The West Texas Intermediate Crude Oil market has pulled back a bit during the trading session on Thursday, as OPEC has delayed its timeline of recovery for 2021 during the session. Demand will be weaker by roughly 110,000 barrels per day according to OPEC, which while we are still recovering, is not perhaps as bullish as once thought. In that scenario, you need to think about this as a “relative gain type of market.” In other words, the stronger the trajectory of demand recovery, the stronger the trajectory of the oil market itself.

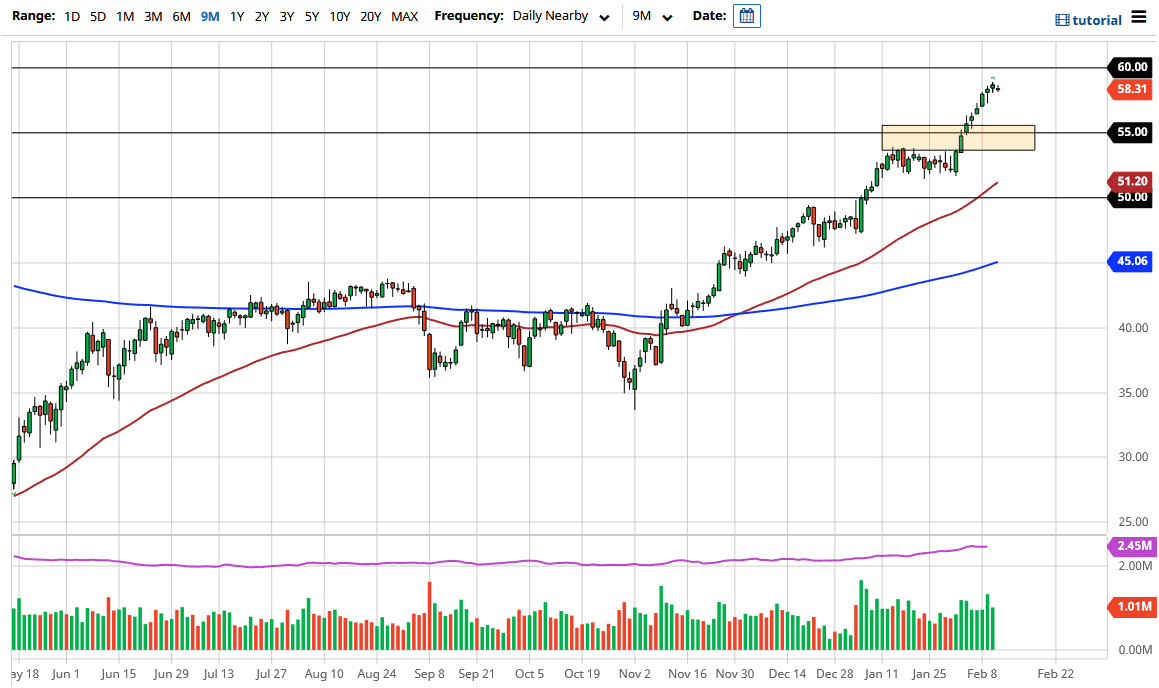

Under almost any method that you measure it, this is a market that is overbought. Because of this, I think it does make a certain amount of sense that we could see a pullback based upon that reasoning alone. There are a couple of different areas that I think the market would be particularly interested in, not the least of which would be the $55 level which was the sign of a breakout in the first place. However, the $57.50 level could also be rather supportive, as it does have some historic precedence for being an area of interest.

Either way, I think a pullback is healthy for this market that had gotten far too ahead of itself. Beyond that, the $60 level of course will be psychologically important and resistive, prompting a lot of traders to book profit once they got there. Some traders have cleaned up in this market over the last couple of months, so it does make sense that some of them wish to cash in. Having said all of that, the biggest problem that crude oil has is that demand is going to no way in any shape or form justify the bullish action that we have seen as of late. Because of this, I think what we are looking at here is an overcooked market that is desperately trying to find reasons to go higher. I think it probably will eventually, based upon the reflation trade type of scenario, but this is a market that probably needs to pullback in order to make it attractive enough for traders to come in and pick it up. Buying crude oil after this type of move is a great way to lose money as you are simply “chasing the trade.”