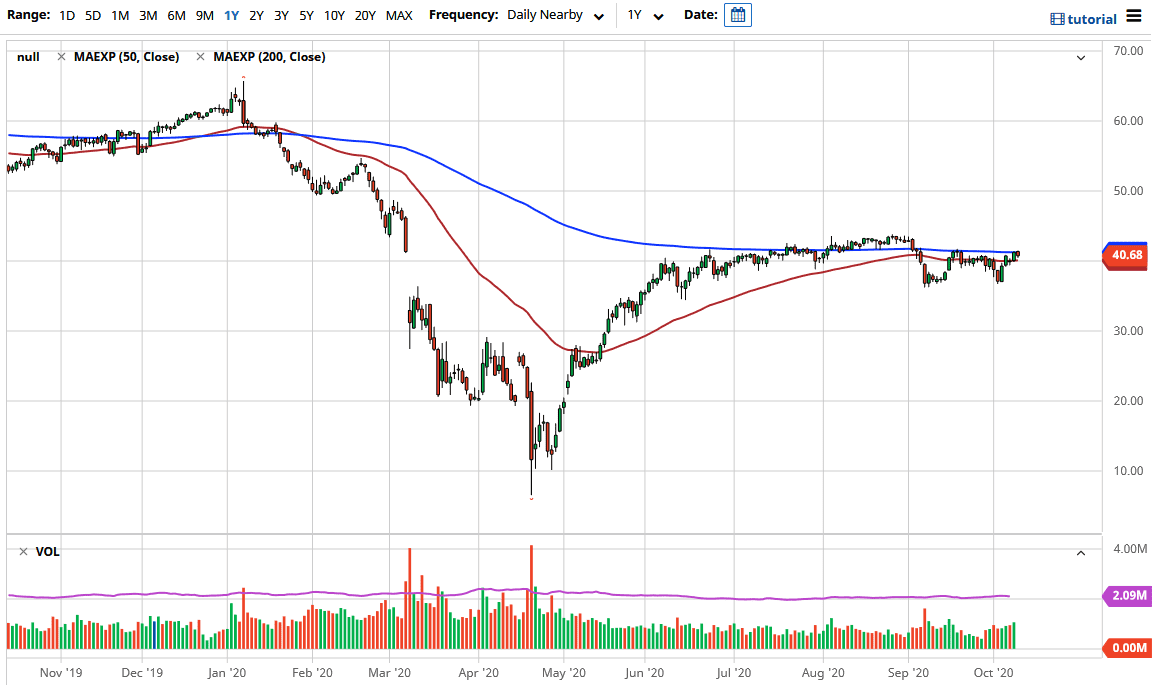

The West Texas Intermediate Crude Oil market has pulled back a bit from the 200 day EMA during the trading session on Friday as we continue to focus on stimulus only. If we get stimulus, the idea is that the Americans will demand more crude oil, thereby driving up the price. However, the reality is that the demand for crude oil has been very weak for some time, and therefore it is hard to imagine that we are suddenly going to take off to the upside for a bigger move. That does not mean that we cannot make a move in the short term, but longer-term we still have structural problems.

To the downside, the $40 level is a large, round, psychologically significant figure, and therefore it is likely that the market will continue to see the 50 day EMA be a bit of a magnet for price as well. I think short-term rallies will continue to be sold into, perhaps extending all the way to the $43.50 level, which was the high that we had broken down from. Ultimately, this is a lot of hope out there more than anything else, but we have seen stimulus three times previously, and it has not made the demand for crude oil skyrocket by any stretch of the imagination.

To the downside, the $37 level has been supported and we have formed a little bit of a “double bottom,” but it is also a minor pattern. I think it is likely that we go down towards the $35 level once we break down below there, then perhaps down to the $30 level underneath. This is not a market that has a lot of demand, because if the price were to start going much higher, the reality is likely that the production of crude oil would start back out. Crude oil is highly levered to the idea of an expanding economy, and that is not something we see much of around the world. That being said, I think that we continue to see choppy trading, but I still favor the downside over the longer term. I believe that we are one negative headline or event from sending this market much lower, and I think as far as buying is concerned in order to see some type of spike higher, we would probably need to see drastic actions.