Today’s AUD/USD Signal

Risk 0.55%.

Yesterday’s signal was activated and achieved a small win. It is not yet closed.

Best Buying Entries:

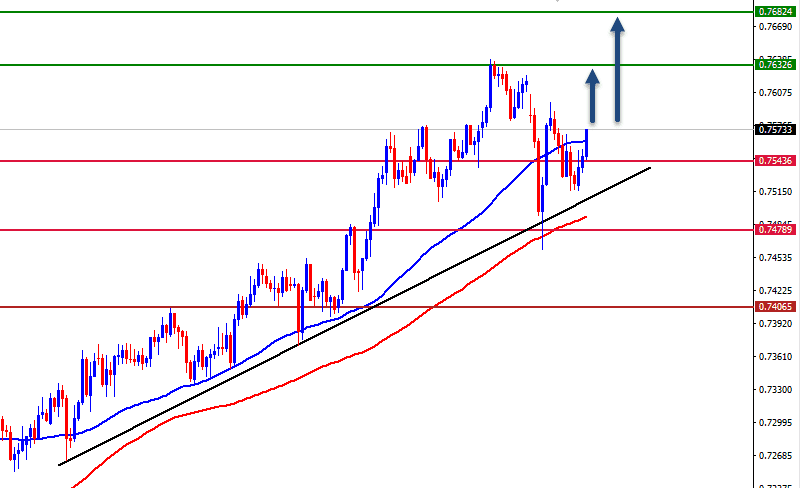

Long entry from the current price 0.7562, or better, from the 0.7500 level.

Put the stop loss below the 0.7460 support.

Move the stop loss to the entry point and continue profit with a 35 pips price movement.

Close half the contracts when the trade is 60 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7630.

Best Selling Entries:

Short entry below the 0.7390 level on the 4-hour timeframe.

Put the stop loss above the 0.7420 level.

Move the stop loss to the entry point and continue profit with a 25 pips price movement.

Close half the contracts when the trade is 35 pips in profit and leave the remainder of the contracts to run until the 0.7350 support.

AUD/USD Analysis

The AUD/USD rose within the general bullish trend, but the pair's rise was weak with the slowdown of the bullish momentum.

Investors followed the Australian announcement of the discovery of a fourth case of the fast-spreading mutated coronavirus, which the United Kingdom announced at the beginning of the week. Travelers coming to Australia from the United Kingdom are subject to mandatory quarantine at a hotel for a period of 14 days. Professor Paul Kelly, Australia's newly recruited Chief Medical Officer, said that there is no need currently for tighter restrictions. Meanwhile, vaccine makers Pfizer, BioNTech and Moderna are testing whether their vaccines will be effective against the new highly contagious variant of the coronavirus.

The AUD/USD pair maintained the general bullish trend, as the pair is currently trading at the 0.75701 level above strong support levels at 0.7543 and 0.7479 and above a trend line, in addition to the 50-day moving average on the four-hour time frame. The liquidity flow indicator also confirms the current bullish trend, as the index tends to rise, indicating the flow of liquidity in the direction of buying the Australian dollar during today's trading.

Entry can be bought from the current levels or any better levels as long as the pair stabilizes above 0.7479, while maintaining the stop loss below 0.7400 levels.

It is preferred that your trading strategy and risk management be adjusted accordingly.