The West Texas Intermediate crude oil market rallied a bit during the trading session on Friday after the non-farm payroll numbers came out. It is worth noting that the jobs number was horrible: 145,000 for the month of December, which was a bit of a shock. At the same time, people are betting on the idea of stimulus, so we have seen a lot of moves in the marketplace.

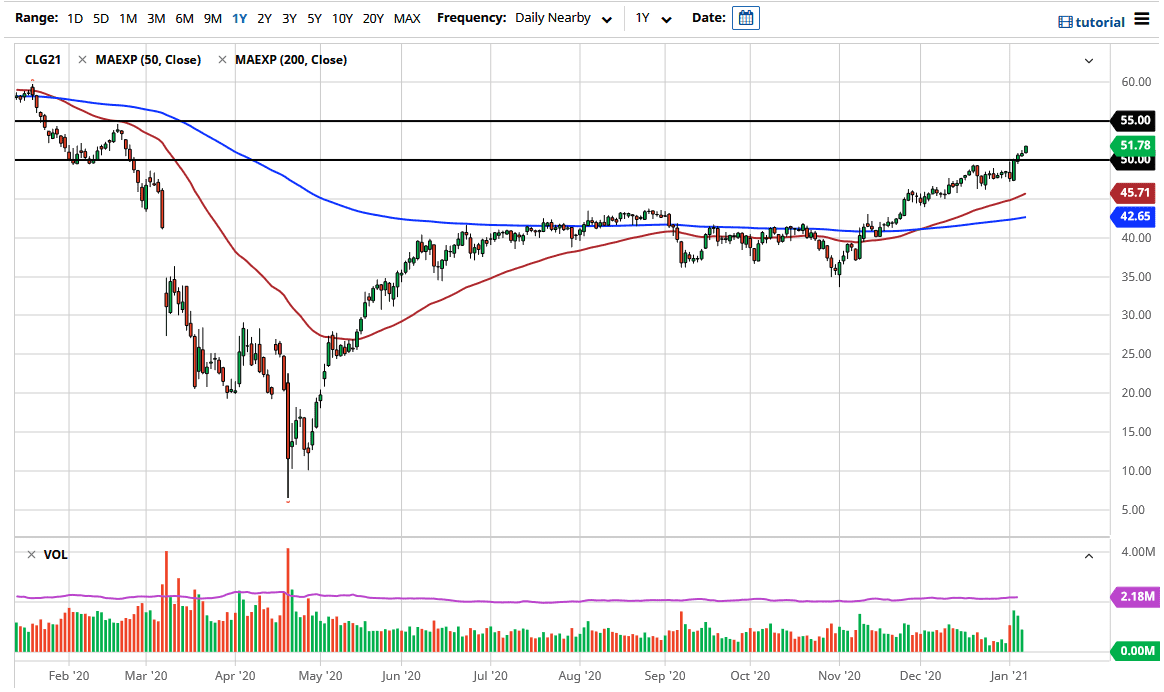

The candlestick is closing at the top of the range, which is a very bullish sign. The $52 level above offers slight resistance, mainly due to the large, round, psychologically significant figure, but it is a minor one. In other words, I think we could go looking towards the upside, perhaps reaching towards the $55 level over the longer term. We are at least going to try to reach towards the $55 level, but it is difficult to imagine a scenario where it simply slices through there.

To the downside, the $50 level underneath should be somewhat supportive, but even if we were to break down below there, we could see even more support based upon the bottom of the Tuesday candlestick, near the $47.40 level. It is not until we break down below there that I would be concerned with the overall uptrend, although I do not think that this is a long-term uptrend that is sustainable. In the short term, many people will continue to focus solely on stimulus, but athey are ignoring the fact that we had a serious lack of demand previously, before we had the pandemic.

It is difficult to imagine a scenario in which we can short this market in the short term, but eventually, we will start to focus on the fundamentals again. At this point, most of those fundamentals include cheap and easy money, and the idea that stimulus going to continue to push economies higher around the world. I do think that we will see a certain amount of disappointment, but in the short term, it looks to me like buying the dips continues to be the only trade that you can do in this market, at least until we start to see how stimulus has not worked yet again.