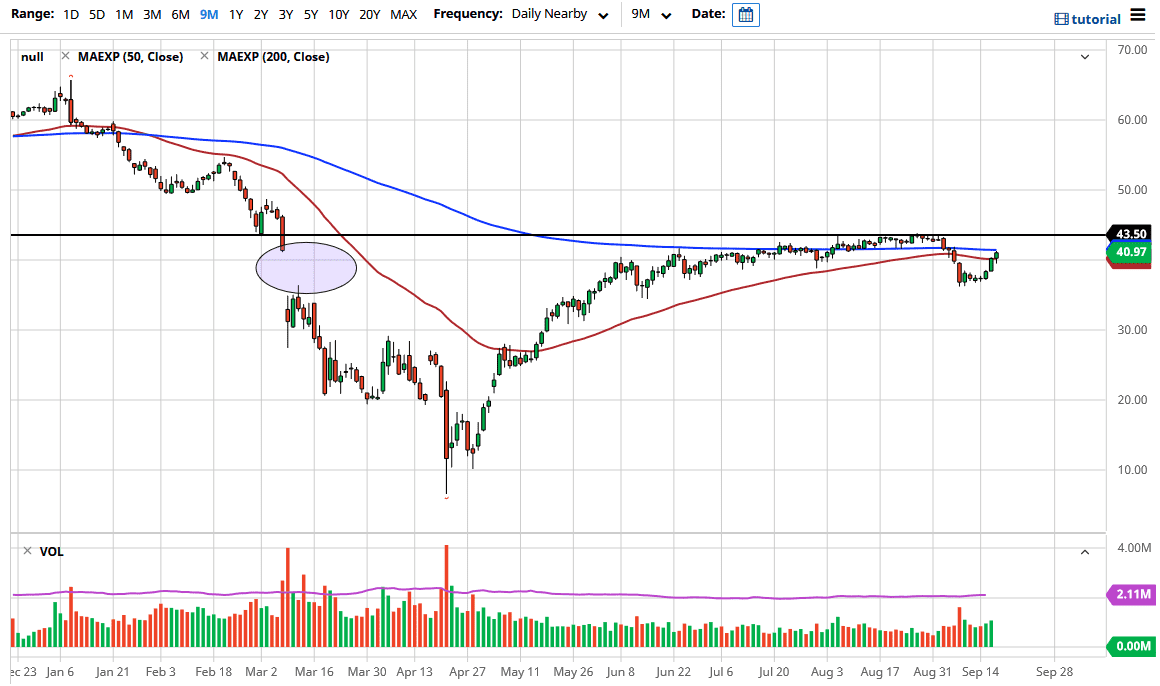

We have recently seen a significant break down, and of course the market is starting to test a major area of resistance in the form of the 200 day EMA and of course the recent selloff. In other words, I would anticipate that there should be a bit of supply above, and I think that the next 24 hours might be very important as to where we go next.

As you can see on the chart, I have drawn a line at $43.50. That is where I think we can continue a longer-term uptrend, although it was an extreme grind more than anything else. Because of this, I think that we continue to see this market try to reach higher, but the question is whether or not we can sustain those gains? I do not know that we can, and more importantly I think that the crucial piece of information might be the US dollar. If that currency starts to strengthen again, it is likely that the market will rollover again and start going lower. One thing that is worth paying attention to is that we did not have much in the way of significant move until recently, and that move was most decidedly negative. We have not wiped out all of that negativity yet, so although it has been very interesting and impressive for the last couple of days, the reality is that we still have not gotten back to where we were just a couple of weeks ago.

Going forward, OPEC has already suggested that demand was going to be a major issue, and that of course is one of the biggest reasons why prices could fall. I suspect that at the first signs of trouble, anybody who has been buying oil is probably ready to bail. I am waiting to see what the Friday candlestick brings, and what type of attitude it has before I start putting money to work. We are in a very important inflection point, and in the short term it looks like we certainly will test that level. Whether we can get above it or not is a completely different question that should be answered relatively soon. I remain slightly negative, but I also recognize that patience will be needed.