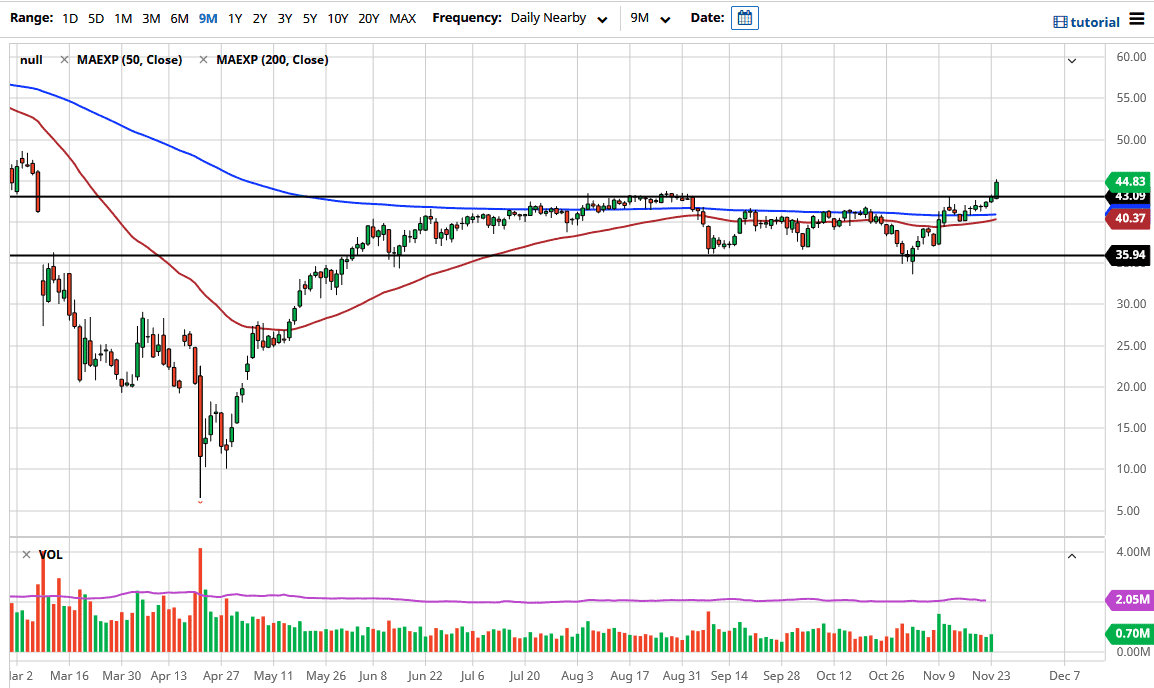

The West Texas Intermediate Crude Oil market has finally broken out of the range that we have been in for some time, and now that we have broken above the $43 level, it looks as if we could continue to go higher. This is surprising to me, but I suppose it comes down to the market simply focusing on the coronavirus vaccines that are in development. This is based on the idea that the markets will see an underlying economy that continues to grow.

We will continue to see a lot of hopeful thinking, so we will continue to go to the upside. Unfortunately, sooner or later reality will creep back in, as the oversupply of crude oil was a problem before the pandemic, and that has not changed. In fact, inventories are rising, not falling, which is a major headwind for this market. However, if we break the US dollar back down, that could help crude oil in the short term.

The most important factor is whether or not people are using crude oil. They are dealing with lockdowns right now and, as a result, there will be a serious lack of demand going forward, at least for the next several months. The market will have to deal with the fact that occasionally reality comes back into play. This is essentially a “two speed market”, meaning that the crude oil market will probably rally in the short term, but longer term we still have massive headwinds above. I see the $47.50 level as the next potential resistance barrier, just like the $50 level after that. $50 will likely be the ceiling in this market, but only time will tell. Crude oil simply does not have enough demand to warrant the market taking off to the upside for a sustained move. Given current global events, one would have to think that the short-term burst may reverse after a few strong sessions. If we were to break down below the lows of the trading session on Tuesday, that could be very negative. The most important thing you should pay attention to in the short term is the fact that we are heading towards Thanksgiving on Thursday, which will greatly influence liquidity.