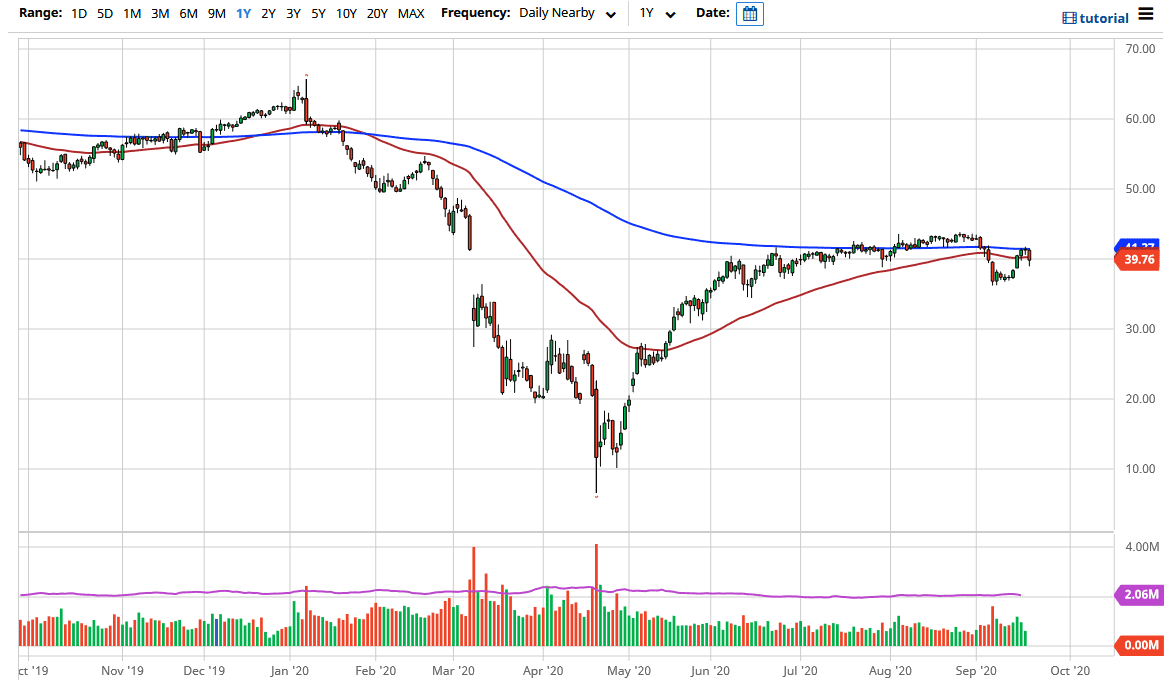

The West Texas Intermediate Crude Oil market has broken significantly during the session on Monday, slicing through the $40 level. At this point time, the market is looking very vulnerable to some type of continued bearish pressure, and as a result, it is likely that the market could go looking towards the lows again closer to the $37 level. That being said, we did bounce just a bit, but it is still looking very vulnerable. That being said, we are below the $40 level as we close out the open outcry session, so at this point in time, it is likely that the market will continue to see selling pressure at the first signs of exhaustion. At this point in time, I have no interest in buying crude oil.

The 200 day EMA above is massive resistance, and therefore if we were to break above it could prove something, this point it does not look like we are ready to do so. The candlestick shows just how vulnerable the crude oil market is, and the US dollar strengthening the way it has will continue to weigh upon the crude oil market. Of particular note, there are signs that the Chinese are importing far less crude oil these days, and that is something that will continue to weigh upon the idea of demand.

If we were to break down below the $37 level, which opens up a bigger move down towards the $35 level, perhaps even down to the $30 level the way this market has been behaving. Regardless, I have absolutely no interest in buying oil anytime soon, at least not until we get a daily close well above the 200 day EMA, something that does not look very likely in the short term. The market falling the way it has was startling, especially if you look at short-term charts, which showed just how negative things were. There has been a significant amount of short-term damage done to the market, so I think we are more likely than not to visit the bottom of the session on Monday, and perhaps plunge lower. If the US dollar does continue to be strong, that will put a significant amount of downward pressure beyond the simple demand story. At this point, oil looks very sick.