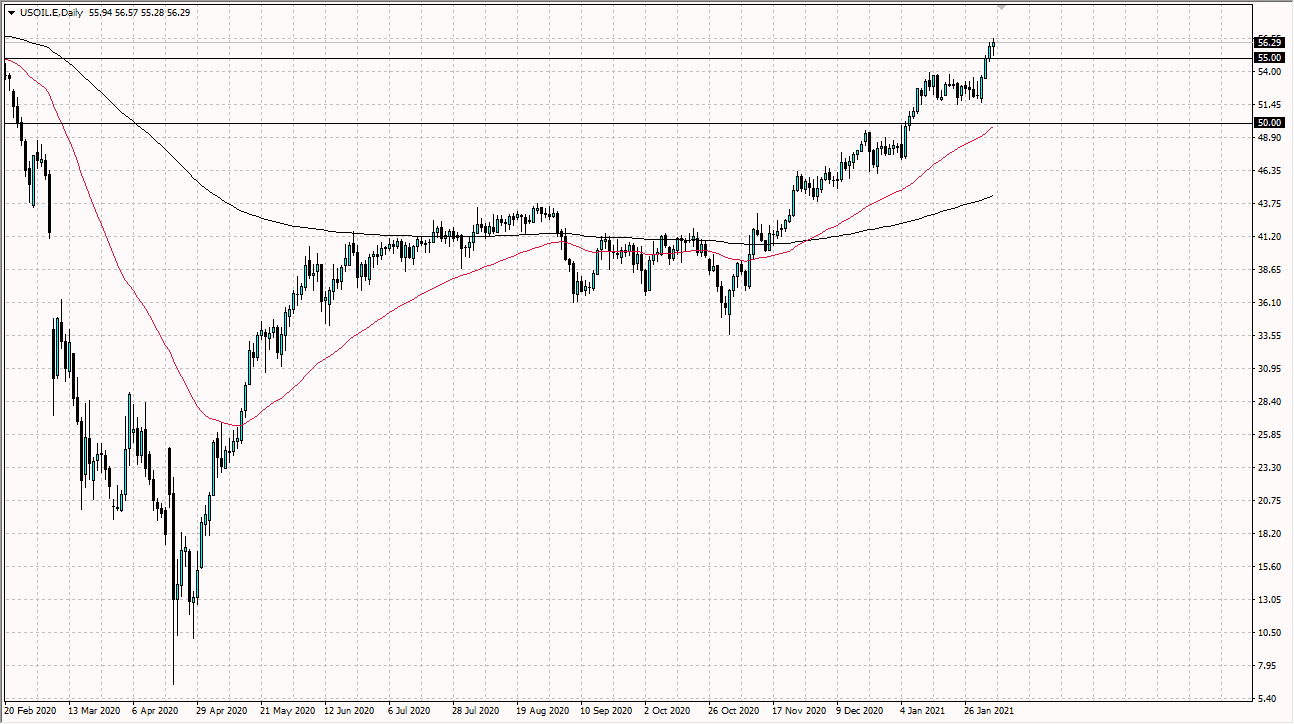

The West Texas Intermediate Crude Oil market has pulled back during the trading session on Thursday to test the $55 level, an area that it broke out from in the last couple of days. Ultimately, the market has cleared a major hurdle, and now it has retested it during the trading session on Thursday. This is a market that I think does more than likely continue to grind higher, but it is worth keeping in mind that the Non-Farm Payroll figures come out during the trading session on Friday. This could move the US dollar and by extension the crude oil markets as well.

That being said, I do think that the market is probably going to go looking towards the $57.50 level, which would be a psychological barrier as crude oil tends to move in $2.50 increments, with a special amount of attention paid to the $5 and $10 increments. All things been equal, you can see that the market has rallied over the last four days, and even though it has been a little bit parabolic I think at this point the way that we recovered during the trading session on Thursday it is likely that we will continue to see a big move to the upside. I believe that pullbacks should be thought of as potential buying opportunities, unless of course we were to turn around a break down below the $51.50 level which was where we launched this most recent leg higher from. That being said, the US dollar could work against the value of crude oil, and of course the jobs number could suggest that perhaps there will be less demand. Nonetheless, I do think that it is only a matter of time before somebody looks through all of those potential problems and continue to push higher.

To the upside, I believe that the market is eventually going to go looking towards the $60 level, but that does not necessarily mean that we need to get there overnight. I think buying the dips continues to work going forward, unless of course we wipe out the last four days, which would be a sign that the market is turning around. Currently, I have no interest in shorting this market even though I do believe that longer-term we will probably see a massive reversal, but that is down the road.