The West Texas Intermediate Crude Oil market fluctuated during the trading session on Thursday, in what would have been a shortened session driven by Globex trading. The candlestick is likely to be very unimportant,so I look towards the Wednesday candlestick to get a feel for what is going on with the market.

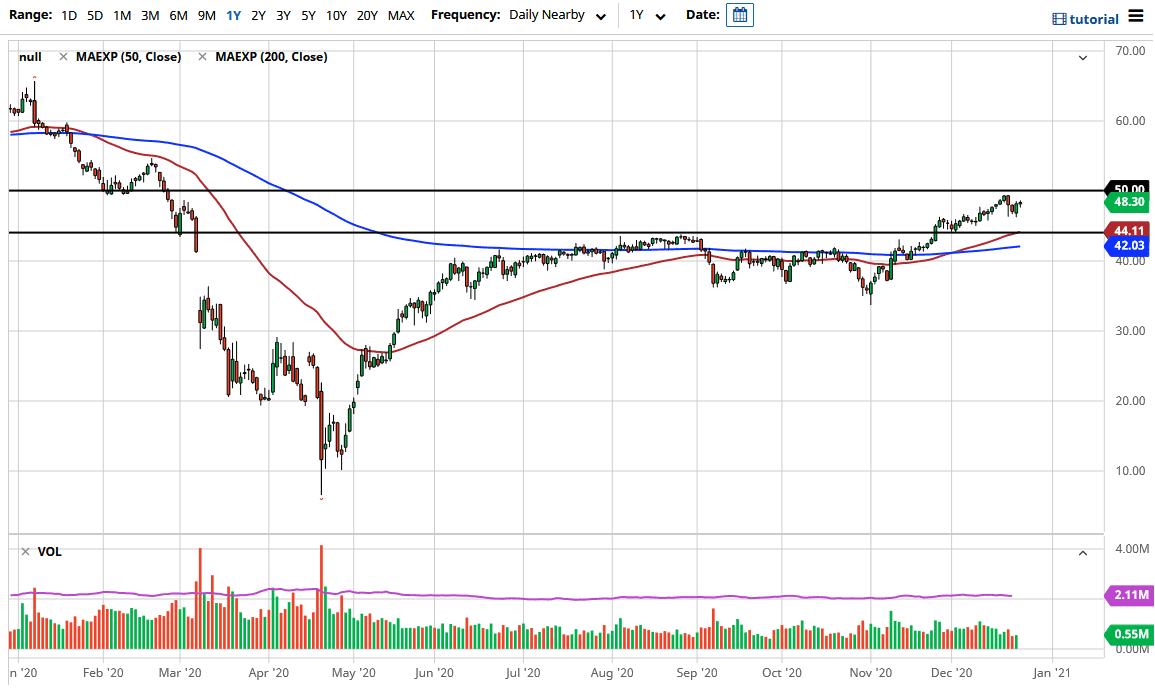

The candlestick from the Wednesday session was rather bullish, wiping out the losses from the Tuesday session. From there, the market could go looking towards the $50 level, which has offered a bit of resistance so far. The $50 level is a large, round, psychologically significant figure, and therefore could offer some noise in general. The question is whether or not we can break above there. If we do, then it will attract a lot of attention and could open up the door to the $52.50 level. Otherwise, if we rally towards that area, it is likely that we would see signs of exhaustion you could start selling into. In other words, we will need to make a decision in the $50 region, and if you are patient you should get your answer soon.

When you look at the market, you can draw a negative correlation between the price of oil and the US dollar, so if the US dollar starts to strengthen, that could cause a lot of negativity here. The market is likely to follow that pattern further. Keep in mind that there is a significant amount of bullish pressure in the market due to the “post-pandemic trade”, and the perceived jump in demand going forward. Demand was fairly weak before the virus, so I think there is a rude awakening waiting to happen for market participants. It is likely that we will see short-term bullish pressure followed by a potential pullback. Nonetheless, it looks as if the $44 level underneath is a major support level, so this is going to be a very erratic and noisy market. We do have a bit further to go to the upside, and it will be interesting to see what stimulus does to this market.