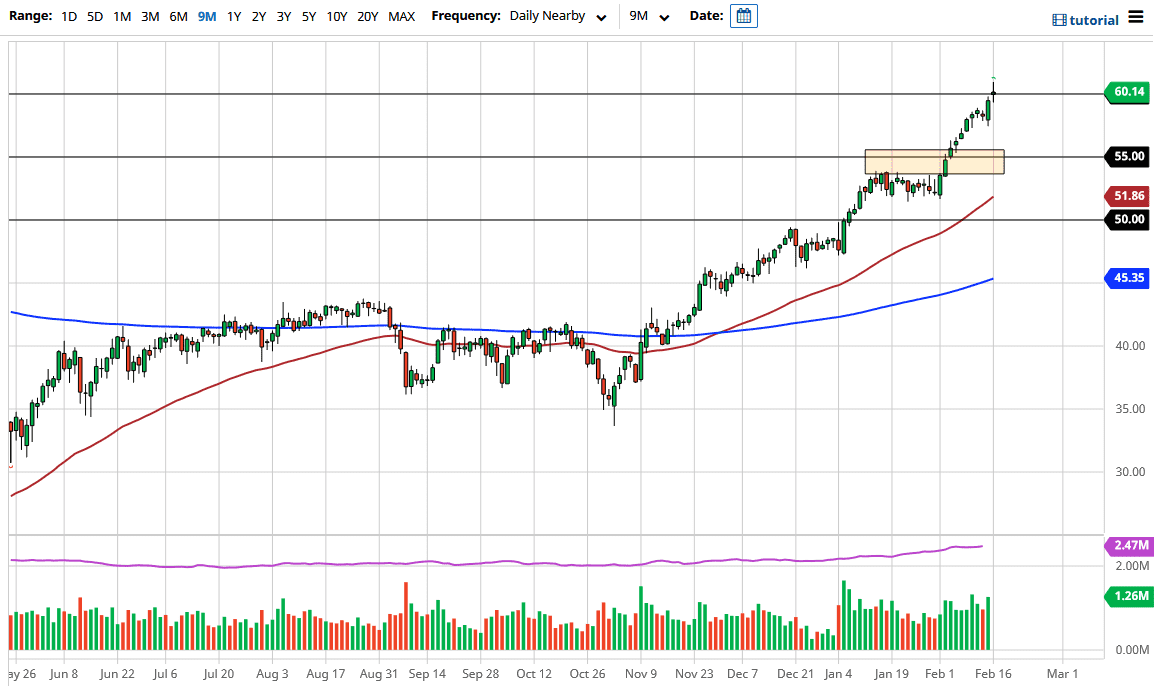

The West Texas Intermediate Crude Oil market gapped higher to kick off the trading session on Tuesday, but started to show a lot of bullish pressure during the day. The market has pulled back to show signs of exhaustion, as it looks like the shooting star that is being printed suggests that perhaps we have gotten a bit too far ahead of ourselves and a pullback is more likely than not. This is a market that had gotten way ahead of itself as of late, so this pullback is probably rather healthy.

Something that was somewhat underreported during the trading session was that there are sources in the Middle East suggesting that OPEC may decide to increase production in April due to the fact that prices have been rallying so hard. This is a market that is still very bullish, but if the market continues the way it has been going, US shale producers are going to flood the markets with supply. That is the biggest fear OPEC has, because they have tried to break the US shale producers in the past and have failed miserably.

The oil markets are also moving higher based upon the idea of a global recovery after the inoculations become much more common. However, at this point, one would have to question how much demand there really will be, because China has been replenishing the stock of crude for a while, and sooner or later they will stop. Real demand was actually fairly weak just before the pandemic hit, so while there may be a massive shot higher as far as the economy is concerned, eventually we have to accept the fact that reality comes back into play. In other words, I think that demand for crude oil could be very sharp in the short term, but eventually things will level out. To me, it looks like the market has all but priced in a massive recovery over the course of the next several months. Keep in mind that the more expensive oil gets, the more US shale will step in and fill tanks around the world. When you look at the longer-term chart, the market probably has maybe another $10 left in it at best to the upside. In the short term, I would not be surprised at all to see this market reaching towards the $57.50 level.