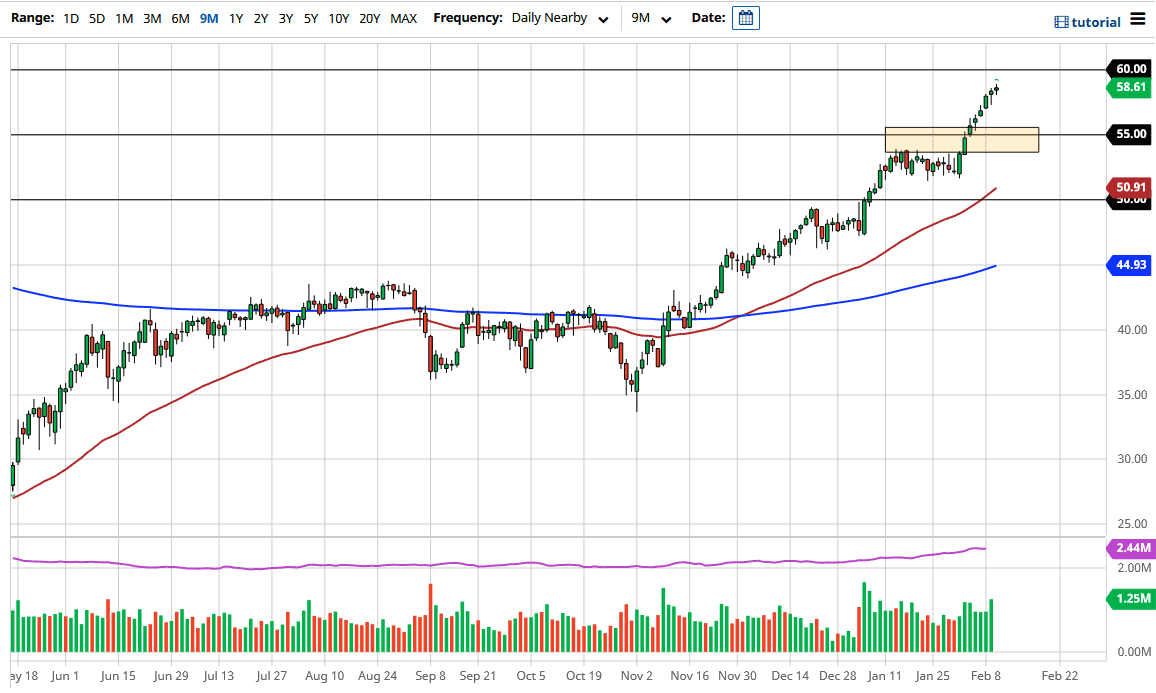

The West Texas Intermediate Crude Oil market fluctuated during the course of the trading session on Wednesday as we have tested the $59 level. That being said, though, the market is likely to continue to see bullish pressure eventually, but I think a short-term pullback is more likely than not. If that is going to be the case, then you need to pay attention to a potential buying opportunity on this dip.

Underneath, the $55 level should be massive support, as it was the scene of a significant break out. The market is likely to hear a lot of noise in general, but there are plenty of buyers underneath. This being the case, the market will see volatility based upon the fact that people are concerned about whether or not the economy is going to turn right back around after stimulus, and the vaccinations being distributed. The theory goes that as soon as everybody gets a shot, the economy goes right back to normal. Obviously, that is not likely to happen, but the narrative remains at the moment, so with this I think there will be plenty of people willing to jump in and buy dips as they occur.

The neutral candlestick for the trading session makes sense, though, and I certainly think we need to give back some of the gains in order to continue the overall uptrend. Longer term, we should go looking towards the $60 level as it is a large, round, psychologically significant figure, and an area where we have seen a lot of action in the past. The biggest problem is that the amount of demand probably does not warrant what we have seen over the last couple of months. The trend is getting “long in the tooth”, so the parabolic nature of this move will show problems heading into the market because a move like this is simply unsustainable. If we were to break above the $60 level, then we could be looking at this market truly breaking out for a huge move. I doubt that will happen very easily, though, at least not without some type of bigger catalyst. There is the ever-present threat of stimulus being smaller than anticipated, and that could send this market much lower.