day on Thursday, buyers came in to turn things right back around and show strength. After all, we are forming a hammer-shaped candlestick for the Friday session just as we did on Thursday. The market is likely to ready to go higher to reach towards the $60,000 level. This is an area that will attract a lot of headlines, but there is nothing special about this level, so think it is only a matter of time before we see the market simply slice through it.

We are in an uptrend, and that is really the only thing you need to pay attention to. After all, you should not try to fight this trend, and the last couple of days have shown the resiliency that the cryptocurrency markets in general have. At this point, as long as the US dollar continues to get sold, it makes sense that Bitcoin would continue to gain. This is a market that has been a way to get away from fiat currencies, which are being pumped into the market massively.

The market quite often thrives on the idea of getting away from inflation and pumping of currency, as Bitcoin has recently been used more or less as a store of value, not money. In fact, it is not really used as money in the developed world, so I am not really sure where we are going with this. Nonetheless, what we do see is a lot of institutions getting involved, so I think that will continue to pump this market higher. These large money players can move the market quite violently, but clearly everybody is looking to go higher at this point, so buying the dips should continue to work going forward. The $50,000 level underneath should be supportive, and then the $45,000 level underneath there has already shown itself to be supported. Furthermore, the 50-day EMA is sitting just below there, and I think it could also offer a nice amount of bullish pressure. Nonetheless, I would have no interest in shorting the market anytime soon.